In the Roadrunner cartoons, Wile E. Coyotes would chase his nemesis relentlessly, even running off cliffs and continue running into mid-air. Only when he looked down, and realised there was no longer any support, did he fall. This gives rise to the term “a Wile E. Coyote moment” in financial markets. when investors realise the stock market has been running without support for a long time, and prices that should have long since been gradually coming down suddenly collapse.

Coyotes can defy gravity for years in the markets — but generally there comes a point when gravity catches up to them. This year has seen the large tech stocks having to readjust to a world where persistent inflation has forced central banks to push up interest rates, thus ending the years of cheap money and the ability to defy gravity.

The large tech stocks have been known by the acronym FAANGs, which represents Facebook, Apple, Amazon, Netflix and Google. But the acronym applies generally to the large tech stocks, such as Microsoft[1]. A combination of rising interest rates, market saturation, increasing competition and a reset in tech stock valuations has changed the narrative for FAANG in 2022.

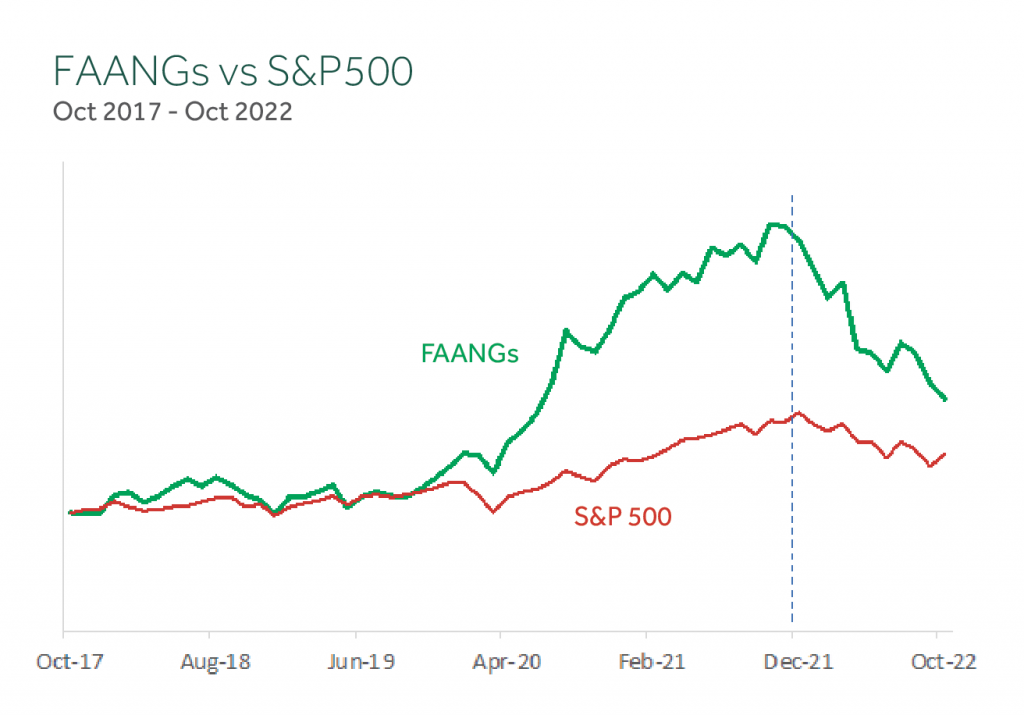

In the below chart we show the extraordinary performance of the FAANG index[2] relative to the broader US market (represented by the S&P 500 index) over the last 5 years.

Microsoft, Google-owner Alphabet and even Apple have all suffered write-downs to varying degrees this year, but the fall from the sky of Meta Platforms Inc., the Facebook parent, and Amazon has been particularly hard.

Meta has now underperformed the benchmark S&P 500 since it went public in 2012. For investors who thought they were betting on the next big thing, it won’t be surprising if they are starting to think twice.

Unfortunately for the tech sector, the bad news continues with Amazon.com Inc. Its third-quarter earnings released at the end of October were in line with market expectations, but shares plummeted 13% when the company issued a disappointing fourth quarter forecast. It’s the second time this year Amazon’s results have been disappointing enough to spark a double-digit percentage selloff. In April, a weak forecast for the second quarter led to a 14% drop in the stock.

Like the rest of Big Tech, Amazon has had a rocky year so far as it confronts macroeconomic headwinds, soaring inflation and rising interest rates. Those challenges have coincided with a slowdown in Amazon’s core retail business, as consumers returned to shopping in stores. Amazon has been down as much as 40% this year.

As the chart above shows, the FAANG stocks were doing better than the market even before the Covid-19 selloff in March 2020. Investors worked on the assumption that these companies would benefit from the pandemic, which they unquestionably did — but it is only now that investors have fully grasped that they shouldn’t be valued as though the pandemic conditions would continue forever. Remarkably, if you measure relative performance between the FAANG+ index and the broader S&P 500 index from March 2020 then the indices are now level pegging.

The selloff in the “new economy” tech sector has seen a rotation into the “old economy” stocks which tend to have more stable earnings streams and typically are less sensitive to interest rate increases. High-growth tech names are more sensitive to rising interest rates as typically they are valued based on their projected profits far into the future. As the US Federal Reserve continues with its aggressive tightening monetary policy, the future profits of tech firms will be worth far less.

This is not to imply that there is anything wrong with these companies and they will continue to deliver product and services that are sought after by consumers. But their valuations are at last being examined critically.

The takeout for an investor is that trying to time the “next great thing” in the stock market is a difficult game to play. Which company will turn out to be the best investment? What sector will be the strongest performer? Which country will offer the highest return? The truth is nobody really knows.

Fortunately, you don’t need to rely on guesswork to invest well. It turns out that for long term investors, a diversified approach that includes all segments of the market – both domestic and international – is a great way to increase your opportunity set, manage overall risk and improve the reliability of outcomes.

This article was inspired by Wile E. Coyote Moment as Tech Goes Off the Cliff by Bloomberg Opinion columnist John Authers. Economist and New York Times editorial writer Paul Krugman is usually credited with making the connection between Wile E. Coyote with economic disaster in 2003.