By Andrew Marchant, Minchin Moore Chief Investment Officer (CIO) & Partner, with thanks to Dr Steve Garth, Industry Veteran, Minchin Moore Investment Committee Member.

At the start of 2023 every market commentator and analyst seemed to be planning for the recession they were convinced was coming. Equities and bond yields would all tumble as the fastest interest rate increases in a generation would plunge the world into a recession.

But something else was going on. Artificial-intelligence shares were red hot and were taking the chip makers with them – the “Magnificent 7” large tech stocks dominated US equity market gains. By the end of September world equity markets were up 17% (in AUD) but the global bond market looked like producing its third negative year in a row – the exact opposite of earlier predictions.

But then the last two months of 2023 saw a remarkable shift in sentiment. In October both the RBA and the Federal Reserve kept up the mantra that interest rates would stay “higher for longer”, but in November data showed U.S. and European inflation falling much faster than expected. Suddenly everything, everywhere, all at once changed.

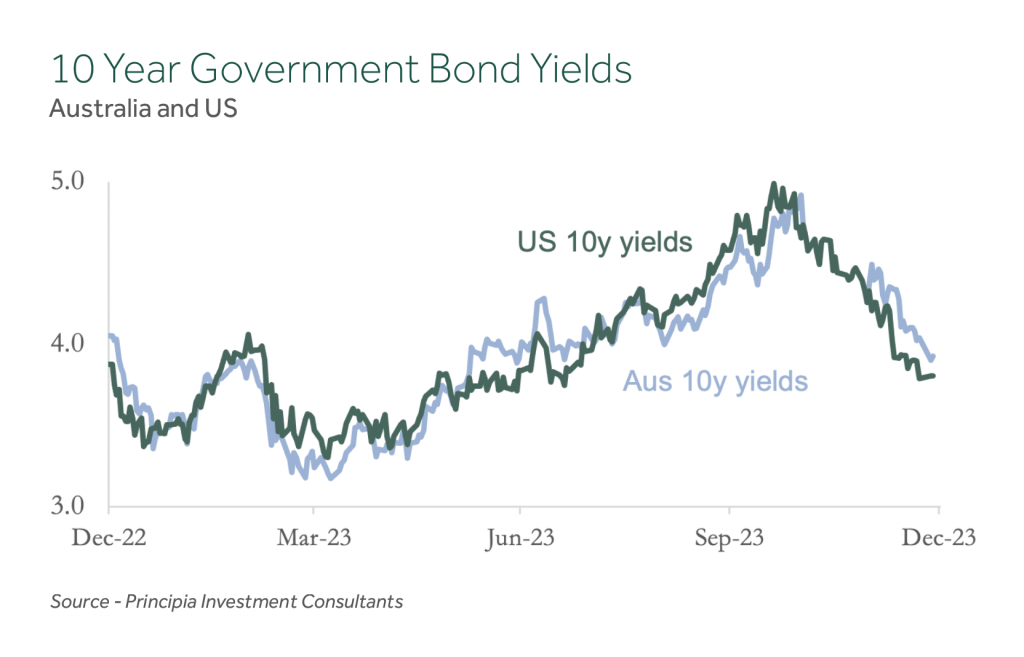

Bond yields started plummeting – but not because of recession. The market now expected that the “terminal rate” for interest rates had been reached, and that the economy would glide into a “soft landing”. Equities, listed real estate, and corporate bonds all surged higher.

