By Andrew Marchant, Minchin Moore Chief Investment Officer (CIO) & Partner, with thanks to Dr Steve Garth, Industry Veteran, Minchin Moore Investment Committee Member.

An eerie calm has fallen over markets in recent weeks, as the banking stresses of early March fade into the background. Market measures of risk, such as volatility, have retreated, while global equity markets have rebounded strongly, buoyed by a resurgence in technology stocks.

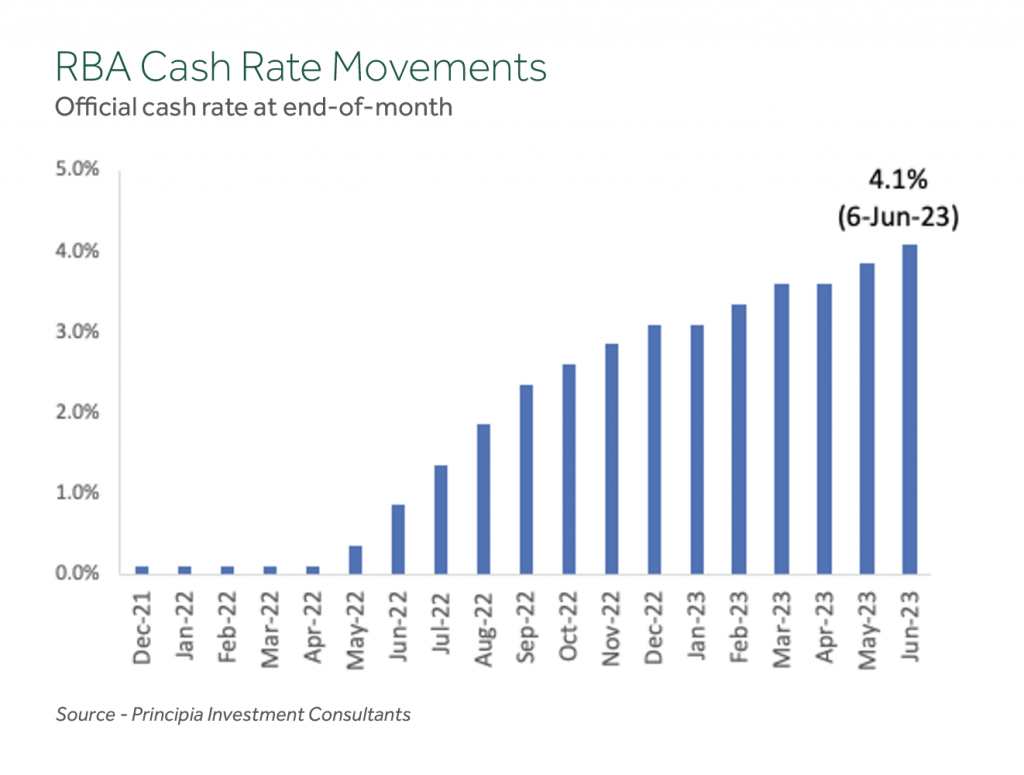

The Australian stock market, represented by the S&P/ASX 200 index is up 14.8% over the last 12 months. This is despite continuing rate increases from the Reserve Bank, and at the end of the second quarter the consensus view is that there will still be another two rate hikes before the terminal rate is reached. In that period the cash rate has increased from 0.85% to 4.1% and is now at its highest level since April 2012. However, the S&P/ASX Volatility Index – a measure of expected volatility over the next 30 days – remains at its lowest levels since the end of 2021.

