One story has dominated the economic news in 2022 — inflation. Around the world, prices have risen faster than forecasters were expecting, because of knock-on effects from the Covid-19 pandemic, the war in Ukraine and strong consumer demand.

According to the Australian Bureau of Statistics, the annual inflation rate reached 6.8% in August. The biggest price increases, the ABS found, were in houses, car fuel and food, particularly fruit and vegetables. Even services, whose prices generally rise at a slower pace than goods, rose 6.7% (compared with core goods at 6.6%). The country hasn’t seen inflation like this for more than 30 years.

One crumb of comfort is that prices have risen more slowly in Australia than in many other countries, including the US and the UK. But it’s still a grim picture, and it’s not surprising that investors are concerned about the impact of inflation on their portfolios.

As we explained in our last article, 2022 has been one of the toughest years on record for investors. That’s because, unusually, bonds have fallen in value as well as equities. As a result, all investors — cautious, balanced, and adventurous ones — have been badly hit.

The question is, what should investors do now, given the inflationary environment we find ourselves in?

Market history is not an accurate guide to the future, but it does teach us important lessons. New research by Global Systematic Investors on investing and inflation provides a few key pointers.

1. Most assets are negatively affected by inflation

The bad news is that whatever you invest in, it probably won’t insulate you from the effects of inflation in the short run. Cash is an obvious example. Bonds fall in value too as a direct result of unexpected increases in yields.

Normally, in times of market stress, bonds and equities are negatively correlated; in other words when bonds fall, equities tend to rise. Inflationary periods are an exception. Rising prices increase economic uncertainty, and companies are often unable to pass on the increased cost of raw materials to their customers, which in turn reduces profits.

Because commodity prices usually rise when inflation accelerates, investing in commodities may provide portfolios with a hedge against inflation. The problem is, of course, that investing in commodities now is like closing the stable door after the horse has bolted. Prices have already shot up, and the possibility of further rises in inflation is effectively baked into them.

2. Predicting future inflation rates is very difficult

Of course, things would be simpler if we knew, in advance, how much further prices would rise or how long inflationary periods would last. But it’s extremely difficult to tell. Some forecasters are very downbeat, others more optimistic, and they can’t all be right.

A US study in August 2021 showed that higher inflation (roughly rates of more than 5%) is sometimes temporary, lasting only a few months. But there are several examples of inflationary periods lasting at least two-and-a-half years. On two occasions since the Second World War, they’ve lasted around four years. The most recent example came in the economic boom of the late 1980s.

If history is any guide, it is possible the worst of the current inflationary environment is already behind us. In Australia, the federal government and Reserve Bank have forecast that inflation will peak at 7.75% by the end of this year, and then fall over the next two years. But forecasts for other countries are more pessimistic.