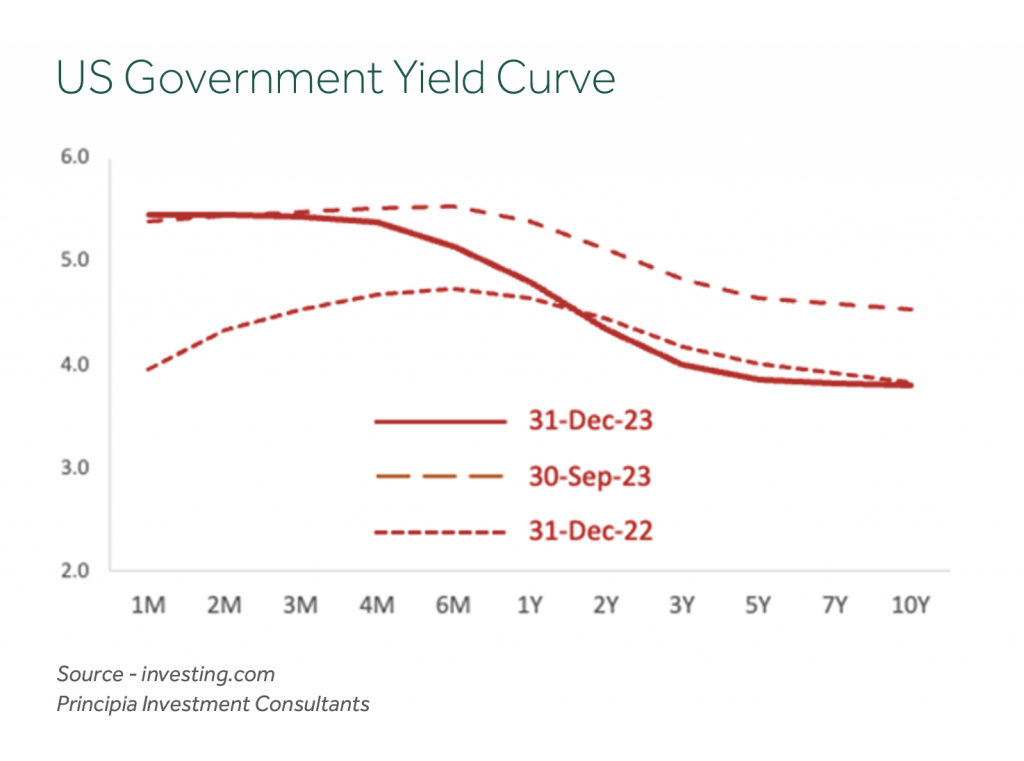

The Fed then triggered fresh market excitement when it used its December meeting to state unequivocally that rate hikes were over. More telling though was the Fed’s “dot plot” which envisaged three 25 bp cuts in 2024.

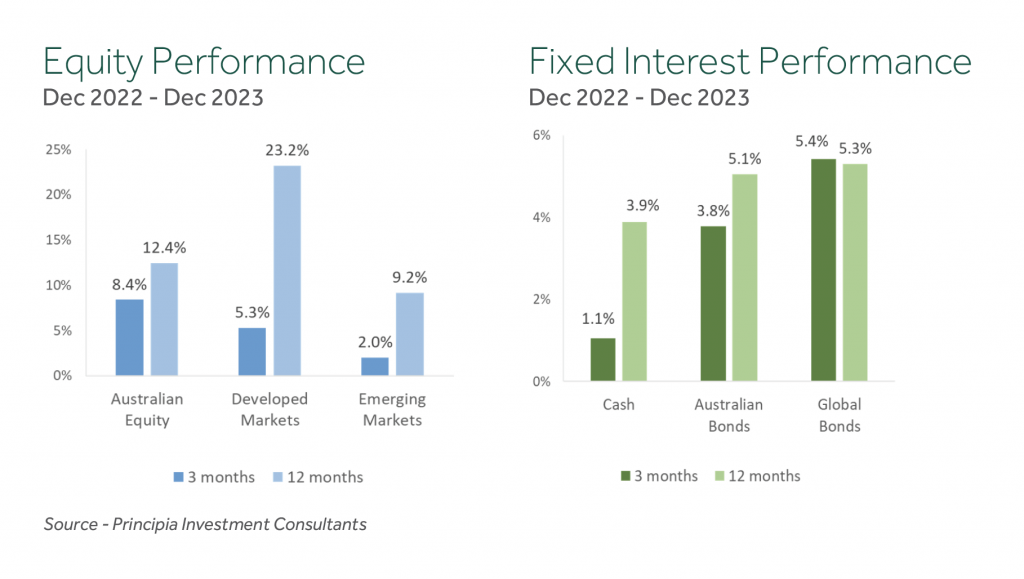

Global shares and bonds enjoyed a strong rally in November and December as traders priced in more than 150 basis points of easing in 2024 year by central banks as inflation continues to slide. The US 10-year Treasury yield declined by more than 1% in the quarter resulting in the global bond index returning 5.4% in that period, and 5.3% for the year.

