By Andrew Marchant, Minchin Moore Chief Investment Officer (CIO) & Partner, with thanks to Dr Steve Garth, Industry Veteran, Minchin Moore Investment Committee Member.

After the exuberance of the “pivot party” in the last eight weeks of 2023 – when central banks all but confirmed that interest rises were over, and the next moves would be downward – many thought that there could be a retraction in early 2024. But markets have shaken off expectations that interest rate cuts are not coming as quickly as they had priced in at the end of last year and steadily climbed throughout the quarter.

Australia’s sharemarket reached an all time high in March, building on the same momentum that has pushed many major global equity benchmarks to fresh records on expectations of a world-wide rate cutting cycle. In the March quarter the S&P/ASX 200 index was up 5.3%, and that’s after the gain of 12.1% between November the 1st and December the 31st last year. The S&P 500 Index was up 10% this quarter, and up over 32% in the last 12 months.

At the heart of these impressive rallies appears to be the unshakeable belief that a soft landing has been achieved, and that economies will continue to grow. The sharpest increases in interest rates in generations has not led to a recession, inflation has been tamed and continues to fall, moving closer to the 2% to 3% target band that central banks target, and interest rate cuts are now just a matter of when, not if.

Economic news of the quarter has been consistent with a Goldilocks scenario of continuing growth, low unemployment and falling inflation, with central banks expected to make rate cuts this year. However, some market strategists have warned that the market has simply become too overbought and that a material pullback is near. But even they acknowledge it is extremely hard to know how stretched a rally in the stock market has become when the advance is as strong and relentless as this one has been.

At this point, it seems there is little to stop this momentum continuing. It’s all blue skies ahead – interest rates and inflation are normalising, economic growth is forecast to improve, unemployment remains low, and there appears to be no obvious risks on the horizon (while acknowledging on-going geopolitical tensions). Of course, these are exactly the times to be cautious about the risks the market doesn’t see coming. This is where a process that incorporates disciplined and systematic rebalancing come to the fore, taking forecasting out of the equation and reducing exposure to outperforming assets during the period of strength.

Inflation & Interest Rates

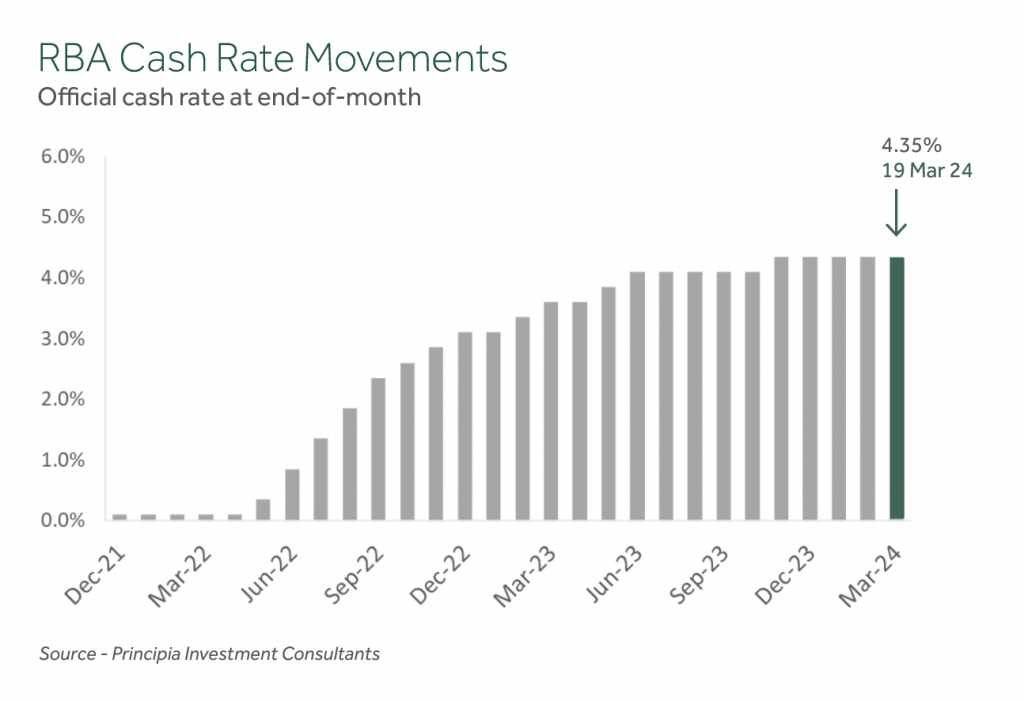

Financial markets continue to be obsessively focused on two key economic indicators: interest rates and inflation. The path for both is inextricably linked and while expectations remain that we have seen the peak in rates, the ‘last mile’ of the inflation journey is proving challenging and frustrating for central bank policymakers. As a result expectations for rate cuts have been revised several times already this year.