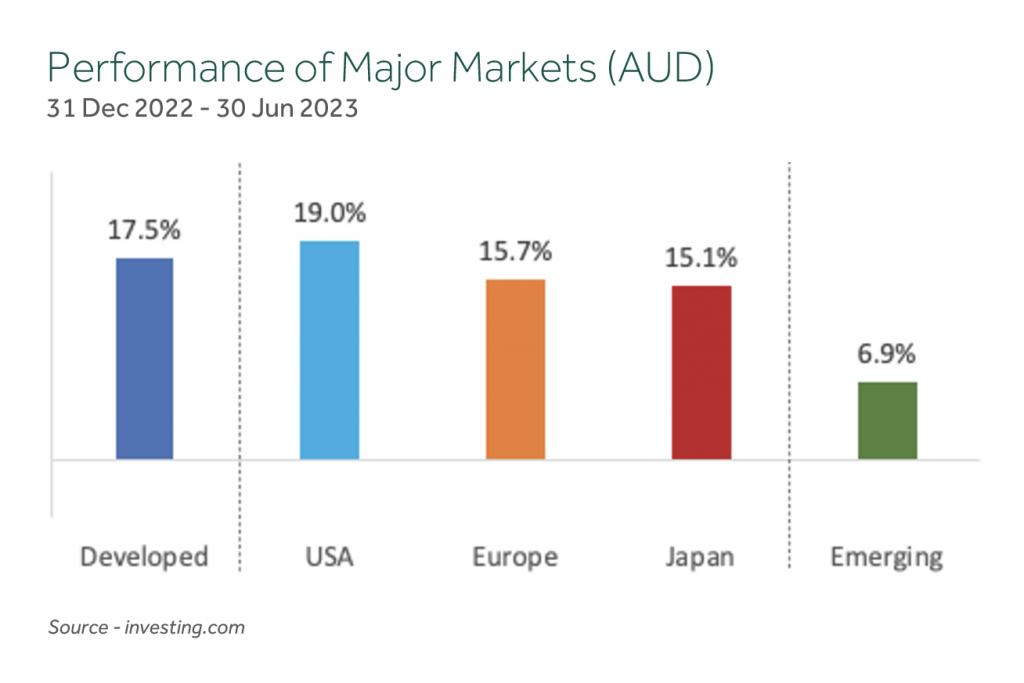

Global equities have rallied over the last 6 months, with the MSCI World ex Australia Index returning 17.5% since the start of the year. The recovery in global risk assets has however been quite narrow and heavily concentrated in a small number of US tech stocks. In the US the S&P 500 Index has gained 13% this year, recouping the 2022 downturn since the Fed kicked off its cycle of rate hikes last March. The index is also up 22% from its October closing trough, leaving it above the threshold of what’s considered a bull market. However nearly all the gains have come from the big stocks in the Nasdaq 100 Index, which is poised for its best opening six months ever, with a surge of 36% erasing last year’s 33% slump.

