Dr Steve Garth, industry veteran, Minchin Moore Investment Committee Member

Keeping the economy moving forward while raising interest rates will be a narrow road and require careful navigation by central banks.

The world’s top central bankers delivered a stern and unified message on the need to curb inflation, declaring at Jackson Hole that it is broad-based, here to stay and will require their forceful action. The US bond market is pricing in an economic recession. In Australia, The Reserve Bank in their Minutes of the Monetary Policy Meeting has described the path to keeping the economy moving forward while lifting interest rates as “a narrow one”.

At the recent Jackson Hole Economic Policy Symposium Federal Reserve chairman Jerome Powell reinforced the Fed’s commitment to maintain the current pace of interest rate increases to stamp out inflation, and that the Fed was unlikely to reverse course next year.

“Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy.” Powell told the meeting.

Equities reacted to Powell’s message. The S&P 500 fell 3.4%, and the Nasdaq 3.9% on the day, putting an end to the “Bear Rally” that begin in the middle of June. Bond markets, which for the last few weeks had been rising in anticipation that inflation was not diminishing anytime soon, were much calmer and rose only by 2bps.

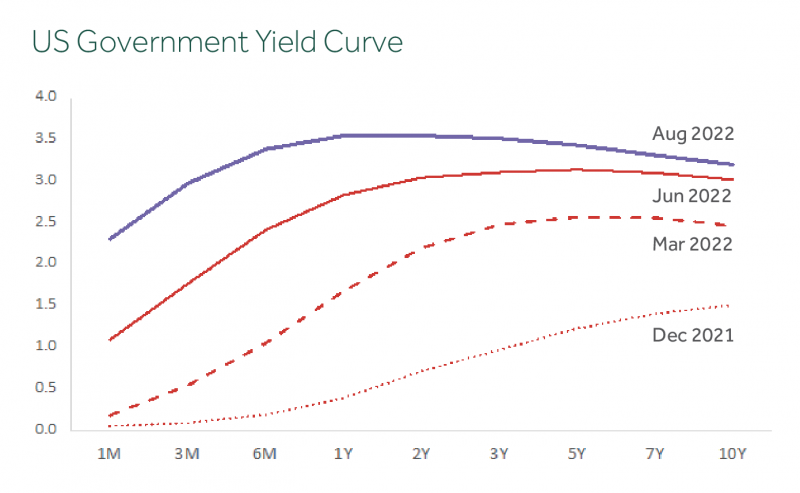

The bond market believes Powell will ignore the clear signs that the US economy is slowing and push ahead with his rate rising agenda. Throughout August bond yields began rising again, heading back to their peak levels of mid-June. At the start of August, the 10-year bond yield was 2.6 per cent but it has now blown out to 3.1 per cent — a massive sell off of bonds in one month.

The Reserve Bank of Australia in their Minutes of the Monetary Policy Meeting has described the path to keeping the economy moving forward while lifting interest rates as “a narrow one and subject to considerable uncertainty”. The warning sign is clearly “Danger: Narrow Road Ahead”

The danger is that if the RBA continues to tighten policy aggressively the private economy will likely go backwards. Demand in Australia’s services sector went backwards over August while weaker growth in activity in the manufacturing sector was also posted.

The bond market in the US is indicating that a recession is a likely outcome, as 2-year yields are higher than 10-year yields. In the past 50 years, whenever the yield curve is “inverted” a US recession tends to occur within the next 24 months.

An inverted yield curve means the US government’s two-year bonds are paying investors a higher return (3.32 per cent), compared with 10-year bonds (3.02 per cent). In theory, investors who lend money to the US government for longer periods of time should be paid a higher interest rate to reflect the higher risk.

The implication from the yield curve is that the Fed will continue to raise rates throughout this year and next, but as the economy goes into recession rates will start to come down again.

For bonds, they will be balancing the opposing forces of pricing in higher inflation while also providing a potential flight-to-safety as stocks price in a risk to earnings. If the bond market signals prove correct, then it will re-kindle increased volatility on share markets around the world as the global growth slows or starts going backward.

In Australia the yield curve is flat rather than inverted, an indication that economic growth will be slow for some time as higher rates take hold. A recession may be hard to ignore in Australia, as China, the US and much of Europe are signalling that a recession is inevitable.

It will indeed be a dangerous narrow road that the RBA must navigate to avoid this outcome. But while we don’t know what the short term holds for equities, we do know that equities recover from market downturns quite quickly. Furthermore, equities ‘price in’ (ie anticipate) the effects of recession before the economy goes into recession – the stock market is forward looking while economic indicators are backward looking.

And we do know that the bond market both here in Australia and in the US have priced in expectations around future cash rates – yields are unlikely to change very much when the RBA and the Fed implement their next rate rise in September. Long term yields are settling around 3%, an implication that long term cash rates will steady at around 2%, and inflation will stay in the central banks target range of 2% to 3%.

What does this mean for long term investors? The message remains the same – stay disciplined in a well-constructed portfolio that has been designed for you by your financial adviser. A diversified portfolio that is not concentrated in particular sectors or countries will deliver long term returns that meet your investment goals.

And remember, just because bond markets are predicting a chance of recession, doesn’t mean you should sell shares. Remember that ‘markets work’, and therefore the likelihood of recession, as calculated by the markets, has already been factored into prices.