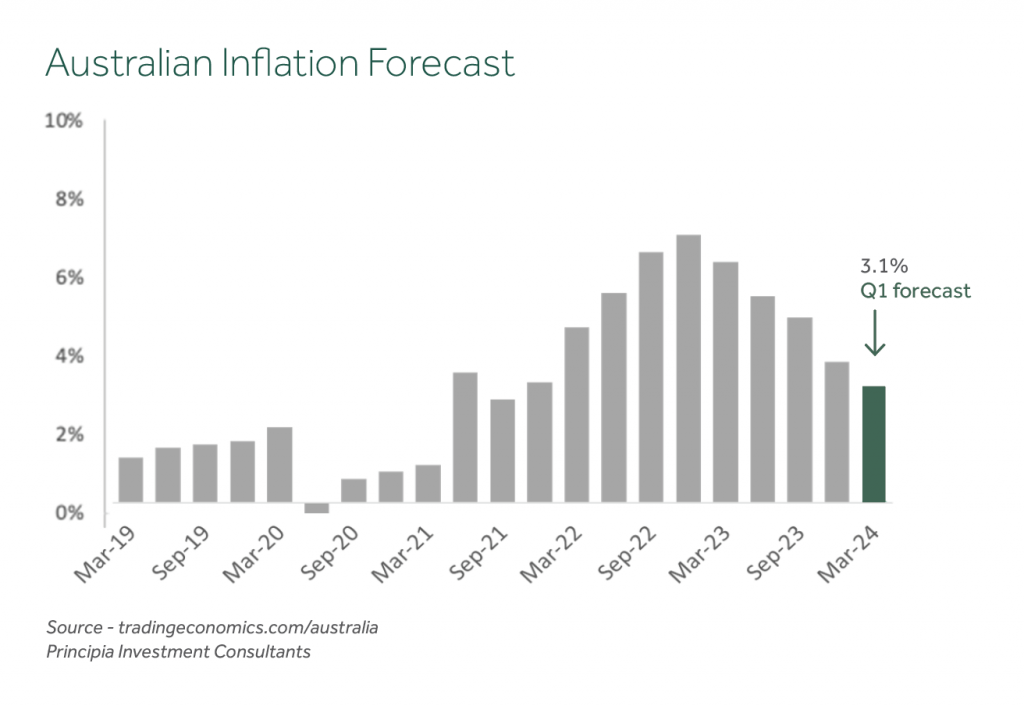

There has been a rapid fall in inflation across the globe since the end of 2022. Australia’s inflation rate was 4.1% in Q4 of 2023 – which was below expectations – and is forecast to be 3.1% for this quarter. While cost pressure in the country have eased inflation remains outside the 2% – 3% target range.

As inflation continues its downward trend, the RBA remains in a wait and see mode. The Board reiterated at their March meeting that the path of interest rates will depend upon the data and the evolving assessment of risks. The central bank has reiterated that they need to be confident that inflation will return to the target range of 2% to 3% in 2025.

