December brought to an end the toughest year for global financial markets since the financial crisis of 2008 amid resurgent inflation, rising interest rates and the shock to commodity markets from Russia’s invasion of Ukraine.

Inflation was the dominant news story of the year, with measures of consumer price inflation hitting multi-decade highs in major economies and proving more resilient than earlier central bank assurances that it would be a transitory phenomenon.

Adding to the global economic uncertainty was the impact of China’s shutdowns to contain outbreaks of COVID-19 among its population, although restrictions began to be lifted as the year came to an end.

Global developed market stocks fell about 12% over the year, but there were signs of a reversal of sentiment in the final quarter as the most recent consumer price indicators raised hopes in some quarters of a peak in inflation.

For equity markets overall, the year marked the worst since the Global Financial Crisis (GFC) of 2008. For bonds, it was the worst year in decades as central banks tightened policy and warned that more action would be needed to return inflation to target.

For the average Balanced investor (holding both stocks and bonds), 2022 was arguably the worst year since 1931, although Australian investors fared much better than investors from other developed nations.

In its last move of 2022, the Fed in December said it expected its key policy rate to rise to 5.1% by the end of 2023. The Reserve Bank of Australia also foreshadowed further tightening, saying it expected inflation to peak above 8%.

Just before the end of the year, the Bank of Japan surprised financial markets by doubling a cap on 10-year bond yields (meaning it plans to let yields on these long bonds move higher), a move interpreted as laying the ground for the bank quitting a decade of extraordinary policy stimulus.

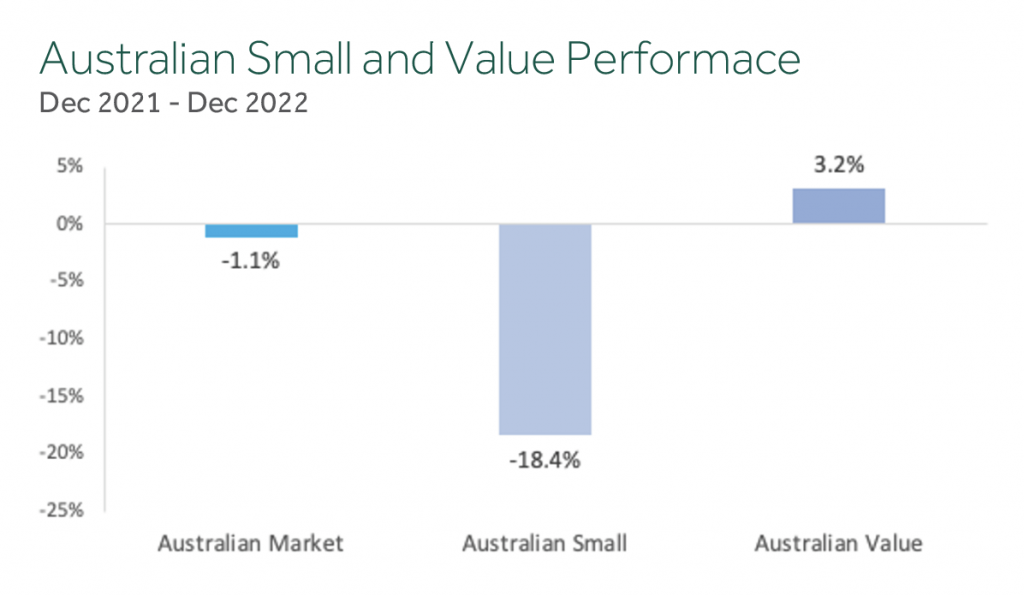

While equity markets were down overall for the year, there was a strong value premium in both the fourth quarter and the full year as low relative price stocks in sectors such as energy beat their growth stock counterparts in technology. The size premium (i.e. the higher return attributable to holding smaller stocks) was negative, however.

