Global stocks were mixed, while bonds fell for a third consecutive quarter to 30 September. Dominating headlines was inflation news, central bank action to rein it in, a rising US dollar, and worries about economic growth.

Sentiment shifted during the quarter. A nascent recovery in risk appetites from July to mid-August gave way to renewed selling in September when US consumer price data dented prior expectations that inflation was turning lower.

Developed markets ended the quarter positive for unhedged Australian investors, but emerging markets suffered a fifth straight quarterly decline.

Most of the media’s attention was on inflation and central banks’ response. After hitting a 41-year high above 9%, US inflation had retreated to 8.3% by August, but remained above forecasts. UK inflation topped 10%, while Australia’s headline inflation rate was above 6% in the year to June.

Central bankers, meeting in August, pledged forceful action to combat inflation, though emphasised that, like the rest of the markets, they were data-dependent. The US Federal Reserve led the way in tightening monetary policy, with three successive 75bps rate rises during the quarter. The European Central Bank upped rates by 125bps in two meetings, the Bank of England by 100bps. The Reserve Bank of Australia raised its cash rate in three moves of 50bps in the September quarter, though stepped down to 25bps at the start of Q4.

After downgrading its forecasts for global economic growth in July, the International Monetary Fund cited downside risks to its outlook from tighter financial conditions, the strengthening US dollar, higher inflation and geopolitical uncertainties arising from the ongoing conflict in Ukraine.

The combination of the higher US currency, global growth concerns and China’s ongoing slowdown were the backdrop for a retreat in commodity prices in the quarter, with crude oil falling from around $US120 to $80 a barrel.

The broad-based rise in the USD also sparked intervention by the Bank of Japan in September to support the Japanese Yen for the first time in 24 years. A week later, the Bank of England intervened to support Gilts after the UK Government proposed unfunded tax cuts, triggering heavy bond selling.

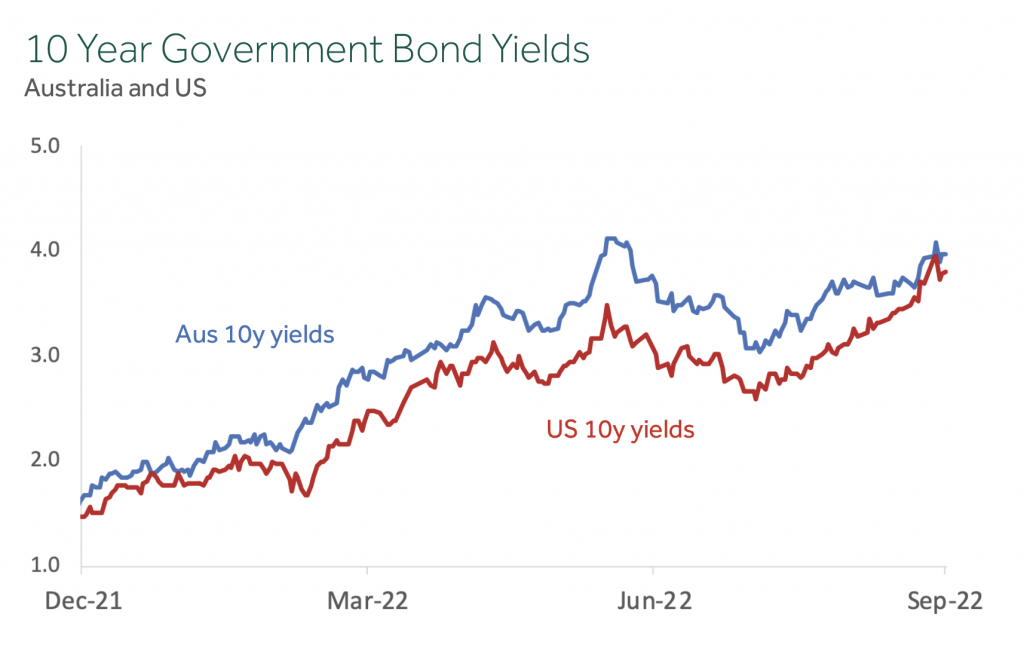

The global bond market, as measured by the Bloomberg Global Aggregate Bond Index, posted its third consecutive losing quarter with both term and credit premiums negative for the period. US Treasury 10-year yields reached a 12-year high above 4% in late September.

The strength in the USD and resulting weakness in the AUD cushioned offshore equity losses for unhedged investors in Australia.

While September was a negative month for equities overall, the Australian share markets still ended in positive territory for the quarter. In Australia, Energy was the standout industry sector, while Utilities were the worst performers.

