As every investor who experienced either the dotcom crash or the global financial crisis will know, stock market crashes can be gut-wrenching.

True, there was a crash in March 2020, at the start of the Covid crisis, but markets recovered remarkably quickly. It was a similar story after the 1987 crash, in which the Australian stock market fell by 50.5%. But it took much longer for prices to start rising again after the downturns in 2000 and 2008. Things can seem grim when prices have been falling for a couple of years.

It’s no wonder, then, that people pay so much attention to warnings that they read in the media that the next crash may be just around the corner.

There was one such warning the other day when the US hedge fund manager John Hussman told his investors that, in his view, stock market conditions are among the worst in history and markets could fall as much as 65%.

So, how seriously should we take Hussman’s warning? After all, he did, apparently, correctly predict the sharp market downturns in 2000 and 2008.

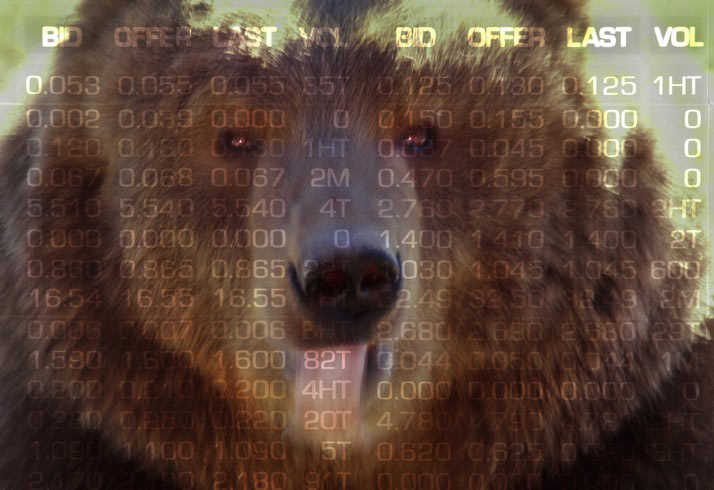

The first point to make is that it’s actually very common for market pundits to make dire predictions. Hussman himself has quite a track record in this regard. He is, in fact, a classic example of what financial commentators call a permabear. The term refers to a person, usually a professional investor or analyst, who consistently claims that the market or a particular market segment is about to decline.

Some permabears always have a pessimistic market outlook, irrespective of prevailing market conditions or the economic indicators. Often, they will advocate investment strategies that protect against market downturns, such as holding more cash, investing in gold, or taking short positions.

Dr Doom and the permabears

Permabears tend to attract attention. Some, like Nouriel Roubini, sometimes called Dr Doom for his prediction of the 2008 financial crisis, have almost become minor celebrities in the financial world. In Australia, the likes of Steve Keen, John Hempton and Martin North have been consistently bearish over the years and have attracted plenty of media coverage.

The growth of social media has given these permabears an even bigger audience. As financial blogger Michael Harris recently pointed out, some have hundreds of thousands of followers.

“As an example,” Harris wrote, “in January 2017, based on a trivial chart pattern, during an interview on a major financial TV network, a permabear predicted the bull market was over. The S&P 500 index gained 21.7% that year. The Twitter account of that individual had less than 100K followers during that time. Now it has close to half a million!”

What has happened to markets from 2018 onwards? Aside from a very short-lived crash at the start of the Covid crisis, and a negative year for stock returns globally in 2022, markets have risen steadily. At the time of writing, the S&P 500 is still trading at near-record highs.

The market pundit Harris is referring to is one of many who have incorrectly predicted a crash in recent years. At the start of 2021, for example, fund manager Jeremy Grantham wrote an article called Waiting for the Last Dance, in which he warned investors in his GMO fund that markets were in “a fully-fledged epic bubble” that was about to explode.

“I believe this event will be recorded as one of the great bubbles of financial history, right along with the South Sea bubble, 1929 and 2000,” he warned.

Grantham could hardly have been more wrong. Over the calendar year 2021, the S&P 500 recorded one of its highest annual returns of recent times — 28.71%. Except for emerging markets, in fact, it was a very positive year for every major equity markets category.

The questions to ask

A useful habit for investors to develop when reading opinions about the future direction of the markets is to ask about the motives behind them. Who is making the prediction? Why are they expressing that opinion? And why have their views been published?

One possible explanation is that the pundit has a commercial agenda. Gloomy market predictions are often made by hedge fund managers. Many hedge funds claim to act as a hedge against falling stock markets.

One of the reasons why they continue to attract so many assets and generate so much in fees is that they appeal to investors — particularly wealthy investors and institutions — who want to protect their assets from market declines. By selling fear, these hedge fund managers are effectively touting for business.

Another explanation is that market doomsayers are seeking attention. Dire warnings attract eyeballs; indeed, the more dire the warning is, the more attention you’re likely to receive. Why? Because many (or arguably most) investors suffer from loss aversion; in other words, they dislike the thought of losing money more than they like the thought of winning it.

Humans also have a negativity bias, and that’s reflected in the financial news agenda. As Morgan Housel explains in his latest book, Same As Ever, “bad news gets more attention than good news because pessimism is seductive and feels more urgent than optimism.”

Putting pessimism in perspective

None of this, is to say that John Hussman’s Cluster of Woe theory is wrong. It seems perfectly plausible, especially given ongoing fears of a recession in the US and elsewhere, the uncertainty surrounding the conflicts in Ukraine and Gaza, and now the growing tension between the US, the UK and Iran.

However, history has shown that being consistently bearish is rarely a profitable strategy in the medium to long term. As noted by the AFR last week, Hussman’s returns have been tepid in recent years. Hussman’s ‘Strategic Growth Fund’ has delivered a total return of -6.8% over the past five years, compared to an +82.5% rise in the S&P500 for the same period.

It is key to understand that markets don’t always act in a rational way. Just because a narrative appears to be rational doesn’t mean the implicit forecast is likely to come to bear.

We just don’t know what the future holds. All knowable information is generally well reflected in current market prices. It is new, unexpected, and unforeseen information that tends to cause prices to rise or fall, and news, by definition, is almost impossible to predict.

There have always been crashes and corrections, and, at any point in time, there will always be grounds for believing that the next one is just around the corner. But if you reduce your equity exposure every time someone says that markets are about to fall, the danger is that you wouldn’t own any equities at all.

As the well-known fund manager Peter Lynch once said, “far more money has been lost by investors in preparing for corrections, or anticipating corrections, than has been lost in the corrections themselves.”

The most logical strategy is to accept that there is bound to be another crash at some stage but that timing it, and your subsequent market re-entry, correctly is almost impossible.

So, make sure you’re taking the right level of risk for you — in other words, as much risk as you need to take, can afford to take, and feel comfortable taking. Once you are sure, just keep investing regularly, and rebalancing your portfolio every year or so.

Avoid the impulse to be distracted by very pessimistic market forecasts. Yes, sooner or later, a doomsayer will be right, but they will continue to be wrong far more frequently.