The Australian sharemarket was up 12.4% for the year – its best return since 2021. Most of that performance came from the last quarter, which returned 8.4%. The MSCI’s World index, the broad gauge of global developed market equities, posted a 23.2% gain for the year, and a 5.3% gain for the quarter.

The Australian dollar rose sharply against the US dollar in the last quarter on the back of falling 10-year Treasury yields. Consequently, the hedged MSCI World index outperformed the unhedged index by 4.1% in the quarter.

Global Property outperformed the equity market in the quarter posting a return of 9.2%, which dragged the annual return into positive territory.

Inflation and Interest Rates

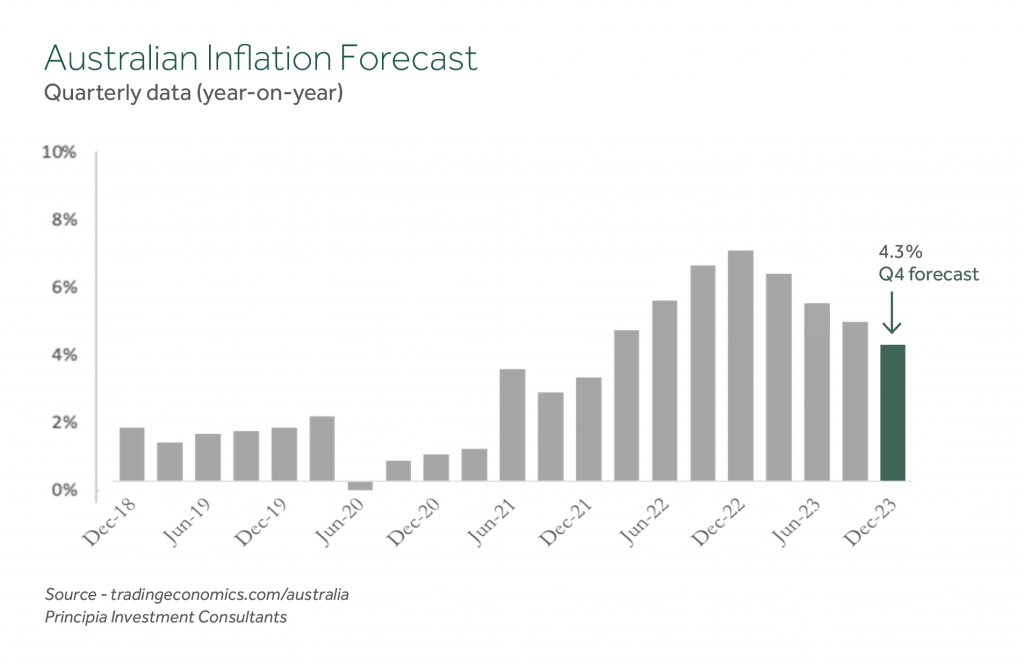

The two key economic indicators that have driven financial markets over the past two years are inflation and interest rates. The path for both is inextricably linked and there are positive signs we have passed the peak in the former and are nearing the end of increases in the latter.

Inflation continues to fall but remains above target. When the wave of inflation swept the globe in late 2021, Australia lagged by about six months. Given the rapid fall in inflation in the US, then Australia should follow a similar path. However, the RBA will be reviewing the data to see if there is a bigger structural issue at play keeping inflation – and interest rates – higher for longer.

