In times of uncertainty, people look to financial advisers for answers on things they just aren’t qualified to comment on. Will markets fall further? Will there be a global recession? What will the Reserve Bank of Australia decide to do about interest rates at its next meeting? Will China invade Taiwan?

All of these are fascinating questions. The problem is that nobody knows how events will unfold. And our tendency to put our trust in those with the strongest opinions is a dangerous thing to do.

Financial journalist and author Robin Powell has been discussing this phenomenon, officially known as the certainty effect, with Joe Wiggins. Joe is an expert in behavioural finance and the author of a new book called The Intelligent Fund Investor.

RP: Why is it, Joe, that people are naturally drawn to people who have strong opinions about things? And not just in the investment sphere, but life in general.

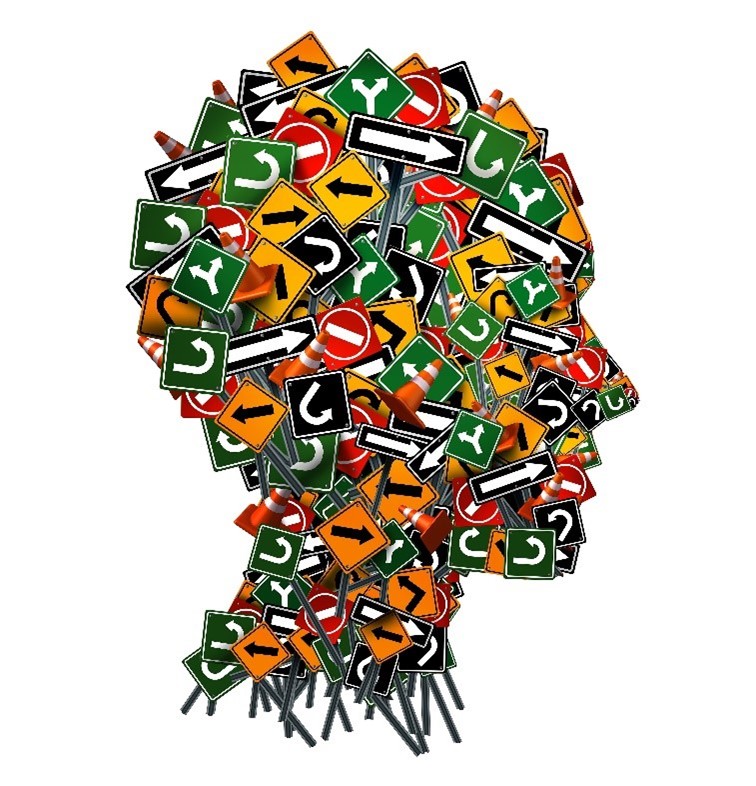

JW: I think it’s because life and particularly the financial markets are incredibly complex and uncertain, and that makes us uncomfortable.

So, we’re drawn to people who supposedly remove that discomfort by having an opinion or a view. When we’re worried or anxious, it makes us feel better if someone has a strong view or perspective. It makes us think that things aren’t chaotic, they’re not random, and they’re actually controllable.

We can see this in investing all the time. We want people to have views on short-term market movements, because it makes us feel better, even though the markets are inherently unpredictable.

It’s a human trait, then, to seek out people with strong views on the markets. But why is it so dangerous?

As I say, the markets are unpredictable. So, if we are predicting or having views on where the markets are heading, the danger is that we’ll trade too much and make poor decisions that will cost us money. There are certain things in investing that we can predict or have more confidence in predicting, like the power of compounding over time, like the benefits of long-term investing in equities, for example. But most things in investing are very unpredictable and uncertain, and therefore, if we have strong views on them, we’re likely to be wrong-footed, and that could cost us.

People might be a little confused by what you’re saying here. All right, they should beware of certainty. But is it acceptable not to have an opinion at all?

It’s true, it can be a confusing concept to grasp. It’s really important to think about your own circle of competence. So, is it reasonable for me to have a view on what the FTSE All Share will do over the next three months? Or what the Federal Reserve will choose to do about interest rates at the next meeting? Is it something that’s inherently forecastable or predictable? Should I have a view at all? And many of these things are just not predictable, so we should avoid thinking that they are.

In other words, it’s not ignorant not to have a view. It’s actually sensible to have an awareness of things in the financial markets that are inherently unpredictable and difficult to forecast.

What does this mean for people when making decisions about their investments?

It’s important for investors to have a focus list of topics on which they can be confident in having a view. That’ll be things like compounding, having a long-term approach, being aware of the behavioural challenges of investing in stock markets, for example. But they should also feel comfortable saying. “I don’t know,” or “I don’t have opinion on this because I don’t think it’s predictable and I don’t think I have the skill required to predict the outcome.”

What are the implications for those who are trying to find a financial adviser they can trust? What sort of things should they be listening out for?

Certainty in an adviser is a warning sign. If he or she is suggesting they can make predictions about things or have a view on things that are incredibly difficult to get right, such as predicting short-term market movements or making macroeconomic forecasts, that should be a real concern. Very few people, if anyone, can get those things consistently right. If the adviser is being honest with you and saying, “These are the things that I don’t think I can control or predict,” that’s an honesty that you should find attractive.

So, look for an adviser who is clear about what they can and do have views on and what really matters over the long term.