In the realm of politics, short-termism is a constant. To start with our terms of government are too short, and our politicians seem to increasingly make decisions based on current polling. Surely their elected role is to broadly consider the best long term strategic options for the country and then make the tough decisions (even if it means wearing the short term political heat). So many great reforms were unpopular in the initial stages, only to be considered “nation building” in the fullness of time.

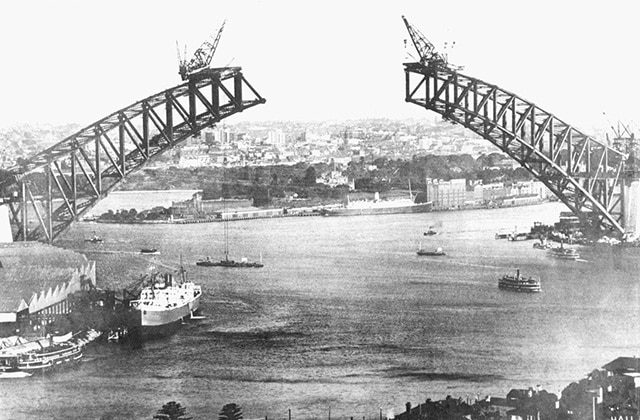

Construction of the Sydney Harbour Bridge commenced in 1924. The build took eight years and the Bridge opened in 1932. At that time it was the longest single span steel arch bridge in the world. It cost a horse and rider three pence and a car six pence to cross and the average annual daily traffic was around 11,000 vehicles per day (it’s now 180,000).

The bridge was clearly overkill in 1932, but the surplus capacity that was built was visionary. It enabled the bridge to continue as the primary harbour crossing for 60 years (until the Tunnel was built in 1992). The government debt incurred to build the bridge took 56 years to repay, but the benefits will span generations.

Good decisions require vision, courage and most importantly – evidenced based research. Doing the homework creates the conviction required to shunt short-termism and make the bold choices.

In contrast to the bridge, one wonders how sensible more recent government investments have been. Pink batts and Collins class submarines come to mind. Not to mention our newfound infatuation with financing our spending through ever-growing government debt – even as our AAA credit rating slips before our eyes.

Somehow our leaders and we who elect them have lost sight of the long term. We want it all now – and it seems we don’t care if it’s our children who will have to pay.

Let’s consider our visionary superannuation system. At its inception it was the vanguard of retirement savings systems. There were few credible systems in existence at the time, so the Hawke-Keating government had to lead the way.

Whilst our superannuation system has been an overwhelming success, inevitably mistakes were made in the initial design. For example, the decision to focus tax collections at the front end (contributions), rather than the back end (pensions and withdrawals) was driven by the desire to bring forward revenue collections, rather than effective tax design principles.

A further design flaw was that there were no caps on contributions. So at the extreme, the mega wealthy could tip in very large sums – even $50 million or $100 million. For a small element of society superannuation has been less of a retirement funding tool as an estate planning and tax sheltering tool.

To be clear, this is not a criticism of those successful people who simply heeded the advice of their advisers and structured their affairs to maximum effect, rather we are merely highlighting the unintended consequence of this oversight in the initial design.

The ‘spirit’ of the system was to provide an attractive savings scheme that would encourage workers to self-fund for retirement. This would in turn reduce the ever growing dependence on the age pension. The system was never intended to be a tax haven for the very wealthy.

While some of the design flaws have been wound back with the grand design in mind, many changes have been made based upon short term budgetary or political circumstances. Others continue to persist today. As with many tax reforms – there is no easy way to fix these remaining problems.

It’s taken some years for the major political parties and the electorate at large to reach consensus, but it is fair to say that today there is an acceptance that ‘tax free super’ should not be “open ended”. That is, zero tax may not be appropriate for those who are independently wealthy or very wealthy (where the line is drawn will depend on your point of view).

Despite this philosophical agreement, there continues to be a fiery debate about “retrospectivity”. The word immediately conjures up emotions of anger and politicians are ever attuned to harnessing this emotion for their own political advantage.

But those speaking the loudest about “retrospectivity” could be clouded in short-termism.

If we pause for a moment to blandly consider the fiscal facts – if you remove all of the elements of the government’s proposed reforms that could possibly be construed as “retrospective”, then what you are left with is precious little revenue gain and a continuation of the arrangement whereby very large superannuation balances attract no tax. Thus, continuing the disharmony between the structural reality and the philosophical consensus (ie those with very large balances should pay something).

Perhaps most critically, removing all elements of retrospectivity provides a continued windfall to one generation (retirees) while penalising another (the workers and future workers). Put more simply, it is another case of “kicking the can down the road” for our children to deal with.

But short-termism isn’t confined to politics. It pervades so many areas of decision making.

In the field of investing, short-termism can be particularly destructive. Intellectually, we know that daily stock market movements are virtually ‘random’, while in the long term they become more predictable. But despite this, we continue to be seduced by the lust for short term gains, and the primal need to avoid short term losses.

Risk aversion is always the most pronounced in the aftermath of bad news. The recent Brexit was no exception. Few people predicted the leave campaign winning and fewer still sold stocks prior to the vote – but many sold stocks afterwards in an effort to quench that desire to “avoid loss”. Since the initial news and immediate stock market sell-off, markets have rallied slightly and those who sold after the fact are currently ‘out of the money’. How this trade plays out over the coming months is uncertain, but therein lies a lesson nonetheless.

Times of market upheaval are rarely good times to make profound asset allocation choices. Big mistakes are remarkably easy to make during periods of turmoil. Let’s consider the last fifteen years – which included the massive upheavals of the subprime mortgage crisis and the Eurozone debt crisis. Despite these market collapses, if you had remained fully invested for the whole 15 years your average annual return was 8%. But if you were out of the market for the best 15 days (out of 5,475 days) your return fell to 3.3%.

Intriguingly the very best days on the markets tend to be during those scary times that ensue after each crisis manifests – times when investors are inclined to ‘play it safe’ and sit on the sidelines waiting for things to appear less risky before they venture back in.

There are so many of these lessons in modern times. Witness the savings and loans crisis, the Asian currency crisis, the dot.com crash, the 9/11 terrorist attacks, the Iraq war, the subprime mortgage crisis, the Eurozone debt crisis – in each case stocks were sold off only to recover to new highs. In each case, media experts told investors to get out and wait for things to improve.

The often cited ‘Oracle of Omaha’, Warren Buffet does nothing remarkable. He simply takes a long time view and he systematically adds to holdings in quality assets during times of crisis. Why can’t we all do this? Because we’re not wired this way. It takes real cognitive effort to resist the short term impulse. This can however be made easier by having a documented philosophy and working with an adviser.