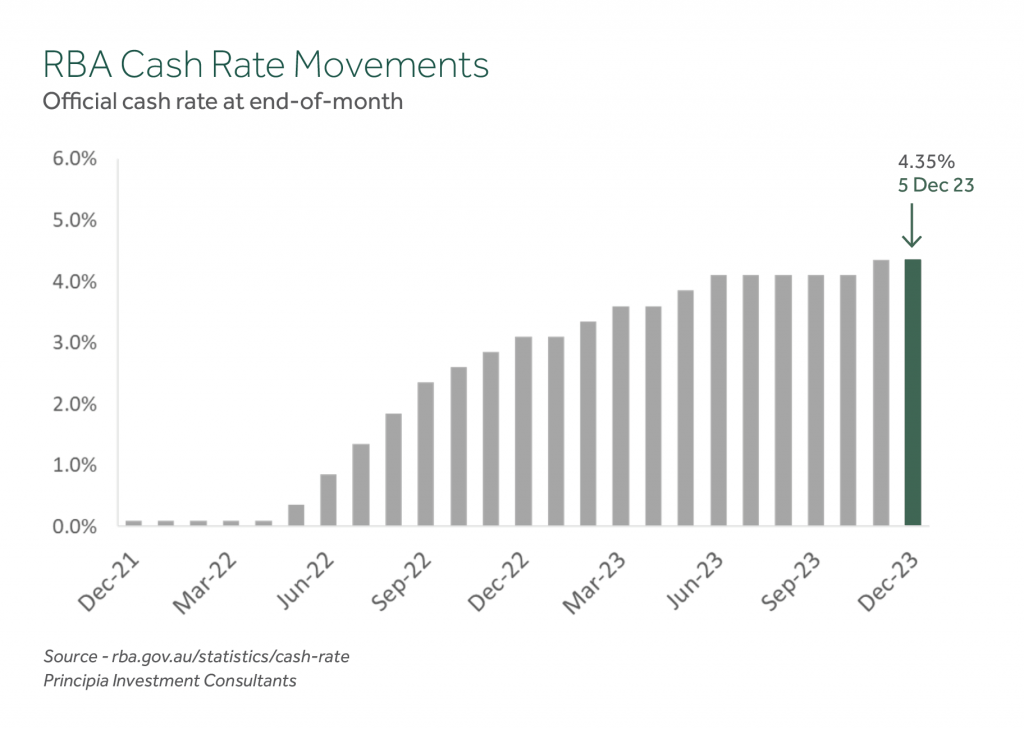

Interest rates are most likely at the terminal rate. As inflation continues its downward trend, the RBA remains in a wait and see mode. While the RBA left the cash rate on hold at 4.35% at its final board meeting of 2023, the minutes of that meeting reaffirm another interest rate rise may be necessary, although the Fed’s pivot has reduced the risk of any further increases.

Portfolio Performance

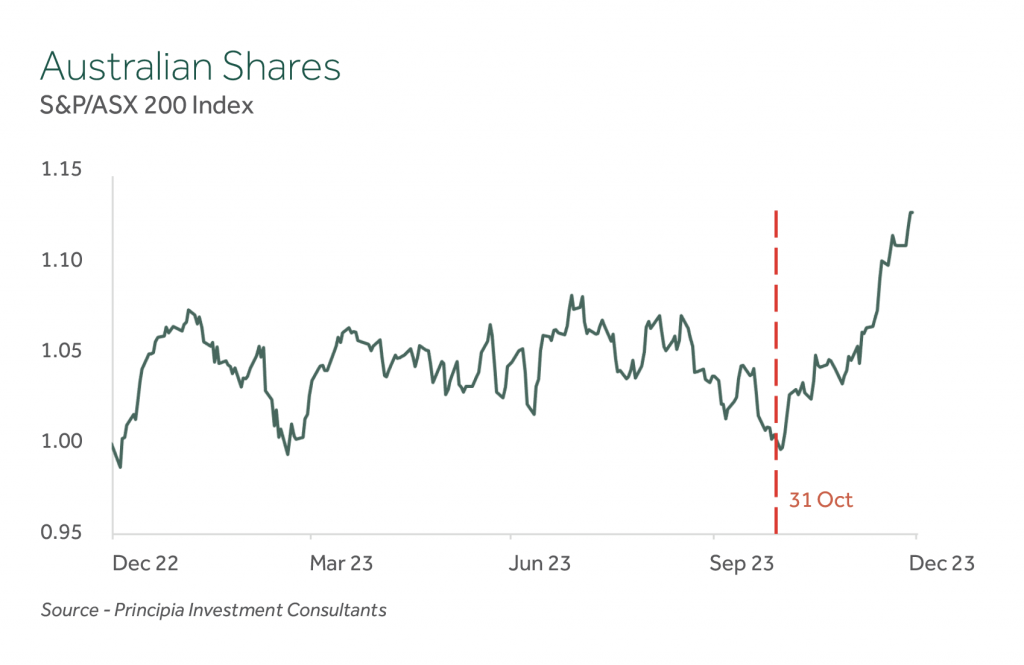

The ASX spent most of the year in a holding pattern as concerns around where inflation would take interest rates dominated sentiment. By the end of October, the market was flat for the year, and the outlook was gloomy. However, with inflation data lower than expected, and with the Fed pivot, the ASX added a stunning 12% through November and December.