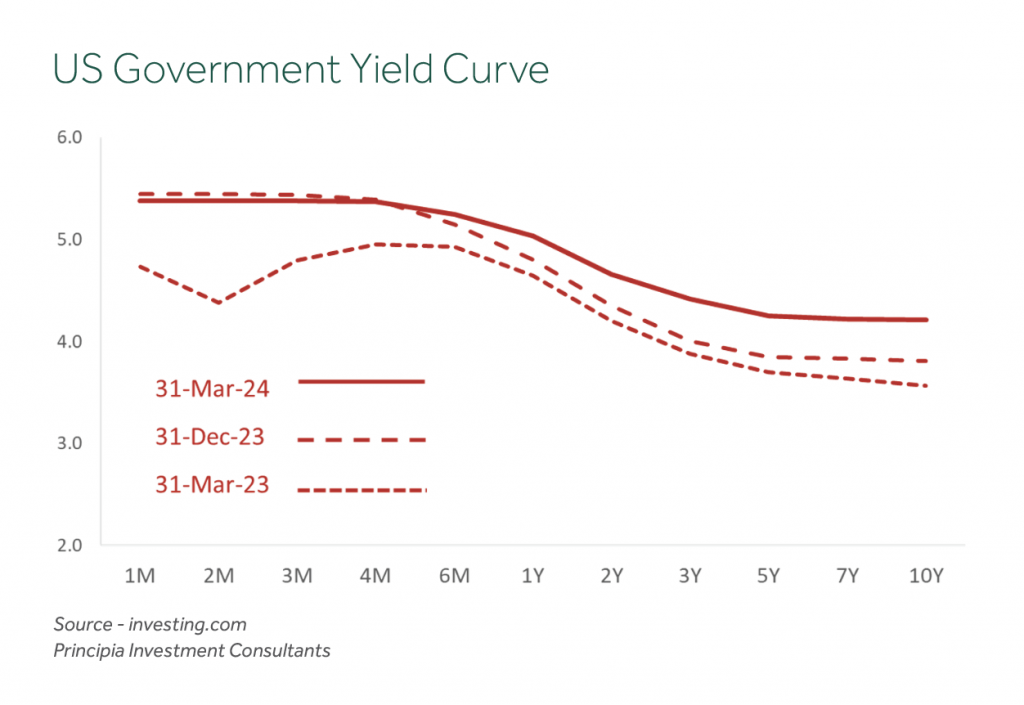

At the start of 2024 financial markets had priced in 1.25% in cuts for the US by the end of the year (commencing in March), and almost 2% of cuts by the end of 2025. By the end of the quarter the expectations were pared back to 0.75% by the end of 2024 (commencing in September) and 1.5% by the end of 2025. Driving this reassessment has been mixed inflation data and uncertainty surrounding the return to the target rate of 2%.

In a recent speech Fed Chair Powell noted the Fed ‘do not expect that it will be appropriate to lower our policy rate until we have greater confidence that inflation is moving sustainably down toward 2 percent. Given the strength of the economy and progress on inflation so far, we have time to let the incoming data guide our decisions on policy’. Chair Powell also observed ‘Reducing rates too soon or too much could result in a reversal of the progress we have seen on inflation and ultimately require even tighter policy to get inflation back to 2 percent. But easing policy too late or too little could unduly weaken economic activity and employment’.

This framing of the decision making considerations has the effect of every data point on inflation and employment being ‘live’ in terms of its impact on expectations for future rate movements, and it also means that all data points are interrogated and analysed deeply to ascertain their expected impact on the Fed’s decision.

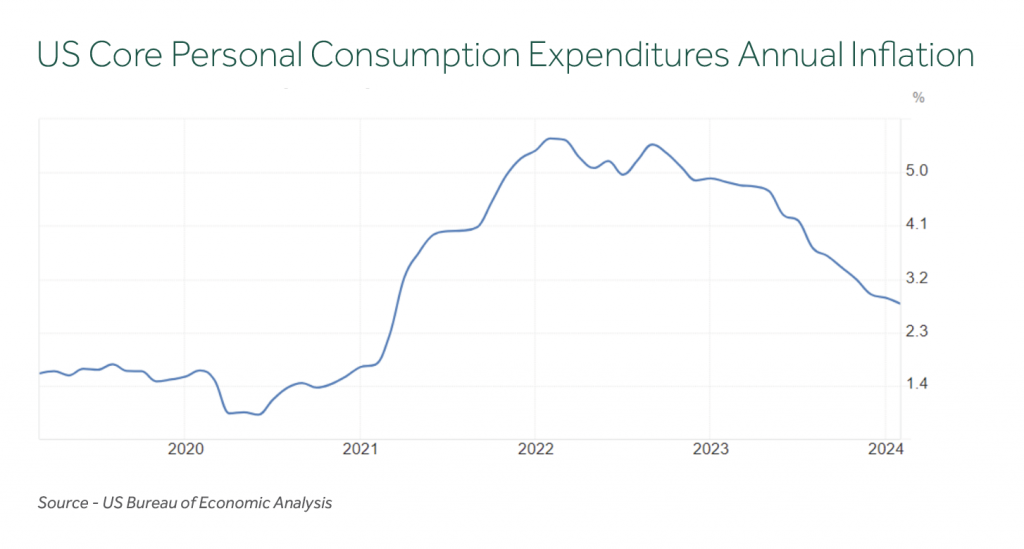

It is pertinent to remind that the Fed has stated its preferred measure of inflation is the Personal Consumption Expenditures (PCE) Index not the Consumer Price Index. The PCE is produced by the Bureau of Economic Analysis and is preferred because it has a broader scope and better reflects how consumers change what they buy to account for rising prices. The Fed primarily looks at ‘Core’ prices, which strip out volatile food and energy prices.

