After a strong run-up in global markets, investors have been rattled by a sharp reversal—led by the same giant technology stocks that fuelled the rally. The impact of Trump’s tariff war, government spending cuts, and shifting geopolitical relationships are all playing a role in the pullback. But what does this mean for investors, and how should we respond?

While volatility can be unsettling, history tells us that market corrections are normal, and maintaining perspective is key. In this update, we break down the latest market movements, why they’re happening, and what they mean for your portfolio. Most importantly, we outline why diversification, discipline, and a long-term mindset remain the best approach in uncertain times.

A long run-up in global equity markets has suddenly gone into reverse, with the giant technology stocks that led the rally now suffering the biggest declines. In an increasingly uncertain world, what are investors to make of all this?

The causes of this pullback centre on the impact on inflation and growth of the Trump administration’s tariff war and cuts to government spending. Also unsettling investors is Trump’s shakeup of decades-old geopolitical relationships.

Members of the so-called Magnificent Seven of tech heavyweights have led the Nasdaq index into correction territory (a fall of 10% or more from the high), with Elon Musk’s Tesla among the worst performers in recent weeks.

In Australia, there are concerns about Trump’s threatened tariffs on steel and aluminium imports, although the bigger worry has been the overall consequences of a trade war on global economic growth and demand for our commodities.

But beyond the rapidly shifting news headlines day-to-day, there are a few points we think our clients should keep in mind to retain a sense of perspective.

First, it is the nature of markets to be volatile during periods of uncertainty. Much good news was already baked into some stocks. The US market had gained more than 50% in two years, and many other global indices reached record highs last year, so a pullback at some point was inevitable.

Second, the reversal in equity markets is not uniform. In fact, many markets are up year-to-date. While the broad US market was down about 4.5% year-to-date at time of writing and the Nasdaq down nearly 10%, the European market was more than 10% higher, while Hong Kong was 19% higher.

Third, remember that the ‘market’ is more than the headline grabbing US ‘Magnificent 7’. Broadly, Minchin Moore allocates only about 65% of our international shares exposure to the MSCI World index, which is dominated by those large US technology stocks. Of the rest, 20% is allocated to a fund of value stocks (low relative-priced stocks) and 15% to smaller companies. These parts of the market perform differently over time.

Fourth, bonds are doing their job in providing ballast during an equity downturn. Since mid-February, government bond yields have been declining (prices have been rising, in other words) as investors globally calculate the impact on growth of the Trump’s imposition of tariffs on many trading partners.

Fifth, the reduction in the concentration of the US market (which accounts for more than 70% of the global market) and the unwinding of some of the extraordinary gains of large growth stocks is not necessarily a bad thing, as it opens opportunities elsewhere – as we are already seeing.

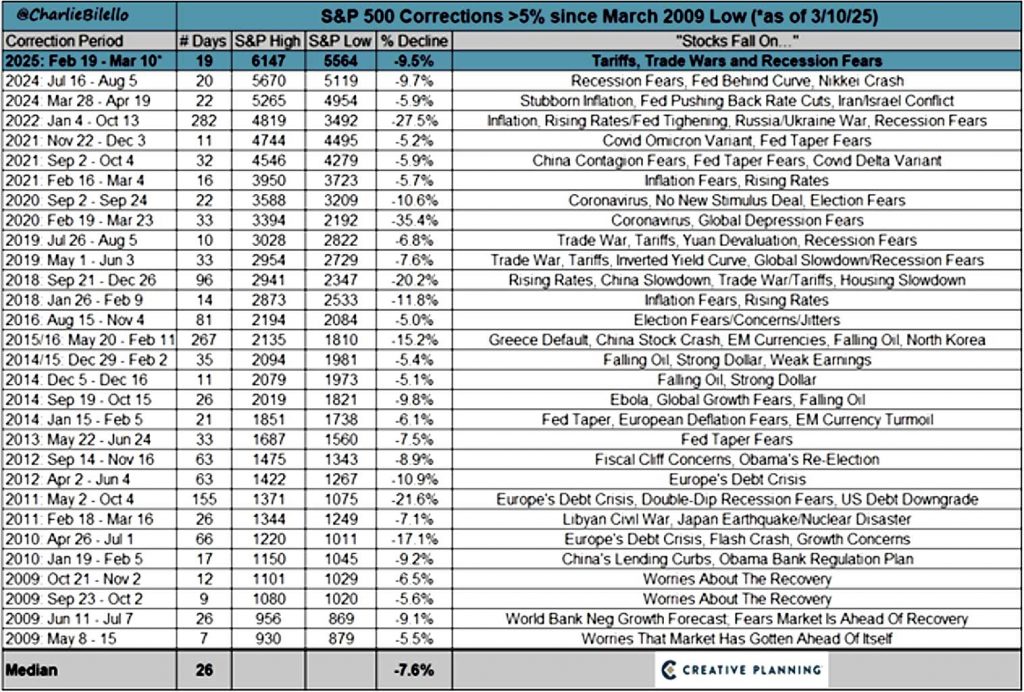

Sixth, after such a strong run it can be easy to forget that volatility is a natural feature of investing. For instance, this latest pullback is the 30th correction of more than 5% since the March 2009 low at the end of the GFC. Going all the way back to 1928, the S&P 500 Index has returned an average of 10% per year despite an average intra-year drawdown of 16%. What’s more, periods of higher volatility and negative sentiment, as we are seeing now, tend to be followed by stronger future returns.

Finally, be wary of pundits that advise you to alter your carefully designed asset allocation based on speculation about what might happen next. We have already seen Trump change his position multiple times on tariffs and it would be unwise to build an investment strategy around the news to date. What moves prices most is unexpected news that is not already priced into estimates of future profits. And we have yet to meet anyone who can forecast the news day to day.

This all means that the best approach, as ever, in times of market volatility is stay with the plan that is made for you, your goals, your risk appetite and your circumstances. Diversification and discipline are the watchwords.

In the meantime, we are always here to answer your questions about any of these, or other issues.