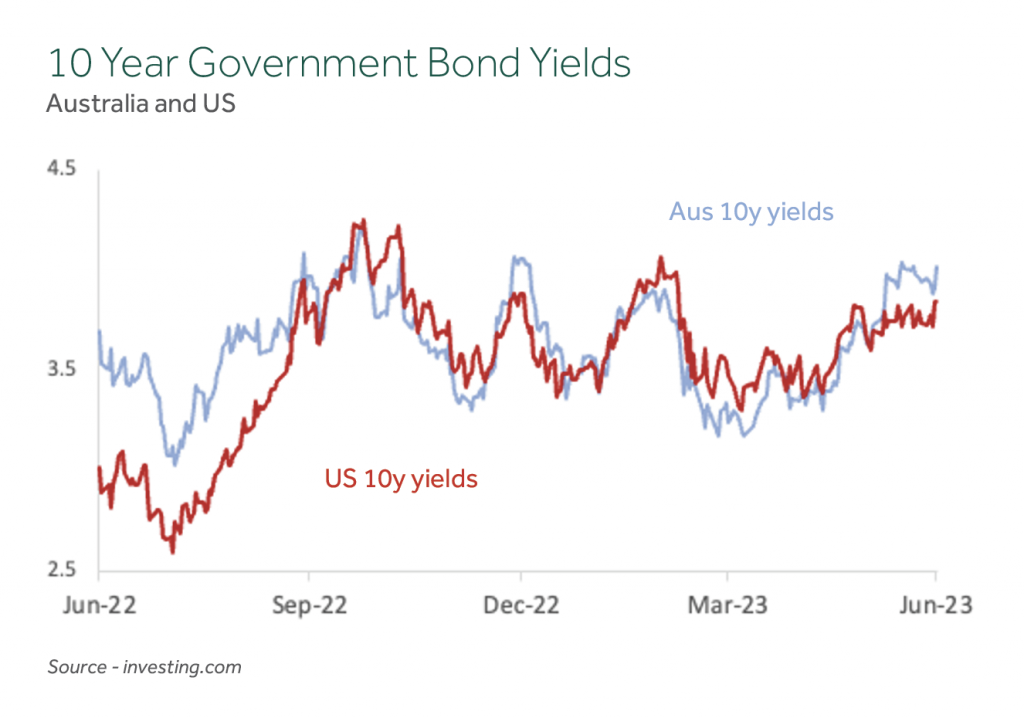

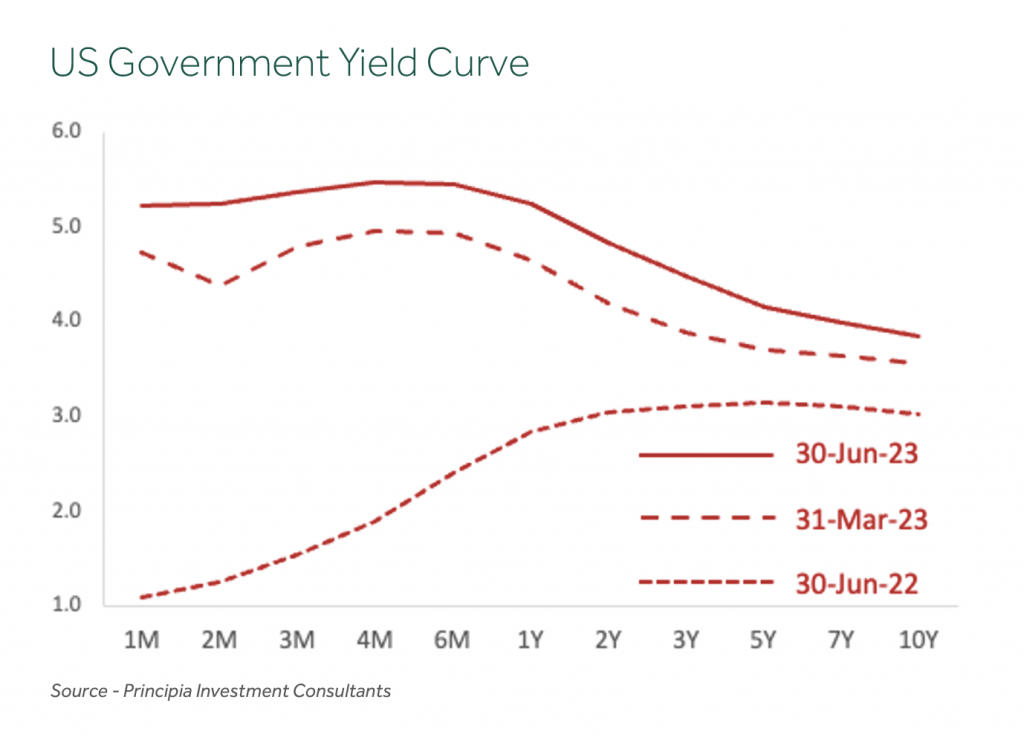

The bond market has been focused on the growing risk of still-higher rates and the US yield curve continues to suggest a recession is imminent. A surprisingly resilient economy gives warning that the job of beating inflation is far from over as data shows that while inflation is coming off its highs the economy is still growing at a faster-than-expected pace. Central banks in Australia and the northern hemisphere are expected to continue to raise official cash rates despite the increasing risk of recession.

