With term deposit rates up around 4.5% or higher, it’s reasonable to that investors may question the role of a bond fund in their portfolio. Given that bond funds had their worst return on record in 2022, and term deposits are effectively a risk-free investment paying a guaranteed return, why wouldn’t investors use term deposits as the defensive allocation in their portfolio? Term deposits offer short term peace of mind – but a global bond fund gives superior long-term returns, better liquidity, greater diversification benefits and are a much better defence against a volatile equity market.

Last year bond markets had their worst returns on record[1] – the Australian bond market returned -9.7% in the 2022 calendar year, and the global bond market did even worse returning -12.3%. The reason for the negative returns was due to the sudden and sustained rise of inflation around the world, and the corresponding aggressive monetary tightening by central banks. The Reserve Bank of Australia has been increasing official cash rates almost every month since April 2022 in the fastest pace of rate hikes in decades.

A consequence of higher interest rates is that Australia’s banks can now offer 1 Year term deposits to customers with rates around 4.5% or higher. It’s natural for investors to ask why they wouldn’t invest in term deposits rather than the bond market, as it appears that TD’s will give better income and protect their portfolio if equities start falling.

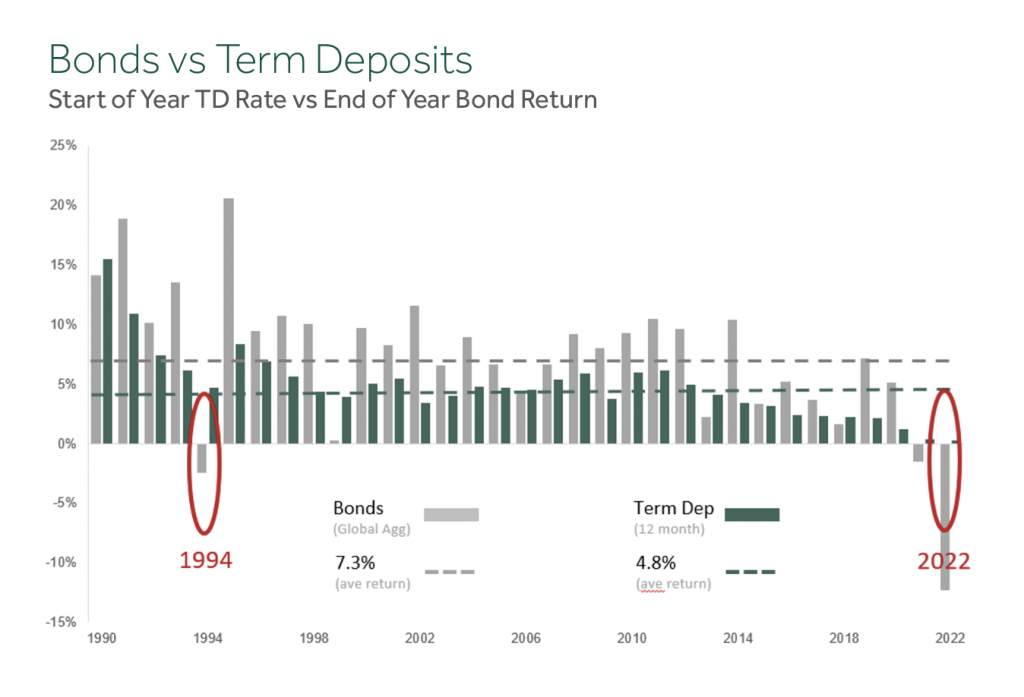

To compare term deposits with a global bond fund[2] then it’s important to realize that term deposits are a forward-looking promise of a guaranteed return over a period (say 1 year), whereas the return of a bond fund is only known at the end of the period. In the chart below we compare the 1 Year TD rate on the 1st of January to the annual return of a global bond index on the 31st of December of the same year from the start of 1990 to the end of 2022.

Source: Annual return of bonds represented by Bloomberg Global Aggregate Bond Index (hedged AUD), 12 Month Australian bank term deposit rates as at the 1st of January data from the RBA.

The chart makes some important points when comparing TD’s to the global bond index.

- 2022 was the worst year on record for the bond index, but the only other time bonds had a negative calendar year was back in 1994 (and for similar reasons – a sudden increase in interest rates to combat soaring inflation). Based on this data, a negative year in bonds is a once in 30-year occurrence.

- Most years bonds have a positive return (term deposits are always positive).

- Bonds have a greater volatility than term deposits, as they are traded in liquid markets and marked to market (priced by the market) daily, whereas the term deposit rate is set by the prevailing cash rate at the time.

