Bond investors are experiencing what could be the most challenging year in fixed interest markets, with 2022 shaping up to be possibly the worst since 19311. But there are signs that global bond markets could be bottoming out and are ready to come back and play their traditional role as a defensive part of a portfolio. In this edition of Insights, Steve Garth, a veteran of the bond markets, takes a look.

Although the stock market generates far more headlines, global bond markets are much larger in value than stock markets, with more than USD100 trillion tied up in bonds2 worldwide versus USD64 trillion in equities. Bonds essentially function as instruments used by governments and corporations for borrowing money.

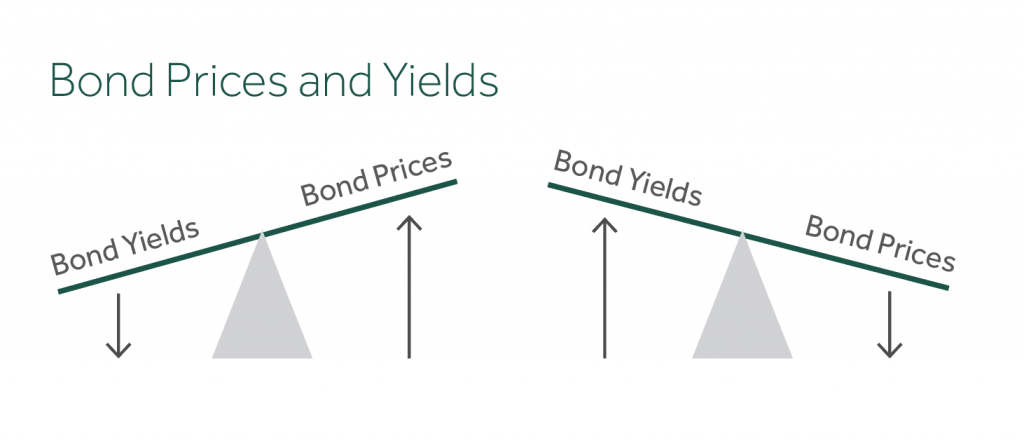

Bond prices and yields have an inverse relationship. When the price of a bond rises, the yield falls. When the price of a bond falls, the yield increases. Higher inflation is one of the main drivers of pushing yields higher, so rising inflation (and rising interest rates) means that bond prices will fall, as we have seen this year.

After a period of ultra-low interest rates brought about by the COVID-19 pandemic the global economy is now experiencing inflation for the first time in many years Prices are soaring everywhere and have been pushed along by Russia’s invasion of Ukraine – which affects food and energy prices – and the continuing zero-Covid policy in China which affects global supply chain.

To curb inflation, Central Banks essentially have one tool at their disposal, and that is to raise interest rates. Higher interest rates increase the cost of borrowing – and therefore slows consumption – which should then get inflation back down to what central banks term their “target range”.

But interest rates are a blunt tool in controlling inflation. If the interest rates rise too quickly the economy comes to a grinding halt in a “hard landing” and an economic recession ensues. If interest rates rise too slowly then it may not be enough to tame inflation, which gives a combination of high interest rates and high inflation (which is known as stagflation). Central banks need to navigate a narrow path to get the economy to slow into a “soft landing”. One can think of this as the Goldilocks Zone – not too hot, not too cold.

So, the unprecedented fall in bond prices this year is due to central banks doing “whatever it takes” to get inflation under control by raising interest rates faster than at any other time in recent history3. But the bond market is giving signs that interest rates may soon reach their peak, and may start to come down sometime in 2024.

In the bond market investors generally demand higher interest rates for lending over longer periods, reflecting the opportunity cost of tying up their money longer amid rising growth and inflation forecasts. But for the last 6 months the US bond market has been reflecting short-term yields higher than longer term yields. This is known as an “inverted yield curve” and implies that investors anticipate economic growth to decline in the medium term

