Any rational assessment of current market prices needs to factor in the huge increase in the money supply that has been spawned by global governments’ ‘whatever-it-takes’ intervention to support markets, businesses, and workers.

Government stimulus efforts have been focused on three key objectives:

- Maintaining financial stability (monetary policy actions and prudential measures)

- Maintaining household economic welfare (social safety net measures)

- Helping companies survive the crisis (loans, tax breaks, etc)

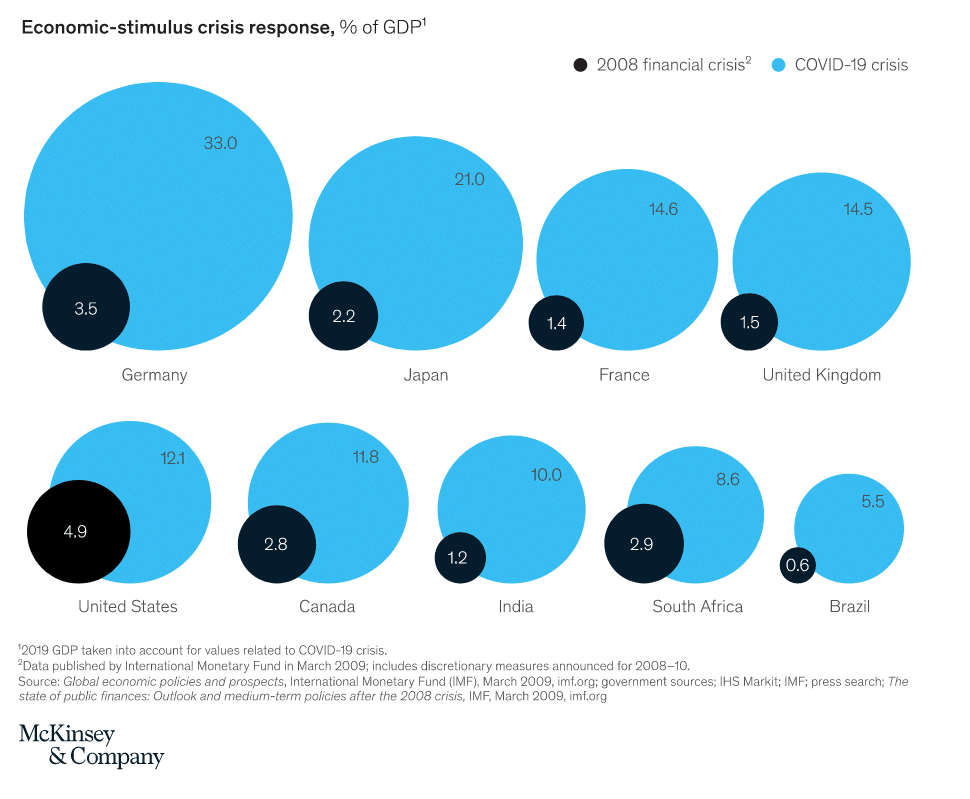

According to McKinsey, the first two months of the crisis alone saw aggregate global stimulus measures announced totaling over US$10 trillion, which is three times more than the response to the 2008-09 financial crisis.

Governments have included all shapes and forms in their stimulus packages: guarantees, loans, value transfers to companies and individuals, deferrals, and equity investments—as if advice from all modern schools of economic thought has been applied at the same time.

Notably, on 23 March (the day of the market’s recent low), the Federal Reserve pledged a commitment to an open ended program of asset purchases in any amounts necessary to support the smooth functioning of markets.

Since that announcement, the Fed and other central banks have pumped trillions of dollars of liquidity into markets through loans, asset purchases and other initiatives. Collectively these measures have skewed the free market forces of supply and demand as central banks have stepped into markets to bolster demand.