3. Markets could rebound strongly when it’s over

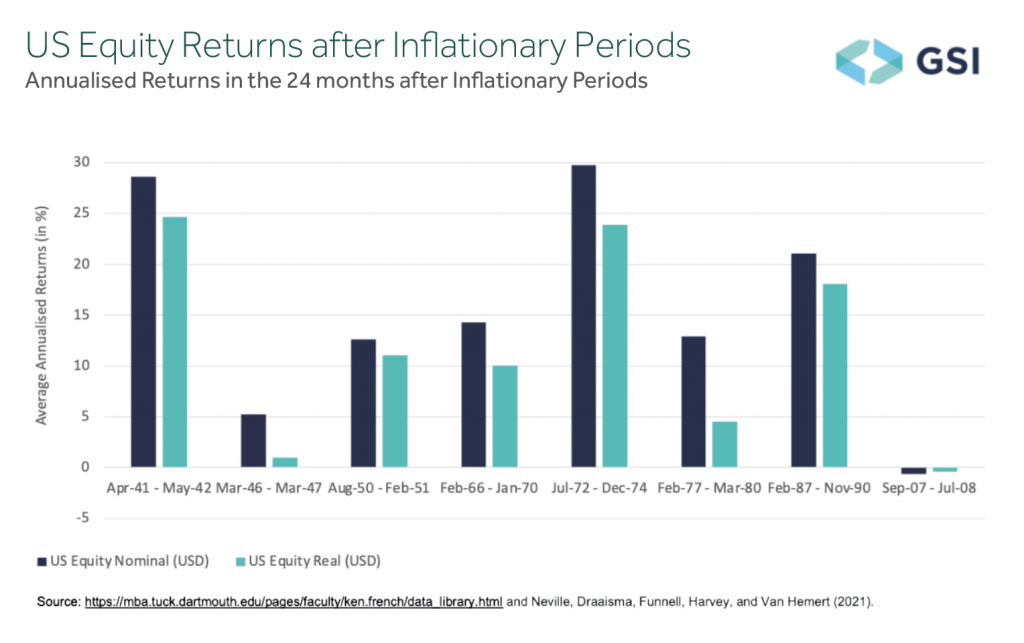

It’s almost always a bad idea to sell once prices have already fallen sharply. Why? Because eventually markets recover, often quite quickly, and it’s very hard to predict when prices will start rising again. As the chart below demonstrates, US equities tend to rebound strongly after inflationary periods. For example, in the two years that followed the crisis caused by the OPEC oil embargo in the early 1970s, US stock markets rose almost 30%.

Of course, inflation could persist for longer than analysts anticipate. But, by the same token, it could ease off far sooner. If you switch into cash now, it might provide you with some emotional relief in the short term, but it could mean missing out when prices recover.

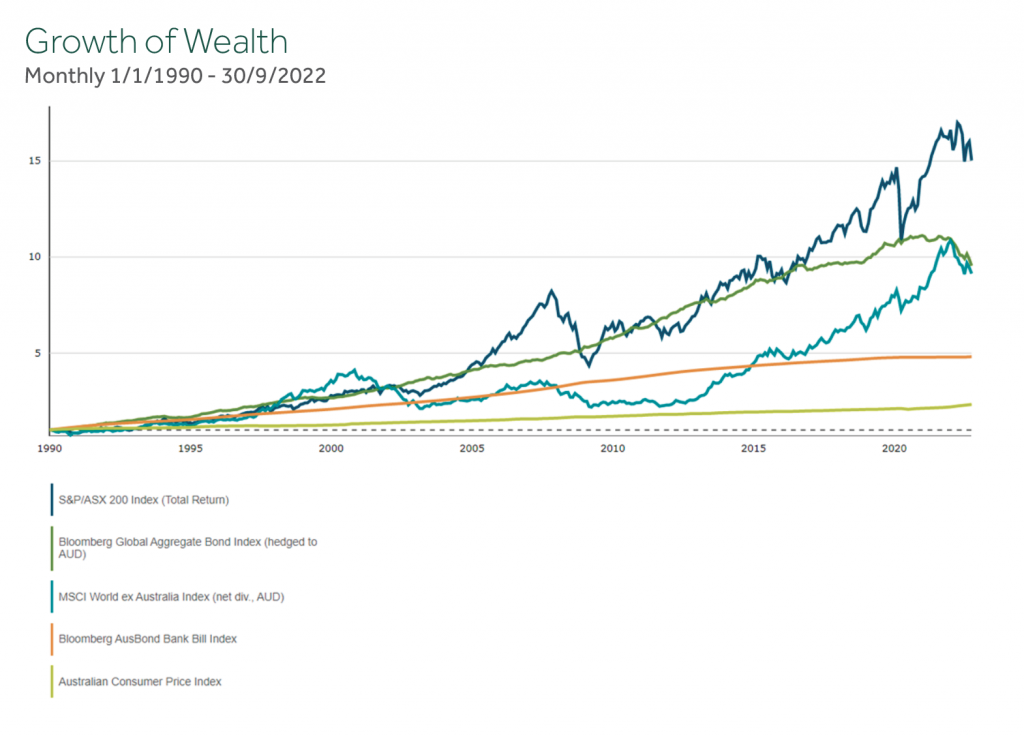

As always, it is important to keep an eye on the long term. Whilst inflation has negative effects in the short run, the major asset classes tend to rebound in time. Eventually, the market demands a real return, and selloffs like we’ve been going through this year can often set up the next period of growth.

Conclusion

As we’ve said before, no one has a crystal ball — either about inflation and the economy, or the future direction of the financial markets. The best approach is to stay calm and disciplined, and to stick to a strategy that’s founded on data and evidence.