Global government bond yields have been rising over the quarter, as stubbornly high inflation pushes central banks to continue to increase interest rates. Despite the global bond index having a 3% gain in the first quarter, increasing yields are delaying the promise of a strong rebound for bonds after last year’s historic negative 12% return.

The annual inflation rate in Australia dropped to 7.0% in Q1 of 2023 from an over-30-year high of 7.8% in the previous period. The headline figure of the monthly Consumer Price Index (CPI) for May 2023 signalled a large deceleration of inflation, though underlying measures were less encouraging. The inflation rate in Australia is forecast to be 6.3% for Q2 2023.

While inflation is falling, it is not falling fast enough to prevent central banks in Australia and elsewhere from continuing to raise interest rates despite an increasing risk of recession. The RBA raised the cash rate for the 12th time in early June to 4.1% and indicated further increases are likely to suppress still-elevated price pressures.

Equity and bond markets are sending mixed messages. The equity market believes that the terminal rate for this cycle of tightening is close, and that as inflation continues to decline the economy will gradually slow to a soft landing. Bond markets also believe the terminal rate is close, but the inverted yield curves in Australia and the US suggest that a hard landing may be in store. There remains uncertainty about the lagged effects of tightening so far and the extent of credit tightening in the US resulting from banking stresses earlier in the year.

The exuberant equity market and low volatility may just be the calm before the storm.

What Dominated the News

The following news summary is not intended to explain the markets’ performance in the quarter, but to provide some perspective about what dominated headlines:

April

- Saudi Arabia and OPEC+ oil producers announce surprise output cuts

- RBA pauses run of 10 straight rate hikes; Awaits inflation signals

- IMF cuts global growth outlook; Warns of risks from financial turmoil

- US inflation rate falls to near two-year low but core rate rises

- US financial institutions hit by deposit flight as clients seek higher returns

- RBA Board to lose interest rate-setting powers in major shake-up

- Fox News settles Dominion lawsuit for $787.5m over US election lies

May

- US regulators seize failed ‘First Republic Bank’; Sell assets to JPMorgan

- US Federal Reserve raises interest rates again, Opens door to pause

- RBA stuns market with rate hike; Warns more may be needed

- World Health Organisation declares end to COVID global health emergency

- Australia posts first Budget surplus in 15 Years amid high commodity prices

- US annual inflation slows to below 5%; Price pressures still strong

- President Biden and Republican leaders reach deal on US debt ceiling

June

- US SEC launches crackdown against Cryptocurrency exchanges

- RBA surprises economists again in raising rates to 11-year high

- Following ten consecutive increases, US Fed leaves key rate on hold

- ECB raises rates to 22-year high; Signals more to come

- Japan’s Nikkei average closes above 33,000 for first time since 1990

- Trump pleads not guilty to Federal charges on classified documents

- Putin on defensive after short-lived Mutiny by mercenary force

Portfolio Movements

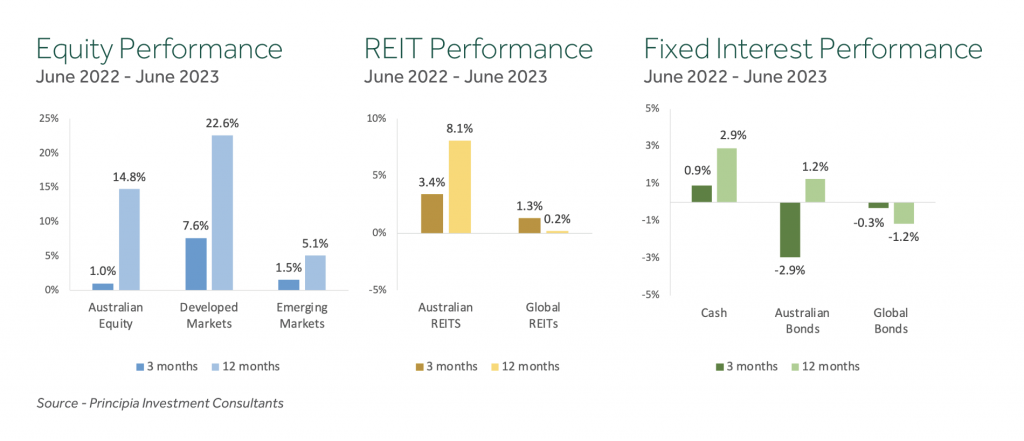

Growth Asset Classes delivered positive returns for the quarter with Australian Shares (+1.0%) unhedged International Shares (+7.6%), hedged International Shares (+7.1%), and International Property & Infrastructure (+0.4%) all advancing.