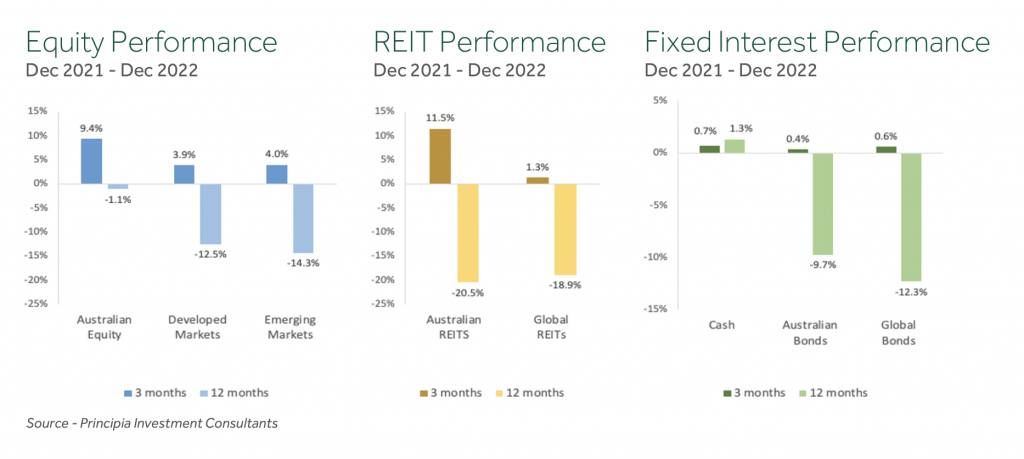

While down overall for the year, Australian stocks outpaced their global developed and emerging market counterparts in the fourth quarter and the full year, thanks partly to surge in energy and resource stocks after Russia’s invasion of Ukraine.

Coal miners, gas producers, lithium miners and iron ore miners were among the top local gainers for the year. Technology stocks were among the biggest losers.

With the Federal Reserve leading other central banks with the pace and aggression of its rate hike cycle, the US dollar was dominant against most other currencies over 2022, although gave up some ground in the final quarter.

What Dominated the News

The following news summary is not intended to explain the markets’ performance in the quarter, but to provide some perspective about what dominated headlines:

October

- IMF, in Global Economic Outlook, predicts inflation to peak late in 2022

- Xi Jinping secures third term as leader of China’s ruling Communist Party

- Russia strikes back against Ukraine after bridge to Crimea hit by explosion

- Australian Government, mindful of UK crisis, stresses stability in low-drama Budget

- Leftist ex-President Lula defeats incumbent Bolsonaro in Brazil run-off poll

- Billionaire Elon Musk completes controversial $44b acquisition of Twitter

- Sunak becomes Britain’s third PM in two months after market crisis

November

- RBA raises rates for seventh consecutive month; flags more to come

- Ukrainian forces recapture regional capital Kherson in country’s east

- Crypto Exchange FTX starts bankruptcy action amid regulatory scrutiny

- COP27 Climate Summit in Egypt agrees on fund to help poor nations

- US and Chinese presidents strike conciliatory tone at G20 Meeting in Bali

- Markets soar as Federal Reserve suggests it will moderate pace of rate rises

December

- Facing widespread Resistance to lockdowns, China relaxes zero-Covid policy

- G7 and Australia agree to $US60 per Barrel price cap on Russian oil

- RBA raises cash rate to 10-Year high of 3.1%; issues hawkish outlook

- Federal Reserve switches to smaller rate rises; but predicts more ahead

- No ‘Santa Rally’ for markets as Central Banks dampen peak rate hopes

- Yen surges as Bank of Japan surprises markets with policy change

- US Justice Dept charges FTX founder with fraud and money laundering

Portfolio Movements

The themes for the quarter continue to be around inflation and the market trying to determine the “terminal rate” for this economic cycle. Weighing on the market is the prospect of global recession in 2023.