- The average return of being invested in the bond index since 1990 has been 7.3%, while the average return of rolling a 1-year term deposit has been 4.8% over the same period – and this includes the great bond bear market of 2022.

For a long-term investor a global bond fund (that is like the Global Aggregate Bond Index) is a much better investment than rolling term deposits once a year. And bond funds pay a distribution quarterly or semi-annually. For a short-term investor – particularly if there is a known short-term need for cash in say one or two years – then a term deposit is the way to go.

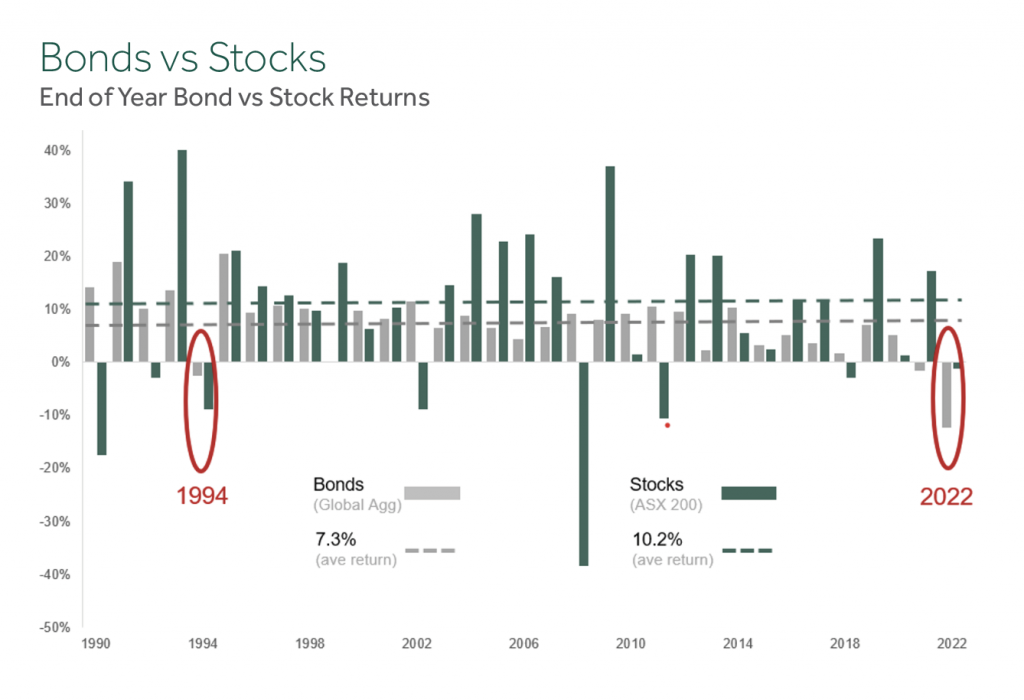

What about the defensive properties of term deposits? Since they are always positive and have a government guarantee on deposits less than $250,000, then they are essentially “risk free” and therefore seem like a good hedge against the volatility of the share market. Investment grade bond funds also provide investors with a high level of protection against absolute capital loss, as they are highly diversified and hold high quality underlying securities, though carry greater volatility as prices are updated daily. How do they stack up against term deposits when it comes to protecting a portfolio against down markets? To look at this question let’s compare the global bond index to the Australian share market since 1990 up to the end of 2022.

Source: Annual return of bonds represented by Bloomberg Global Aggregate Bond Index (hedged AUD), annual return of the Australian stock market represented by the S&P/ASX 200 Index (total return).

As expected, stocks have the higher return, with an average return of 10.2% compared to the global bond index average return of 7.3%. But it is also apparent that stocks have a much higher volatility than bonds. Most times when the stock index is negative then the bond index has a strong positive return – in fact greater than what a term deposit would have given in that year. The exceptions again are 1994 and 2022, when both stocks and bonds were negative.