The stock market rally in the first half of 2023 was built on the back of technology stocks. But now with the Fed pivot all sectors are booming, and Developed Markets are providing some of the best returns in years. The strong performance in international markets continues to reinforce the benefits of globally diversified portfolios.

All Growth Asset Classes delivered positive returns for the quarter with Australian Shares (+8.4%), unhedged International Shares (+5.3%), hedged International Shares (+9.2%), and International Property & Infrastructure (+8.6%) all advancing strongly.

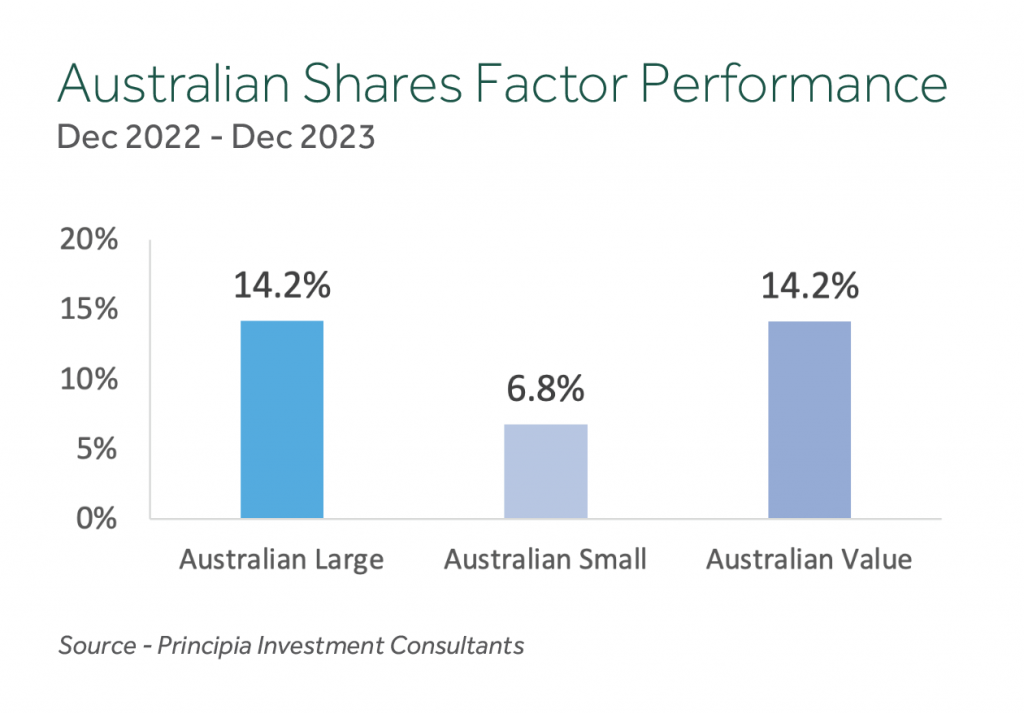

Within Australian Shares we combine three broad components (or factors) to construct a well-diversified aggregate portfolio:

- Large Companies (for broad market exposure),

- Value Companies (those with cheaper relative valuations), and

- Mid/Small Companies (expected to deliver higher returns over time).

Each of these three sub-categories behave differently through time, and each plays a role in contributing to performance and risk management. Through the investment cycle we expect each to experience different sequencing of return, leading to opportunities to top up the underperforming components and take profits from the components that are performing well.