Asset prices of stocks, bonds and property all fell in 2022 as the worst inflation in decades caused central banks to repeatedly raise cash rates. Inflation was due to three main factors: (i) the end of expansionary fiscal and monetary policy due to the COVID-19 pandemic; (ii) demand for services curbed by restrictions, and demand for goods leading to supply chain bottlenecks; and lastly, (iii) commodity price rises owing to strong demand, and the war in Ukraine which pushed prices even higher.

It now appears that the higher cash rates are having their desired effect – all three of these factors may be abating, and that the terminal rate for this cycle of increasing interest rates is close. However other variables, namely the low level of unemployment, building wage pressures and relatively resilient household finances may keep inflation relatively elevated.

In financial markets there were two significant rebounds in stocks and bonds during 2022 despite the overall fall in asset prices. The first was from mid-June to mid-August when comments from the Federal Reserve were interpreted as pointing to an impending pause in rate rises. However, hopes of a Fed pause evaporated as a Jackson Hole speech by its chair, Jerome Powell, triggered a further sell-off. Stocks and bonds hit their lows in mid-October.

A second rally has dominated the December quarter, resulting in positive returns for global equities and bonds. However, that rally ended on December 15th when the US Federal Reserve raised rates by an expected 50bps but projected further increases throughout 2023 as well as a rise in unemployment and a slowdown in economic growth.

The year ended much as it started; with markets trying to come to terms with how much further rates will need to go before the “terminal rate” is reached – the rate that central banks consider enough to bring inflation back down towards their target band.

A rally that saw the US S&P 500 and Australia’s ASX 200 gain about 14 per cent from the start of October spluttered out mid-December. Markets are caught between hope that central banks have raised rates far enough to bring inflation down, and fear that their actions will bring on a recession of unknown depth and length. Over the quarter the Australian market was up 9.6% but was down -1.1% over the 12 months.

The other Growth Asset Classes also delivered positive returns for the quarter, a welcome reprieve during a tough year, with unhedged International Shares (+4.0%), hedged International Shares (+7.1%), International Property (+2.1%), & Infrastructure (+3.8%) as markets reacted to expectations that the peak for inflation (and interest rates) was nearing.

