There has been much written lately about the winning streak that AI-related stocks are having this year. Shares of Nvidia are up about 170 per cent, while Apple and Microsoft – the top two US companies by market value – have both climbed nearly 40 per cent.

This begs the question:

How do you pick these winners in advance?

Recent advancements in AI technology, together with hype around ChatGPT and the future role AI will play in our daily lives has seen stocks connected with AI soar this year.

Notably, shares in Nvidia are up about 170 per cent, while Apple and Microsoft – the top two US companies by market value – have both climbed nearly 40 per cent.

These phenomenal short-term gains have prompted many investors to question how they can pick these winners in advance? Well, the truth is picking the winners in advance is so hard that it may not be worth trying. Moreover, the good news is that you don’t have to. A portfolio that includes a diversified exposure to international shares that is linked to market cap weights will include stocks before, during and after they have their winning streak. That is your best bet for a successful investment journey.

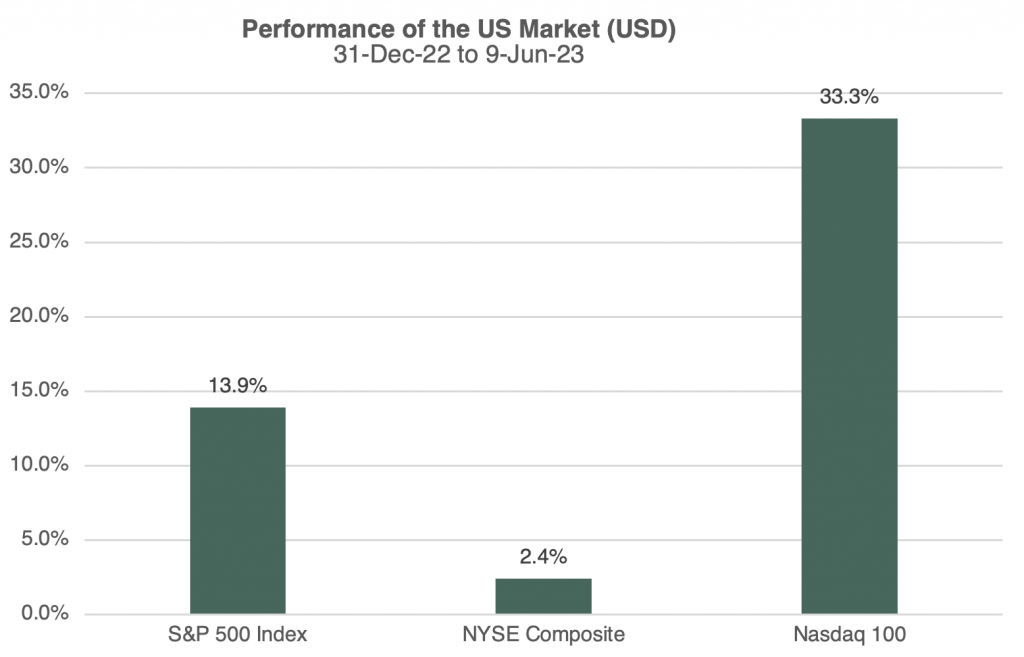

The US stock market – as represented by S&P 500 Index – became a “bull market” this month after gaining 20% from an October low, driven by investors betting on America’s resilient economic growth and an expected pause in interest-rate hikes signalling the end of this rate cycle. But the rally in the overall market has been eclipsed by the tech-heavy Nasdaq 100 which has gained 33 per cent since the start of the year. The chart below shows the year-to-date performance (up to Friday 9th of June) of the S&P 500 index, and the two major exchanges that stocks trade on that make up the index – the New York Stock Exchange and the Nasdaq. The top stocks (by market capitalization) in the NYSE Composite index include Berkshire Hathaway, Johnson and Johnson, Exxon Mobil, and JP Morgan. The top stocks in the Nasdaq are Apple, Microsoft, Amazon and Nvidia.