Within Defensive Assets, the rise in yields saw International Debt (-0.3%) post a negative return for the quarter. Australian Credit (hybrid securities) posted small positive return (+0.4%) as did Cash (+1.0%), both of which are benefitting from higher interest rates.

The US yield curve remains inverted despite the slowing of inflation and the economy remaining resilient in the face of higher interest rates. Economists are now divided on whether the US will have the long anticipated hard-landing, or whether a soft landing is now more likely. However, the Fed has signalled more rate rises are to come.

Performance for the December quarter across diversified portfolios ranged from +1.4% for 50/50 Growth/Defensive portfolios to +2.8% for 85/15 portfolios.

Annual returns to 30 June 2023 for diversified portfolios improved from the low point in December 2022 and ranged from +6.2% for 50/50 portfolios to +10.9% for 85/15 portfolios.

Australian Shares Portfolio Strategy

Within Australian Shares we combine three broad components to construct a well-diversified aggregate portfolio:

- Large Companies (for broad market exposure),

- Value Companies (those with cheaper relative valuations), and

- Small Companies (expected to deliver higher returns over time).

Each of these three sub-categories behave differently through time, and each plays a role in contributing to performance and risk management. Through the investment cycle we expect each to experience different sequencing of return, leading to opportunities to top up the underperforming components and take profits from the components that are performing well.