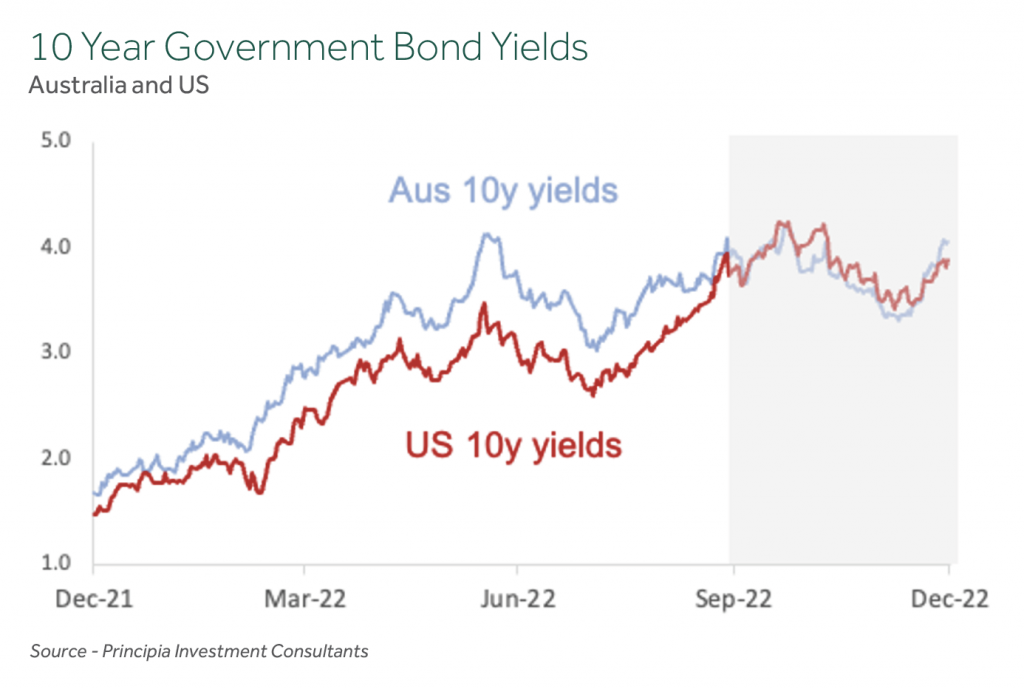

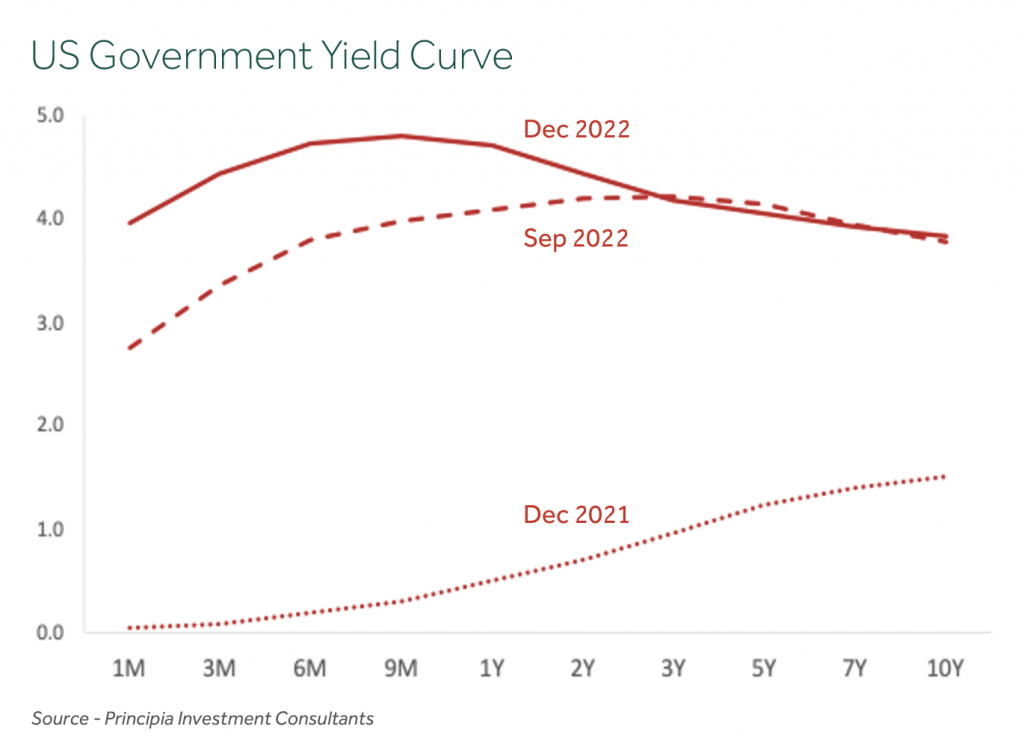

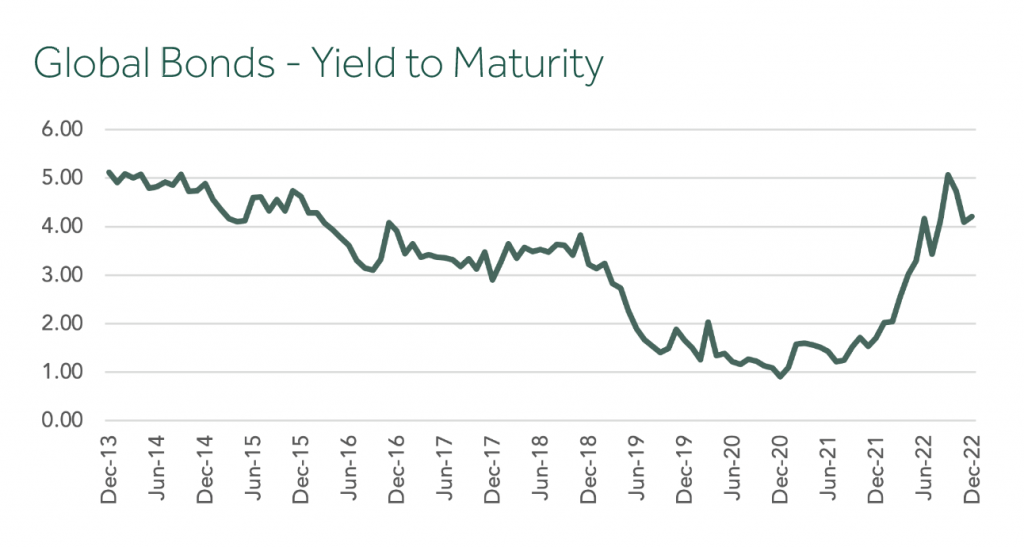

Bond yields ended sharply higher compared with where they began the year although during the quarter yields fell on optimism about a downshift to smaller rate rises and a lower terminal rate. Indications of a more protracted tightening cycle ended the rally.

Within Defensive Assets, this contraction in yields saw International Debt (+0.7%) post a small positive return for the quarter, as did Australian Credit (hybrid securities) (+0.5%).

The US 2-10 year bond yield spread – closely monitored for its ability to predict the US economic outlook – is now near -80 basis points, warning of recession. However, the Federal Reserve has said its job is far from over. Inflation, while starting to cool, is still far too high, and interest rates are predicted to rise further.