PCE Inflation data is released at the end of each month and as at February 2024, the 12m rate was 2.5%. The Core PCE rate was 2.8%, the lowest level since March 2021. These inflation measures sit a little lower than the Consumer Price Index level of 3.5% (and 3.8% for Core CPI). The variation in these measures and media focus on CPI also contributes to volatility in market expectations for the Fed’s course of action.

Portfolio Performance

Diversified portfolios enjoyed a quarter of positive returns, as the momentum at the end of 2023 continued into the new year. By the end of March, most of the major stockmarkets, including the ASX and US has reached record high levels. 12 month returns from all the major asset classes were positive and portfolio returns for the year were the highest since the end of 2021.

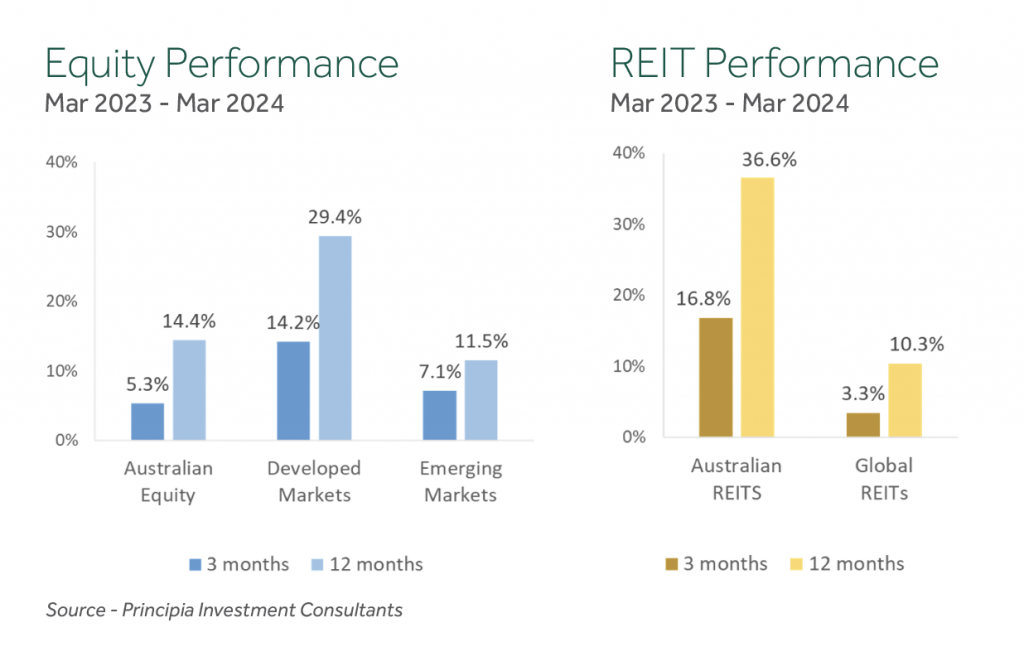

Growth Asset Classes delivered positive returns for the quarter with Australian Shares (+5.3%), unhedged International Shares (+14.1%), hedged International Shares (+10.0%), and International Property & Infrastructure (+3.0%) all advancing strongly.