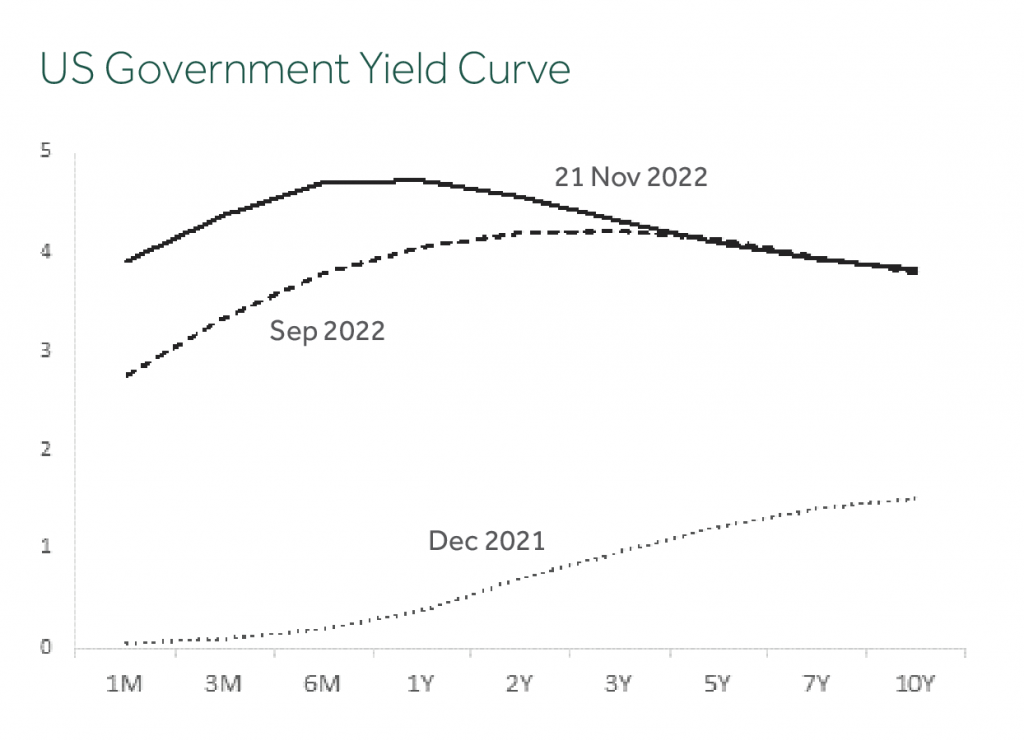

The chart below shows the US Government yield curve at 3 points in time – the end of 2021, September 30, 2022, and November 21, 2022. The chart contains information on the bond market’s expectations around inflation, interest rates, and the economy in general. The three main points we can read into these expectations.

Firstly, interest rate increases in the near term are already priced in. Up to this point the Federal Reserve have made “jumbo” increases of 75bps, but at the November meeting the Fed Chairman Jerome Powell indicated at the meeting on December 14th rise would most likely be 50bps. Of course, none of this is certain – it will depend on whether the most current data shows that inflation is indeed slowing. But regardless of the actual quantum, the market has priced in rates continuing to increase over the next 6 months.

Secondly, the market is expecting that the “terminal” rate – the rate at which the Fed’s will no longer raise rates – is not far away. The current rate after the November meeting is in the range 3.75% – 4.0%. The most widely held view in the market is that the terminal rate will be somewhere in the range 4.75% – 5.25% and should occur in the middle of next year. Once again, none of this is certain but it is the collective view of bond market participants.

And thirdly, the market believes that at that terminal rate the economy will indeed slow, and that the costs of servicing global debt burdens governments have accrued over the last 40 years or so will put many economies into recession. It can be argued that the UK and Europe are already in recession, China has had slowing economic growth for the last 12 months, and the above yield curve is an indication that the bond market believes the US will go into recession sometime in 2024.

And for a third time, none of this is certain, it will all depend on future inflation prints. Keep in mind that the bond market is quite bad at forecasting the future – one only needs to look at the above chart and see what the bond market thought of the world at the end of December 2021. Back then, the bond market thought that in ten years’ time bond yields would be of the order of only 1.5% or so. That’s a long way from the current 10-year bond yield at 3.5%. Nonetheless, the consensus view is that the indicator has moved on the US going into recession from “possible to probable”4.

So, what does all this mean for investors who have had an allocation to bond funds in their portfolios?

- Given that future increases in rates are largely priced into the current yield curve, there is no reason that yields will go higher (prices will go lower) when the rate rises do occur. We may not know the exact “terminal rate”, but the market has priced in a consensus view of where this will most likely end up. Subject to the many unknown factors out there, bonds may well have bottomed out.

- Back at the end of 2021, the yield to maturity on most Australian bond funds benchmarked to the Bloomberg Global Aggregate Bond Index was in the order of under 1%. Today, the yield to maturity on these same bond funds is above 4%. That means if yields don’t go any higher then investors will be earning approximately 4% per annum from their bond fund and can potentially recoup the loss from these funds within 3 years.

- If there is a recession in the US, and more generally a global recession, then the current US yield curve is indicating that rates will start to come down from their terminal rate of around 5% to the rate of around 3% – 3.5%. This would mean that there would also be capital appreciation from holding these bond funds and the time it takes for the funds to recoup their losses maybe much shorter than 3 years.

- Finally, if indeed there is a recession, then most likely there will be a “flight to safety” where there is greater demand for safe haven assets like government bonds instead of the riskier growth assets. This will push down yields even further than just the effect of central banks setting official interest rates.

The out-take from all this is that if you have been weathering the bond market storm the clouds are beginning to part and rays of sunshine are peaking through. As always, stay disciplined and stick with the portfolios that your financial advisor has designed to meet your specific goals.

References

[1] Is This the Worst Year Ever for Bonds?

[2] 5 Bond Facts You Need to Know

[3] Comparing the Speed of U.S. Interest Rate Hikes (1988-2022)

[4] The government has recession concerns