Moves in global markets in recent days have been wild. Monday saw Australian stocks tumble -7.4% and US stocks -7.6%, one of the US market’s biggest one day falls ever.

On the same day Australian energy stocks plunged more than -20% as Saudi Arabia and Russia both promised to boost oil production in what looked to be the start of a new price war.

Thankfully, Tuesday (10th of March) saw the Australian market rebound +3% and the US market +5% as calmer heads prevailed and markets thought more deeply about likely government stimulus packages.

In this edition of Insights we look at what’s really behind the volatility and give investors a sense of how their diversified portfolios have been travelling through this roller coaster period.

What is driving the extreme volatility?

People are behaving emotionally, not just in supermarkets, but in capital markets as well.

To be clear, the global economy isn’t just muddling its way aimlessly into recession. Keynesian economics has taught governments and central banks how to counterbalance slowdowns in economic activity with the use of monetary and fiscal policy.

As we go to print the Australian Federal Government are making plans to unleash a $10 bn stimulus package, and the Reserve Bank of Australia looks likely to cut interest rates again. These measures will keep cash circulating through the economy, boost confidence and combat the decline in economic activity. They are not intended to cease the slowdown, but rather “cushion the blow”.

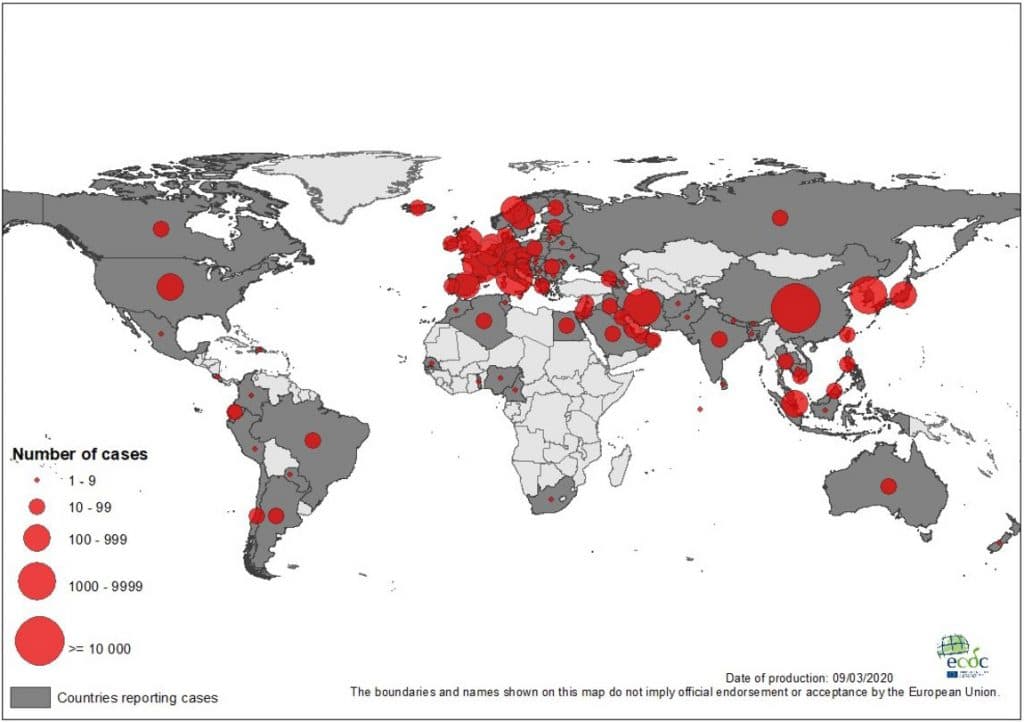

Virus epidemics don’t go on indefinitely. They tend to run out of steam within a year or two. Thus, economic activity is likely to be V-shaped or U-shaped.

The bottom of the “V” or “U”, will test businesses and households. Businesses that were on the brink may fail and overleveraged households may have to sell their homes if they can no longer find enough work to meet their bills. But most businesses and households will muddle through.

In many respects, the harshness of this cycle is a necessary part of the capitalist process – it ensures funds are allocated to the most well run and resilient businesses. The less competent businesses fail and are replaced. It’s harsh, but it works and its what makes capitalism the most successful system the World has ever known.

When considering the share market in times like these, it is worth considering legendary investor Benjamin Graham’s words:

“In the short run, the market is a voting machine but in the long run it is a weighing machine”.

What he meant was that in the short-term prices are driven by human emotions – fear and greed – but in the long run prices are driven by economic fundamentals – future expected earnings.

Keeping level heads in times like these can be a challenge. After all we are all subject to the same evolutionary traits that stir similar defensive responses in all of us. Yet succumbing to our emotions is rarely the right thing to do when it comes to investing. If you are feeling anxious about your investments then reach out to your adviser. Understanding more deeply how your investment program is meant to work in times like these can help to ease your fears.

How has my portfolio faired with COVID-19?

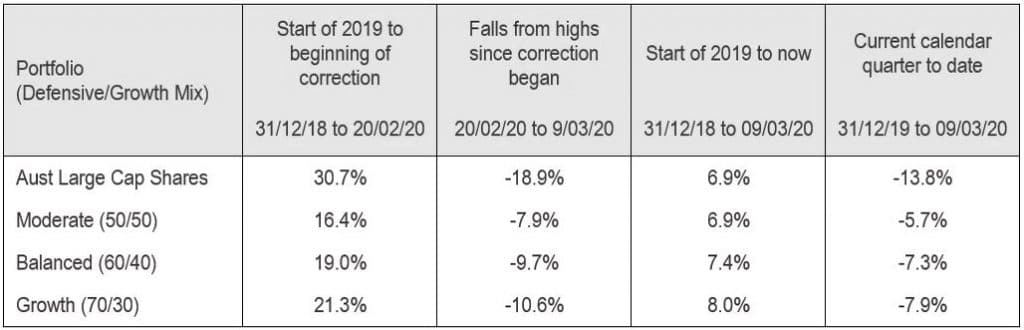

In recent years our systematic portfolio rebalancing regimen has seen us harvest profits from equities to top up other asset classes whose returns have been less spectacular – cash, bonds, and alternatives.

Now, as we enter this market sell off – it is the cash, bonds and alternatives that are doing the heavy lifting – working to offset some of the equity market losses.

This diversification is central to our process and ensures portfolios behave in a more muted way than pure equities. Indeed, many may be surprised at how little damage has been done to portfolios during this sell-off.

The typical returns of various portfolios (managed by Minchin Moore) for the March quarter to date are shown below:

If you are feeling anxious about your portfolio, please reach out to your adviser. We are here to help you through times like these.