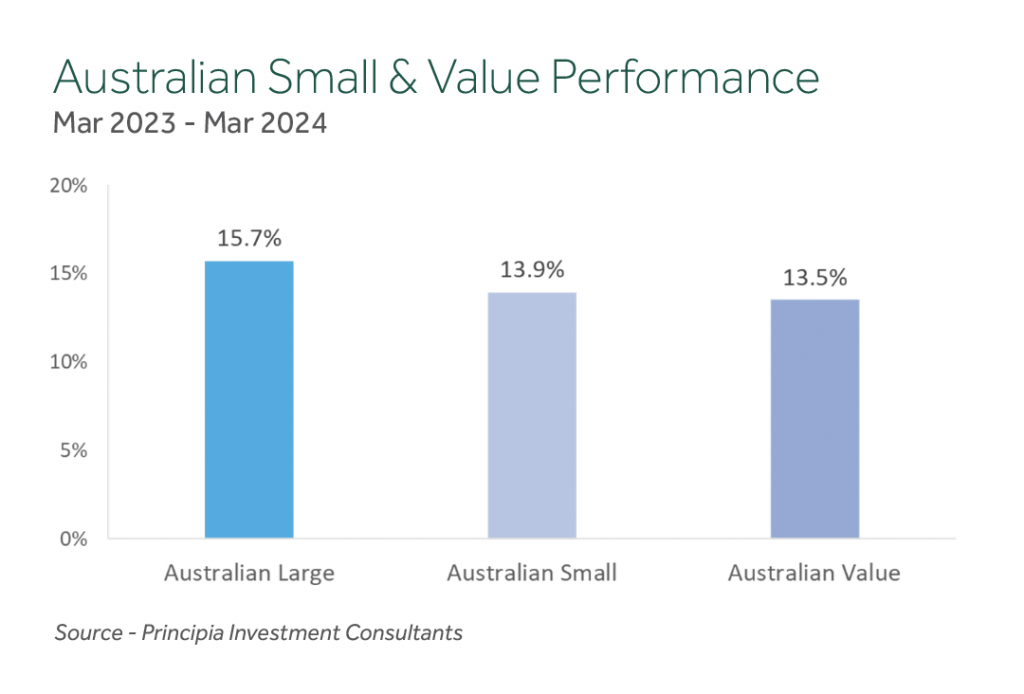

Within Australian Shares we combine three broad components (or factors) to construct a well-diversified aggregate portfolio:

- Large Companies (for broad market exposure),

- Value Companies (those with cheaper relative valuations), and

- Mid/Small Companies (expected to deliver higher returns over time).

Each of these three sub-categories behave differently through time, and each plays a role in contributing to performance and risk management. Through the investment cycle we expect each to experience different sequencing of return, leading to opportunities to top up the underperforming components and take profits from the components that are performing well.

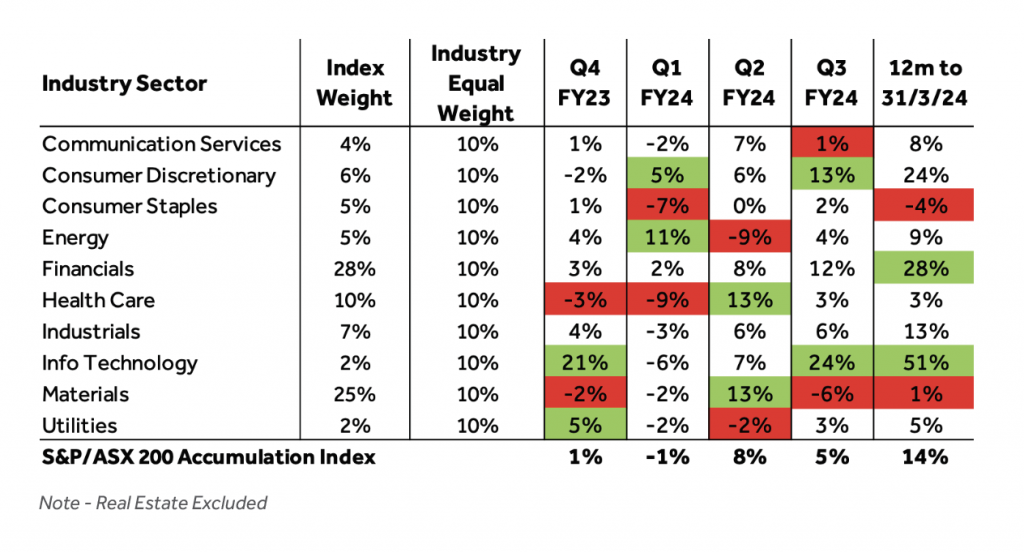

An ‘Industry Equal Weight’ approach to the selection of direct large cap Australian shares continued to provide diversified sources of returns as shown in the table below (the top and bottom two sectors each period have been highlighted). The annual returns to March 2024 from the Industry Sectors ranged from -4% for Consumer Staples to +51% for Information Technology. In many respects the ‘winners’ and ‘losers’ have switched places, with Consumer Discretionary, Financials, and Information Technology posting better returns after lagging over the preceding 12 months, while Energy, Materials, and Utilities were muted after leading the way over preceding quarters.