It is a tale of two different markets when looking at the S&P 500 this way. NYSE traded stocks make up around 54% of the index, while Nasdaq traded stocks make up the remaining 46%. But the five largest stocks in the S&P 500 are all Nasdaq stocks and they make up close to 25% of the index (the S&P 500 represents the 500 largest stocks in the US and covers approximately 80% of available market capitalization[1]).

Market commentators generally agree that excitement over advances in artificial intelligence is a key factor fuelling gains in mega cap hi tech stocks. In particular Nvidia – a company that not many Australian investors would have heard of a few weeks back, and only entered the Top 10 companies in the S&P 500 index in 2020 – is up a staggering 170% year to date. The stock keeps climbing higher and higher – shares were already up 110% heading into its May 23 earnings report but have risen by more than 50% since then after the chipmaker’s upbeat sales forecast.

Given that the overall performance of the US market is being driven by a very narrow group of stocks – the five largest stocks in the S&P 500 have accounted for more than 80 per cent of the index performance year to date – the warning signs about the dangers of a concentrated market are flashing. There could be a significant fall in the broader market should those mega cap stocks falter – although betting against these stocks over the last 10 years has been a dangerous strategy.

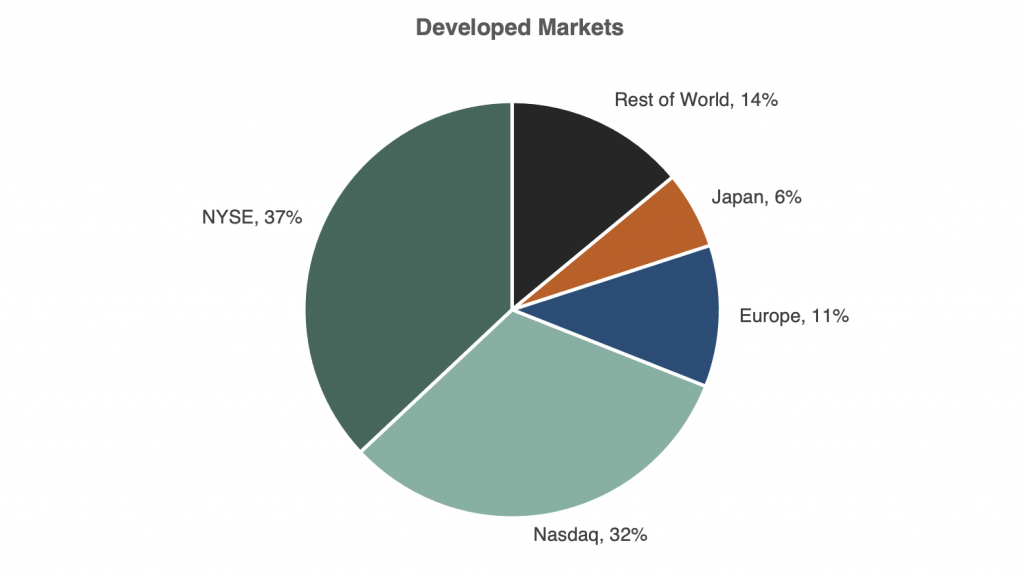

How does an investor know when to get into a stock and when to get out? They fact is they don’t. Market timing stocks is impossible. A recent story in Bloomberg[2] was how fund manager Cathie Wood’s flagship exchange-traded ARK Innovation fund closed out its position in Nvidia in early January. Then came the artificial intelligence frenzy that sent the stock and its big tech peers surging. If the experts can’t time markets and know when to get into and out of stocks, what chance do the rest of us have? The good news is that investors don’t have to bet on trying to pick the “next big thing” in the stock market. A portfolio that includes a diversified exposure to international shares that is linked to market cap weights will include stocks before, during and after they have their winning streak. The chart below shows the characteristics of the MSCI World Index, a broad-based index that holds around 1500 stocks from developed markets.