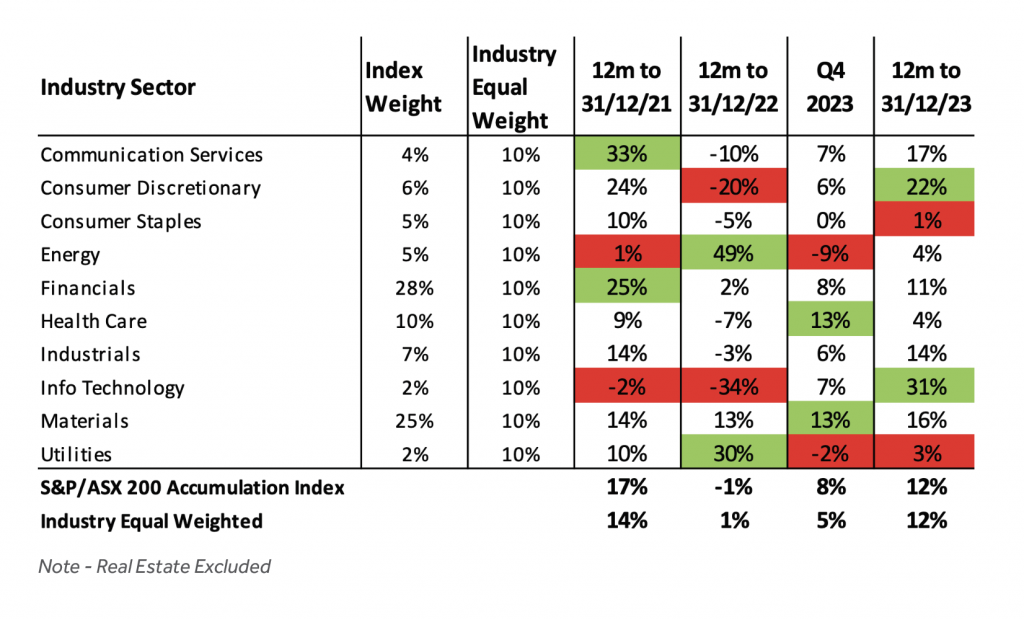

An ‘Industry Equal Weight’ approach to the selection of direct large cap Australian shares continued to provide diversified sources of returns as shown in the table below (the top and bottom two sectors each period have been highlighted). The annual returns from the Industry Sectors ranged from +1% for Consumer Staples to +31% for Information Technology. In many respects the ‘winners’ and ‘losers’ have switched places, with Consumer Discretionary, Communication Services, and Information Technology posting better returns after lagging over the preceding 12 months, while Energy and Utilities were muted after leading the way in 2022.

Our approach seeks to manage risk and improve diversification by allocating equally across the Industry Sectors, rather than adopting the traditional market weighted approach. This method takes advantage of the less than perfect correlation between the Industry Sectors, which can be clearly seen in the table.

The quarter saw the divergence between traditional and sustainability focused portfolios narrow, as returns from the Energy and Utilities Industry Sectors (which are typically not held in sustainability portfolios due to their exposure to fossil fuels) were weaker, while Industry Sectors more prominent in these portfolios, including Information Technology and Health Care led the market. We continue to expect longer returns from each approach to be similar, particularly given a consistent underlying investment philosophy.

Within Defensive Assets, a huge two-month rally in bond prices rescued fixed income markets from an historic third straight year of declines. The U.S. 10-year Treasury yield, the benchmark for borrowing costs globally, has dropped 100 basis points (bps) since November, the biggest fall since 2008.

The sharp decline in yields saw International Debt (+5.4%) post a significant return for the quarter. The December monthly return of 3.02% for the Index was the 5th highest on record (since creation in 1990) with November being the 3rd highest monthly return. Australian Credit (hybrid securities) posted small positive return (+1.7%) as did Cash (+1.1%), both of which are benefitting from higher interest rates.

The US yield curve remains inverted as the 10-year Treasury yield declined by 100 bps in the quarter. At the beginning of December, the Fed pointed to three interest rate cuts in 2024, with additional reductions anticipated in 2025 and 2026 due to the faster than anticipated decrease in inflation.

Performance for the December quarter across diversified portfolios ranged from +5.1% for 50/50 Growth/Defensive portfolios to +6.8% for 85/15 portfolios.

Annual returns to 31 December 2023 for diversified portfolios improved from the low point in December 2022 and ranged from +8.8% for 50/50 portfolios to +13.5% for 85/15 portfolios.

Investment Lessons from 2023

The start of each new year presents us with the opportunity for reflection on how the projections, expectations, and forecasts from the prior year fared. Inevitably this is a humbling experience as the predictive power of forecasting continues to underwhelm, although there are always insights to glean from the experience.

This time last year the official cash rate in Australia was at 3.1% – the first time it had been higher than 3% since 2013. The RBA had raised rates for the eight months in a row, and 2023 would see the hikes continue until reaching the current levels of 4.35%. Similarly in the US, the Fed Funds Rate was 4% at the start of 2023 on its way to its current level of 5.5%.