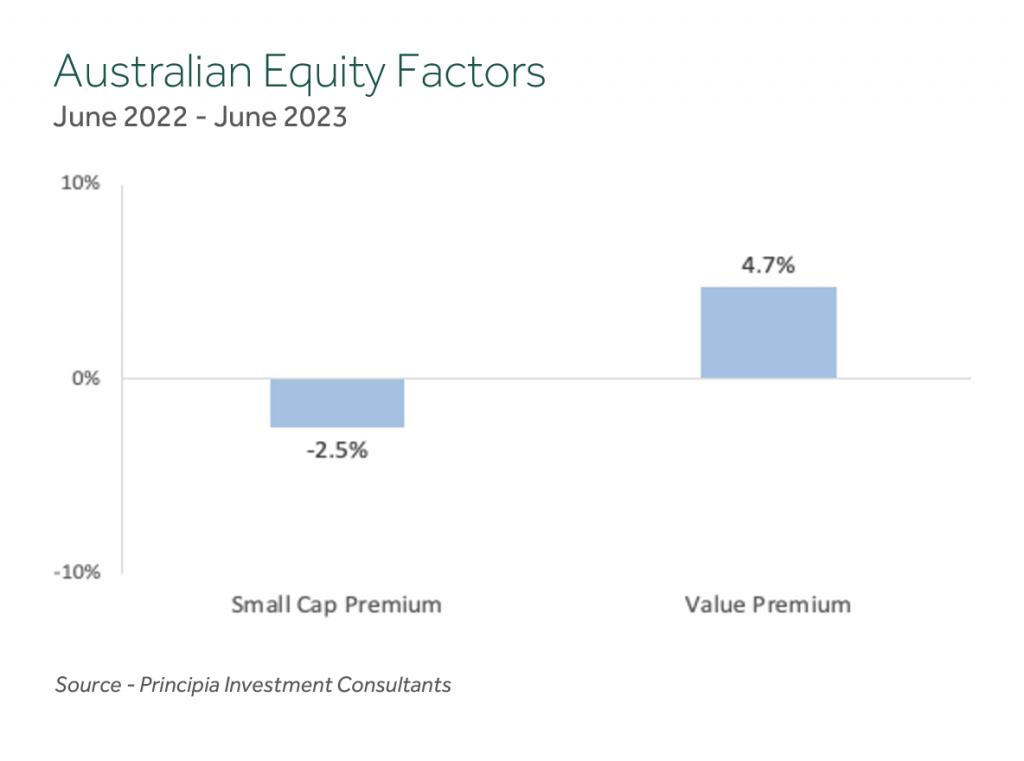

Factors are very volatile over short time periods. Looking over the course of the last 12 months, value stocks out-performed growth stocks by 4.7%, as lower relative price companies on average did better than higher relative price companies. However, smaller companies have under-performed the broader market by 2.5%.

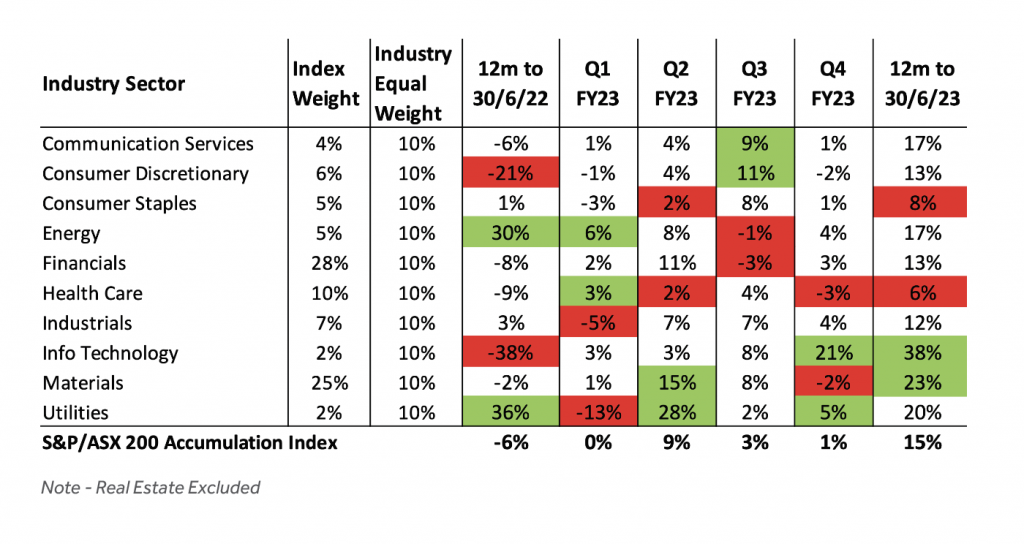

An ‘Industry Equal Weight’ approach to the selection of direct Australian shares continued to provide diversified sources of returns as shown in the table below (the top and bottom two sectors each quarter have been highlighted). The annual returns from the Industry Sectors ranged from +6% for Health Care to +38% for Information Technology. In many respects the ‘winners’ and ‘losers’ have switched places, with Materials, Communication Services, and Information Technology posting better returns after lagging over the preceding 12 months.

Our approach seeks to manage risk and improve diversification by allocating equally across the Industry Sectors, rather than adopting the traditional market weighted approach. This method takes advantage of the less than perfect correlation between the Industry Sectors, which can be clearly seen in the table. Through the investment cycle there are periods when each sector delivers superior returns and periods when they underperform. This variation in return provides opportunities to harvest returns from outperforming sectors and add to exposures in underperforming sectors at depressed prices – without trying to forecast in advance when the rotation will occur.

The quarter saw the divergence between traditional and sustainability focused portfolios narrow, as returns from the Energy and Utilities Industry Sectors (which are typically not held in sustainability portfolios due to their exposure to fossil fuels) were matched by improved returns in Industry Sectors more prominent in these portfolios, including Information Technology, Industrials, and Financials. We continue to expect longer returns from each approach to be similar, particularly given a consistent underlying investment philosophy.