A common misconception is that the stock market closely tracks the strength of the economy. And so, in times like these, when expectations are firmly set on most developed economies going into recession next year (if they’re not in recession already), often the natural assumption is that we’re in for a tough year on the markets as the economy slows.

If history is any guide, the reality is somewhat different, as Mark explains in this edition of Insights.

Investors often worry, that when a recession is officially announced, markets will respond negatively. In truth, this is rarely the case. The key thing to understand here is that markets are forward-looking and have typically incorporated the expectation of the impending recession long before the economy delivers two consecutive quarters of negative GDP growth (the technical definition of ‘recession’).

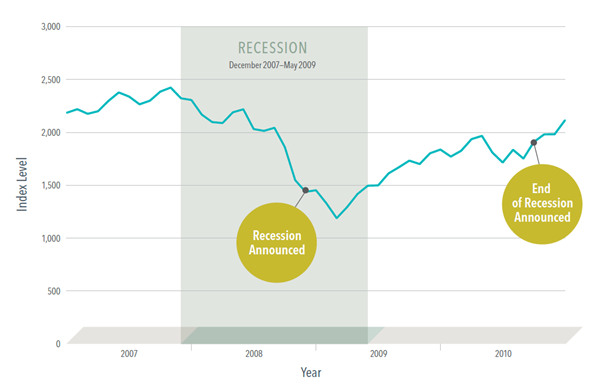

The global financial crisis offers a lesson in the forward-looking nature of the stock market. The US recession spanned from December 2007 to May 2009, as indicated by the shaded area in the chart.

But the official “in recession” announcement came in December 2008—a year after the recession had started. By then, stock prices had already dropped more than 40%, reflecting expectations of how the slowing economy would affect company profits.

Although the recession ended in May 2009, the “end of recession” announcement came 16 months later (September 2010). US stocks had started rebounding before the recession was over and climbed through the official announcement.

So, as we contemplate the possible movements in the markets in the year ahead – the key question is: how much of the anticipated slow down is already priced in?

As the GFC example highlights, equity markets will typically start to rise before the economy begins to improve. Determining exactly where we are in this cycle is always incredibly difficult however, and we’d caution against trying to make such predictions. But if there is a lesson here, it’s that at least some (if not all) of the looming economic slowdown is likely incorporated into prices already.

So, as we go into the Christmas break period, there may be reason for optimism, despite all the negative headlines. Merry Christmas!