These were among the fastest and steepest rate rises in history, and the market feared dire economic consequences. The US yield curve had been inverted since the middle of 2022, which has historically been a leading indicator of a coming recession, and it was widely believed that the economy would crater under the weight of such a rapid increase in interest rates.

The consensus view among market commentators was that equities were going to have a tough time in 2023, as the slowing economy would drag the stock market down with it. In particular, the high tech stocks, which were down by more than 30% in 2022, would have further to fall as interest rates continued their upward path. High tech stocks are growth companies – those with high price to earnings ratios – and in theory these are more sensitive to interest rate changes than other stocks.

But none of that happened. The economy did not spiral into a hard landing and now looks to be gliding into a soft landing as we start 2024. Stocks did not crash and burn. The Australian market was up over 12% for 2023, while the MSCI World Index rose 23%. The Nasdaq stocks, which were supposed to fall further, have had an amazing run helped by the AI craze, increased a staggering 45% (in USD) in 2023, wiping out the bear market of 2022.

So, as we enter 2024, there are three important lessons investors can take away from the past twelve months.

1 – Timing the market is a fool’s game

This may be an investment idiom as old as investing itself but had investors listened to pundits and avoided the stock market in 2023, they would have missed out on some of the strongest returns in equities for many years.

To be fair, the investor who went to cash at the start of 2023 may have felt vindicated by the end of September. At that point the Australian stock market (as represented by the S&P/ASX 200 Index) had a year to date return of near zero, while the bond market was slightly negative. Cash was king. But in a sudden turn of events in the last quarter both markets experienced a rally that no-one saw coming, and Australian Shares rose by 8% and Bonds by 5%!

There is plenty of evidence – both anecdotal and empirical on why market timing doesn’t work. The last 12 months gives us another example of how listening to market forecasts and trying to time when to get in – and when to get out – of the market is a sure fire way to lose wealth.

2 – Diversification is key

The second key lesson from 2023 is also one of the oldest investment idioms – that diversification is the only free lunch in investing.

Technology stocks abroad soared in the first half of 2023 thanks to advancements in artificial intelligence, with many retaining this growth throughout the rest of the year, and now the Nasdaq is on the cusp of its strongest year in two decades.

The “magnificent seven” tech giants have seen a 99% surge in their shares over the year. Meta (the parent company of better known Facebook), Microsoft and Apple have all soared by more than 150%. while AI’s demand for semiconductor chips has catapulted Nvidia 240% higher into the $1 trillion dollar club.

But any Australian investor in a portfolio that has a diversified exposure to international shares that is linked to market cap weights will include the “magnificent 7” stocks. Nearly 70% of the MSCI World ex-Australia Index (the standard benchmark for many Australian fund managers investing in international shares) is made up of US companies, and just under half of that US exposure is the Nasdaq companies.

The outstanding returns of this small cohort of US companies have helped propel the MSCI World ex-Australia index to a return of over 20% – one of the strongest returns in years. But it’s not all due to the US tech stocks. Over the course of the year the Japanese market is up over 17% (in AUD), which seems odd given that the Japanese economy seems to be in a state of stagnation. And the European market – still contending with the conflict in Ukraine – is up around 18% (in AUD).

What all this means for investors is that a diversified exposure to companies and countries linked to market cap weights will deliver the returns of the global capital markets without having to time the market – or to pick which stocks, sectors or countries will be the best performers in any year.

3 – Stay disciplined

There is no question it has been a wild ride in markets over the last two years. Inflation came back from the dead to reach its highest level in 40 years, and in trying to return inflation back to their preferred levels central banks increased interest rates from essentially zero to levels not seen for years in record time.

Consequently, markets experienced a downturn in 2022, with tech stocks down near 30% and the bond market having its worst crash in history. A portfolio of 60% equities and 40% bonds – seen as a conservative portfolio – had one of its worst years ever.

For the past two years investors have been inundated with predictions of a recession, a repeat of 1970s style stagflation, a housing market crash and worse. And yet none of this happened. Equity markets are now higher than they were 2 years ago.

The lesson is clear – investors need to look past the ‘noise’ of positive and negative commentary and concentrate on long-term goals, develop a financial plan you can stick with, and adopt an evidence based investment philosophy incorporating systematic rebalancing.