The MSCI USA index makes up around 69% of the MSCI World Index, which consists of the NYSE-traded stocks and the Nasdaq-traded stocks as shown in the chart. Other major components are the MSCI Europe index and the MSCI Japan index. For comparison, the MSCI Australia index makes up around 2%. Because the MSCI World Index is market cap weighted the top stocks are – you guessed it – Apple, Microsoft, Nvidia, Alphabet (the parent company of Google), Tesla and Facebook. In fact, the first non-US stock is Switzerland’s Nestle, coming in at number 18[1].

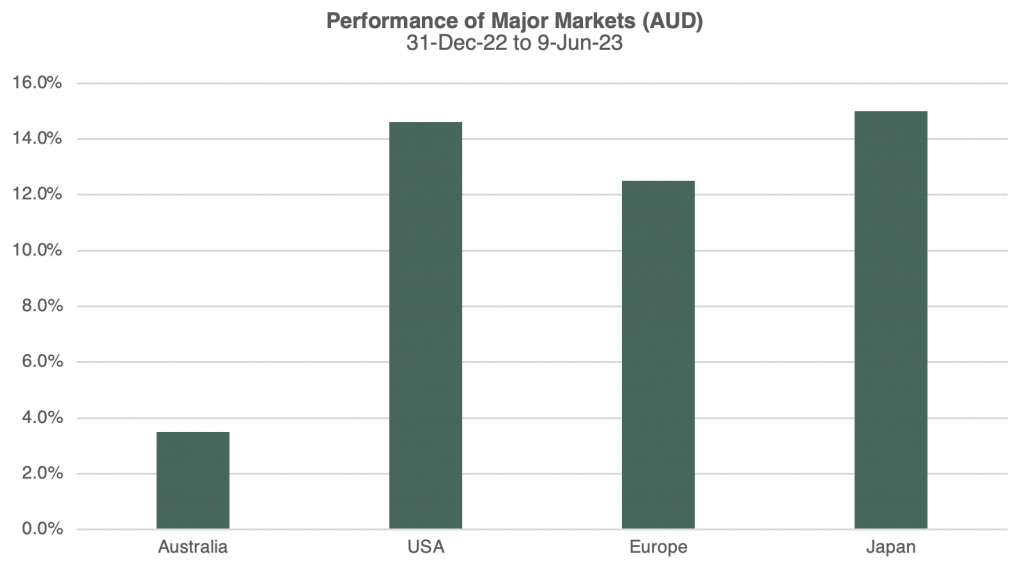

But having exposure to international stocks that are linked to market cap weighting means you also pick up winning stocks that you may never have heard of. The chart below shows the year to date performance of the component MSCI country indices in AUD. Note that the MSCI USA index is different to the more common S&P 500 index due to different index methodologies, and we are quoting AUD returns here.

It may surprise many to see Japan with the top year to date performance of the major markets. In fact over the last decade the growth of the US and Japanese markets have been identical (when expressed in their own currency). This seems odd given that over the past decade the US economy has been a powerhouse of growth, while the Japanese economy has been stagnant despite ongoing government initiatives to produce some growth. It just shows that a diversified exposure can give returns from unexpected stocks, and unexpected countries.

What all this means for investors is that trying to spot trends in advance or companies that are about to capitalize on the latest technology has never been a successful strategy. Timing markets and picking winners is hard – and impossibly hard to do it consistently. But having a diversified exposure to companies linked to market cap weights – both here in Australia and in other markets – means that you don’t have to pick the winners. A diversified portfolio will do it for you.

[1] https://www.spglobal.com/spdji/en/indices/equity/sp-500/#overview

[2] https://www.bloomberg.com/news/articles/2023-05-25/cathie-wood-s-arkk-dumped-nvidia-stock-before-560-billion-surge

[3] The data is from the iShares MSCI World ETF as at June 12th. As the ETF seeks to replicate the MSCI indices the quoted numbers maybe different form the actual index.