Performance for the December quarter across diversified portfolios ranged from +3.6% for 50/50 Growth/Defensive portfolios to +5.9% for 85/15 portfolios.

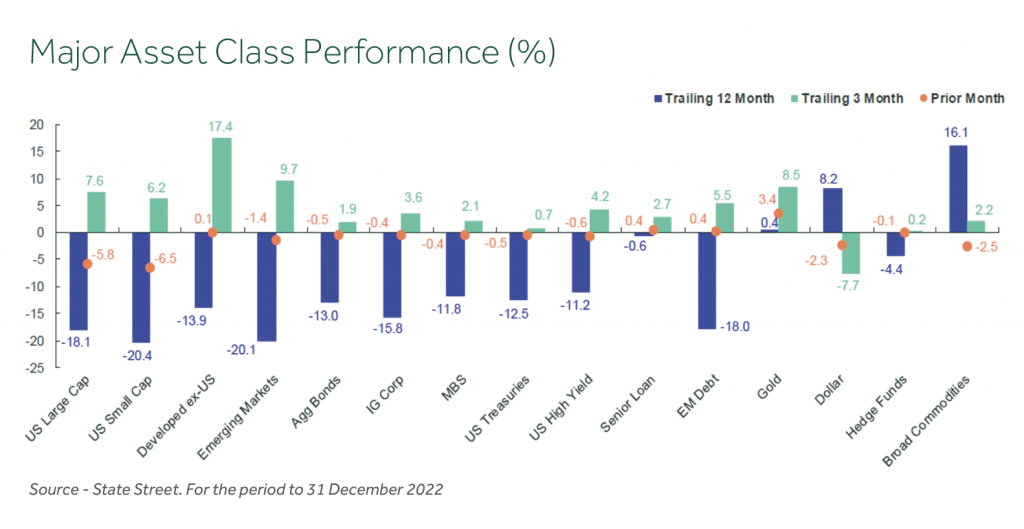

The year ended 31 December 2022 was a difficult one for diversified portfolios – returns were the worst since the GFC impacted 2008. During this period, investors have experienced a synchronised selloff across the major asset classes (as shown in the chart below), with very few investments being spared. Notably both Defensive Assets (Bonds) and Growth Assets (Shares) posted negative annual returns. In the US, the benchmark S&P 500 Index and 10 year Treasury Bonds both posted negative returns, only the fifth time this has occurred in records going back to 1928, and this was the first time both suffered worse than -10% in the same year.