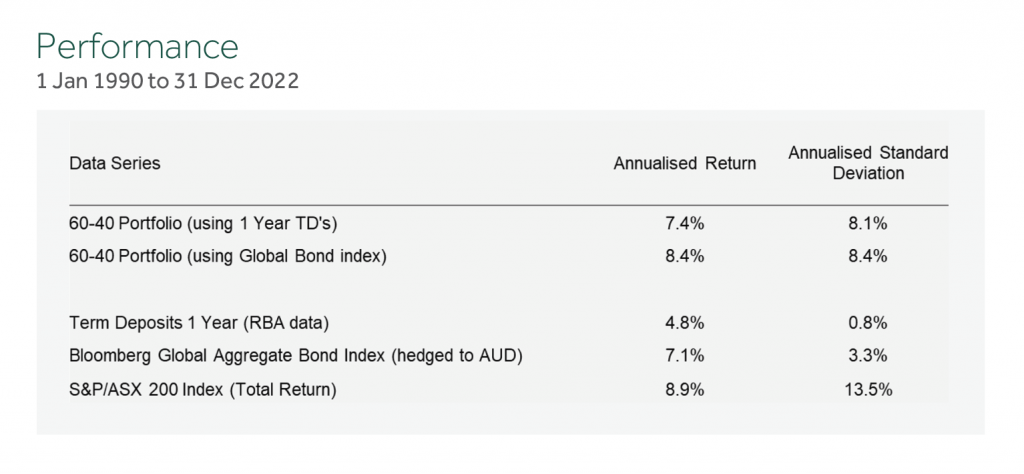

Another way to look at the defensive properties of bonds compared to term deposits is to consider two 60-40 portfolios. In the first portfolio 60% is in the Australian share market, and 40% is in 12 months TD’s (rolled on the 1st of January each year). The second portfolio has 60% in Aussie shares, and 40% in global bonds.

Source: FE Analytics monthly data, Data series are Bloomberg Global Aggregate Bond Index (hedged AUD), S&P/ASX 200 Index (total return) and RBA retail deposit and investment rates; 1 Year Banks’ term deposits ($10000).

The 60-40 portfolio with the defensive component in global bonds compared to a 100% Australian equity portfolio has a 0.5% lower return per annum but has reduced volatility by an extraordinary 40% (from 13.5% to 8.4%). For a slightly smaller overall return there is a huge reduction in volatility (risk).

Now consider the 60-40 portfolio where the defensive allocation is all in term deposits (a common un-advised SMSF portfolio[3]) and compare that to the 100% Aussie equity portfolio. Returns are now a more significant 1.5% per annum lower but the reduction in volatility is much the same as the global bond portfolio. Another way to look at the data is the 60-40 TD portfolio is nearly 1% per annum worse off than the 60-40 bond portfolio with very little difference in overall volatility.

The result is clear – if you are looking to reduce the overall volatility of your investments by being in a 60-40 portfolio you will have a much better outcome by having the 40% defensive allocation in global bonds rather than term deposits.

There are a few other points to make when comparing term deposits to bonds.

- Most term deposits are a fixed rate investment. If interest rates start to rise investors have to wait until maturity to take advantage of higher rates on offer, although they can break the agreement, but that usually involves incurring a cost, or loss of interest earned.

- Income. Most bond funds pay interest (distributions) quarterly of half yearly (assuming they have made a profit for the period), while interest on most term deposits is typically only paid at maturity.

- Liquidity. This refers to the ability to access money from your investment when you want. Term deposits are not liquid investments; investors agree to forgo access to those funds for a pre-determined period. If investors want to access their funds they are usually faced with break costs (a portion of interest earned is forgone in lieu of early redemption).

- Diversification. This provides an important protection, particularly when interest rates are moving lower and typically shares prices and often property prices will also be moving lower. A bond fund helps offset losses elsewhere in your portfolio.

- Capital appreciation. Term deposits do not provide any opportunity for capital appreciation – you get the yield and that’s it. Bonds offer not only income but also the opportunity for capital appreciation (but as we have seen not all the time). Bond funds take advantage of an active secondary market as bond managers look to maximize expected return.

- Different Roles: Whilst bonds and term deposits are often compared, in truth, they can play an important role in a diversified portfolio. Bonds provide a diversification benefit, and hedge against the risky assets in the portfolio, whilst deposits act as a secure, virtually risk free, store of wealth.

There is no getting away from the fact that 2022 was a horrible year to be in a bond fund. But the end of the aggressive rate tightening cycle now seems to be in sight. A consequence of the battle against inflation will certainly see a period of below-trend growth and may see many countries enter a recession. That also means central banks may need to start reducing rates soon – and that will result in higher returns and better diversification from a bond fund.

Term deposits are currently paying out

upwards of 4.5% in Australia – but that still equates to a negative real return

of a few percentage points given Aussie CPI is running at 7%. Nonetheless it’s

attractive in a volatile market – but only if you have a short time horizon. A

global bond fund will give superior long-term returns, better liquidity,

greater diversification benefits and will be a much better defense against a

volatile equity market.