Our approach seeks to manage risk and improve diversification by allocating equally across the Industry Sectors, rather than adopting the traditional market weighted approach. This method takes advantage of the less than perfect correlation between the Industry Sectors, which can be clearly seen in the table.

The quarter saw the divergence between traditional and sustainability focused portfolios continue to narrow, as returns from the Energy and Utilities Industry Sectors (which are typically not held in sustainability portfolios due to their exposure to fossil fuels) were weaker, while Industry Sectors more prominent in these portfolios, including Information Technology, Financials, and Consumer Discretionary led the market. We continue to expect longer returns from each approach to be similar, particularly given a consistent underlying investment philosophy.

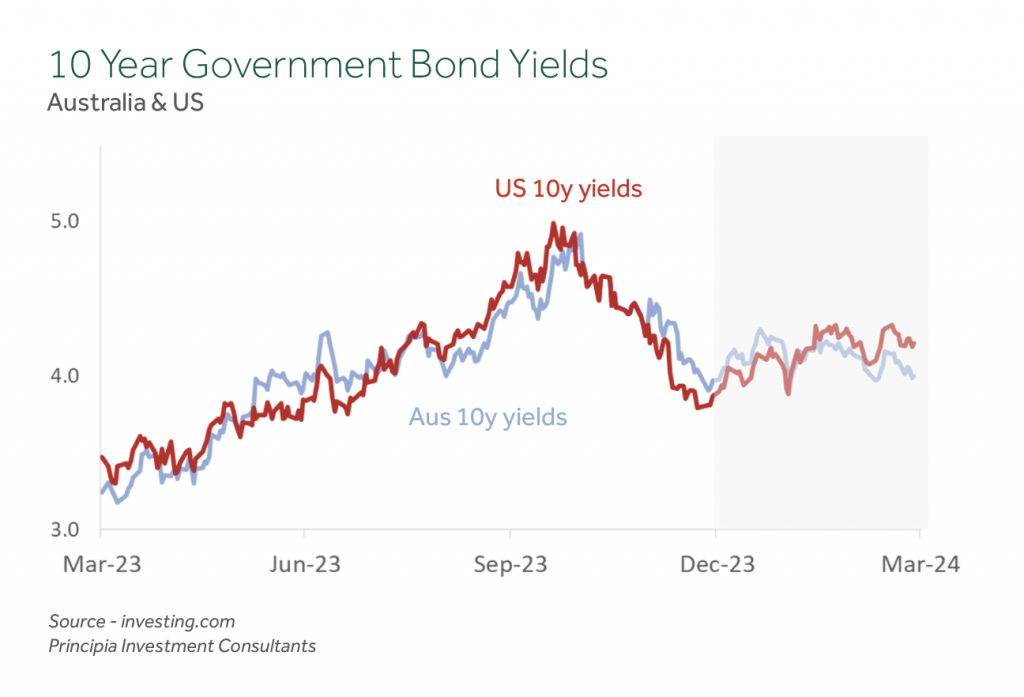

Within Defensive Assets, Bonds have pulled back after the strong rally in Q4 2023, as central banks have reiterated that they are in no rush to start moving interest rates down, and consequently expectations for rapid interest rate cuts have been scaled back. The back up in yields saw International Debt (-0.3%) post a small negative return for the quarter. The annual return was a healthier +2.5% outcome. Australian Credit (hybrid securities) posted small positive return for the quarter (+1.7%) as did Cash (+1.1%), both of which are benefitting from higher interest rates.

The change in the US yield curve reflects the changing expectations around interest rate cuts from the Federal Reserve. At the start of the year the market had priced in three 25 bp cuts over 2024. However, the Feds have reiterated that they will proceed cautiously as it decides when to begin cutting rates while carefully considering the latest economic data points.

Performance for the March quarter across diversified portfolios ranged from +3.9% for 50/50 Growth/Defensive portfolios to +6.8% for 85/15 portfolios.

Annual returns to 31 March 2024 for diversified portfolios ranged from +10.0% for 50/50 portfolios to +16.0% for 85/15 portfolios.