Diversified Investment Grade International Debt (Bonds) experienced the worst annual return (-12%) since the inception of the Global Aggregate Bond Index in the 1990s as bond yields rose. It is notable that higher bond yields are the driver of higher long term returns from the asset class and also provide a greater buffer against future declines in Growth Assets should they occur.

Annual returns for diversified portfolios ranged from -6% for 50/50 portfolios to -8% for 85/15 portfolio, the weakest result since the Global Financial Crisis (2008/09).

Green Shoots

Amongst the gloom there has been some positive news for diversified investors. A fall in the Australian Dollar, notably compared to the US Dollar where it fell 6%, has resulted in unhedged exposures within Property & Infrastructure and International Shares protecting against the decline in market values. Cheaper (Value) companies outperformed more expensive (Growth) companies by 12% in Australia and 24% in International markets.

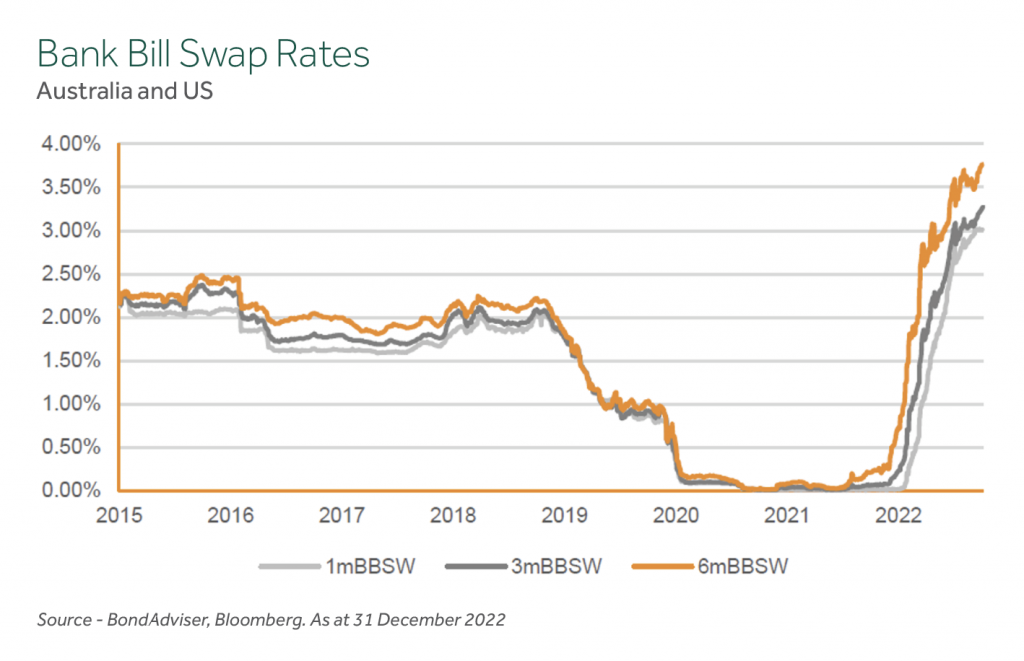

Higher interest rates are feeding through to improved returns from Cash and Term Deposit investments (as shown below) and push up the income returns on listed hybrid securities.

The other side to the coin of declining bond prices is a sharp increase in yields, which will flow through to investors as higher returns as the bonds head towards maturity over coming years.

We also observe that the longer the investment period, the more likely that correlations between the asset classes will reduce and their diversification benefits will return.

Australian Shares Portfolio Strategy

Within Australian Shares we combine three broad components to construct a well-diversified aggregate portfolio:

- Large Companies (for broad market exposure),

- Value Companies (those with cheaper relative valuations), and

- Small Companies (expected to deliver higher returns over time).

Each of these three sub-categories behave differently through time, and each plays a role in contributing to performance and risk management. Through the investment cycle we expect each to experience different sequencing of return, leading to opportunities to top up the underperforming components and take profits from the components that are performing well.