Appendix

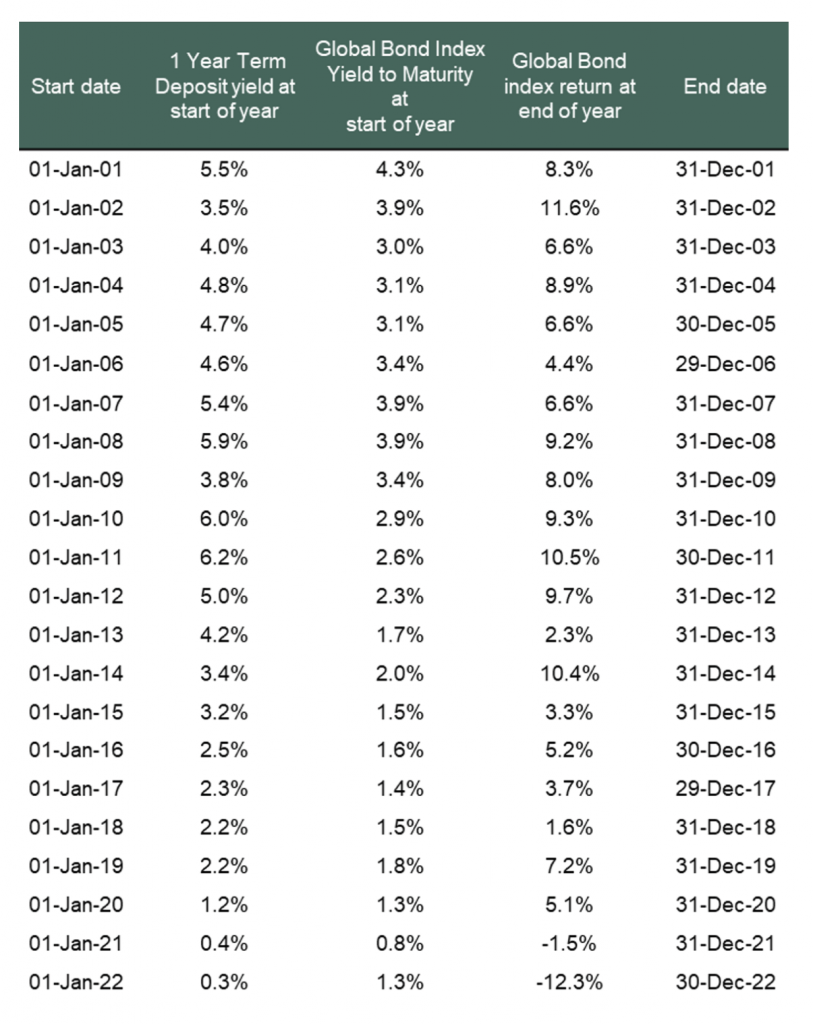

It’s often the case that investors who are considering term deposits over a bond fund compare the stated term deposit rate with the current yield to maturity of the bond fund. But yield to maturity is only a relevant figure if the bond(s) are held to maturity. In general, bond funds consist of tens or even hundreds of bonds, and these bonds are rarely held to maturity – bond fund managers typically are buying and selling different bonds all the time, and this means the yield to maturity is constantly changing. Furthermore, yield to maturity does not take into account any capital appreciation that may occur throughout the holding period.

The table below shows the average 1 Year term deposit rate next to the yield to maturity of the global bond index at the start of a year and compares these to the return of the bond fund at the end of the year. It’s understandable that when comparing term deposit rates with the current yield to maturity investors may favour term deposits because TD rates have been higher in 18 out of 22 years. However, when looking at the actual return of the bond index over the next 12 months the bond index had a greater return than term deposits 17 out of 22 years.

The point here is that yield to maturity is not an expected return for what the bond fund will do in the next 12 months and should not be used to compare to a known term deposit rate. The return of a bond fund over the next year is unknown, just as the future return of a stock market index is unknown. This can be a difficult concept for investors because they understand that a bond pays a fixed coupon and that the yield to maturity on a particular bond (that is held to maturity) is the total return. But yield to maturity of a hedged global bond fund is not a useful number and will mis-lead investors into thinking they are getting a guaranteed higher yield from the term deposit. Returns from bond funds are not known in advance, but as we have seen here for the long term investor bond funds have delivered superior returns and greater diversification benefits than term deposits.

[1] Using index data that is only available since 1990. There have probably been worse times to hold bonds, such as post-War recession and the Great Depression.

[2] In this analysis we use the Bloomberg Global Aggregate Bond Index (Hedged AUD). This is a common benchmark for many global bond funds available.

[3] https://www.ato.gov.au/About-ATO/Research-and-statistics/In-detail/Super-statistics/SMSF/