2022 was an incredibly divergent year in this regard, as shown below. The S&P/ASX 200 Index delivered -1.1% for the year, while the S&P/ASX Small Ordinaries Index delivered -18.4%.

Value companies continued their relative outperformance during the quarter and have now recovered their medium term (3 to 5 year) and long term (10 year) performance advantage over the broader market.

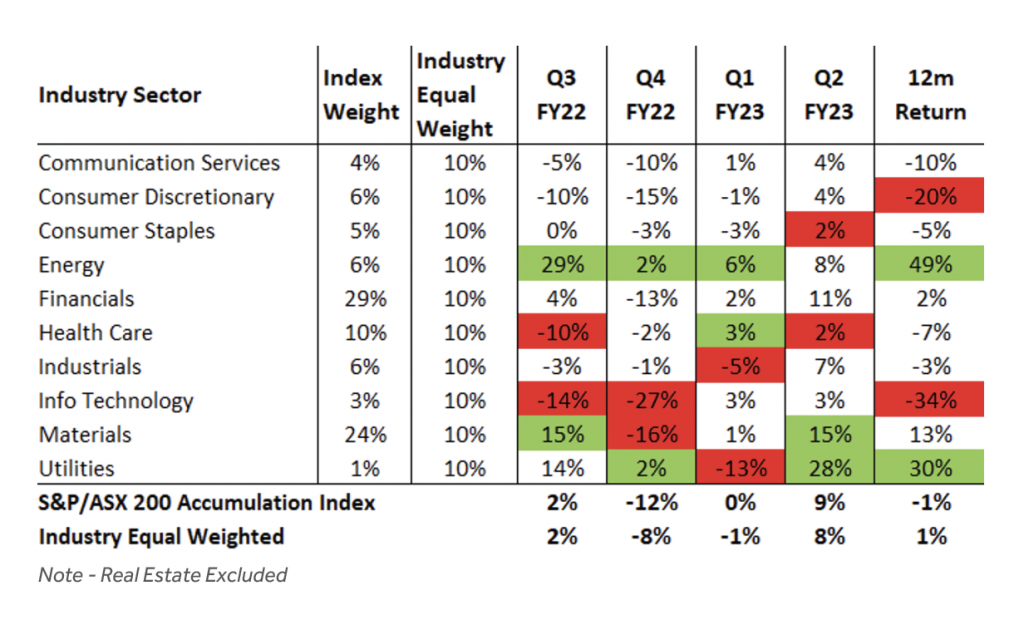

An ‘Industry Equal Weight’ approach to the selection of direct Australian shares continued to provide diversified sources of returns as shown in the table below (the top and bottom two sectors each quarter have been highlighted). The annual returns from the Industry Sectors ranged from -34% for Information Technology to +49% for Energy. In many respects the ‘winners’ and ‘losers’ have switched places, with Materials, Energy, and Utilities leading the way, and the Consumer Discretionary, Communication Services, and Financials Industry Sectors lagging after posting much higher than market returns over the preceding 12 months.

2022 saw a material divergence between traditional and sustainability focused portfolios, largely due to the latter typically holding low or zero exposure to fossil fuels companies, which are typically classified in the Energy and Utilities Industry Sectors. This approach underperformed in 2022 as a result. We caution against inferring too much from short term outcomes (just as we advised when the reverse was the case in 2020) and continue to expect longer returns from each approach to be similar, particularly given a consistent underlying investment philosophy.

Our approach seeks to manage risk and improve diversification by allocating equally across the Industry Sectors, rather than adopting the traditional market weighted approach. This method takes advantage of the less than perfect correlation between the Industry Sectors, which can be clearly seen in the table. Through the investment cycle there are periods when each sector delivers superior returns and periods when they underperform. This variation in return provides opportunities to harvest returns from outperforming sectors and add to exposures in underperforming sectors at depressed prices – without trying to forecast in advance when the rotation will occur.