There was no consistent pattern in the premiums. Value was positive in Australia and emerging markets, but negative in other developed markets. Small caps were negative in Australia and mixed elsewhere.

What Dominated the News

The following news summary is not intended to explain the markets’ performance in the quarter, but to provide some perspective about what dominated headlines:

July

- Former Japanese Prime Minister Shinzo Abe assassinated at campaign event

- Boris Johnston quits as UK Prime Minister, dragged down by scandals

- IMF downgrades global growth outlook, cites downside risks

- US annual inflation rate hits 9.1%, highest since 1981

- European Central Bank raises interest rates for first time in 11 years

- US Federal Reserve delivers second successive 75bps rate hike

- Australian inflation speeds to 21-Year high of 6.1%, peak still to come

August

- China conducts military exercises around Taiwan in protest at US speaker visit

- RBA hikes Cash rate by 50bps to 1.85% in fourth move in four months

- Stocks stage relief rally as US inflation eases in July from 9.1% to 8.5%

- Britain’s annual inflation rate jumps to 10.1%, highest since 1982

- World’s Central Bankers, at Jackson Hole, pledge tough action on inflation

- Euro falls below parity with US Dollar to lowest level in two decades

September

- RBA hikes Cash rate to seven-year high of 2.35%; signals more to come

- Liz Truss appointed UK PM after winning Conservative leadership poll

- Queen Elizabeth II Dies after 70 Year reign; Charles III becomes King

- Amid persistent inflation, US Fed raises key rate by 75bps for third month

- Bank of Japan intervenes to support the Yen for first time since 1998

- Bank of England intervenes in Gilts as UK Govt tax cut plan triggers selling

- Far-Right Leader and Eurosceptic Giorgia Meloni wins Italian election

Portfolio Movements

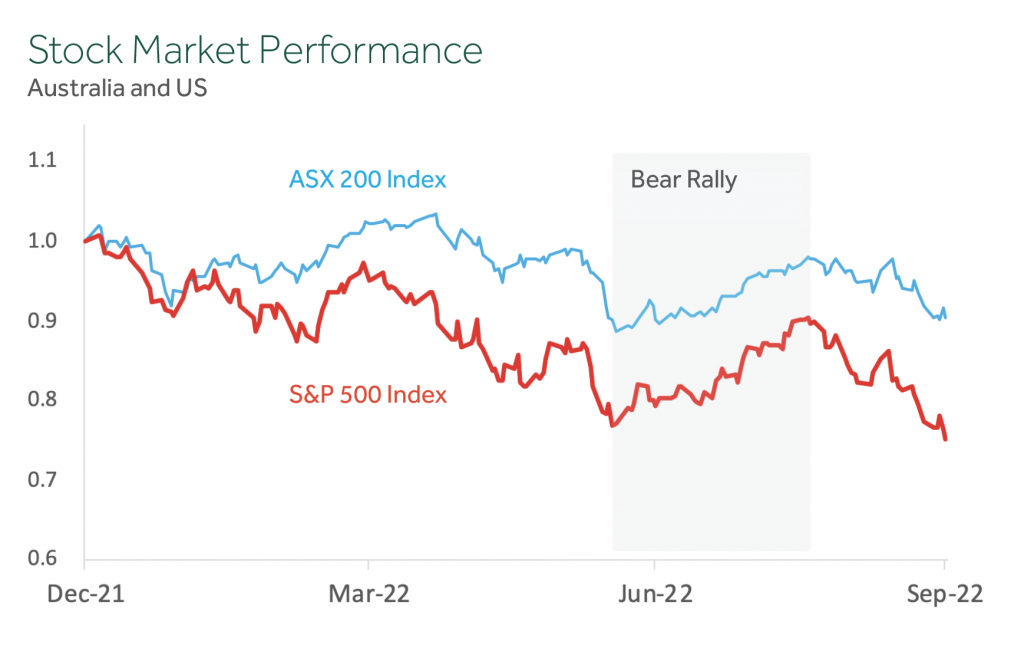

Throughout July and most of August stock markets around the world started to climb, Both the Australian and US stock markets were up by more than 10% over the period. But this turned out to be a “bear market rally” – a sharp, short-term rebound in share prices amid a longer-term bear market decline.

The stock market “bear rally” came to an end on August 26th when at the Economic Policy Symposium Fed Chairman Powell said that “Restoring price stability will likely require maintaining a restrictive policy stance for some time”, re-iterating the Fed’s stance to combat inflation. It may have taken nine months, but the Fed’s message is now being received loud and clear.

Source: Principia Investment Consultants

Performance for the September quarter across diversified portfolios ranged from -1.6% for 50/50 Growth/Defensive portfolios to -2.5% for 85/15 portfolios.

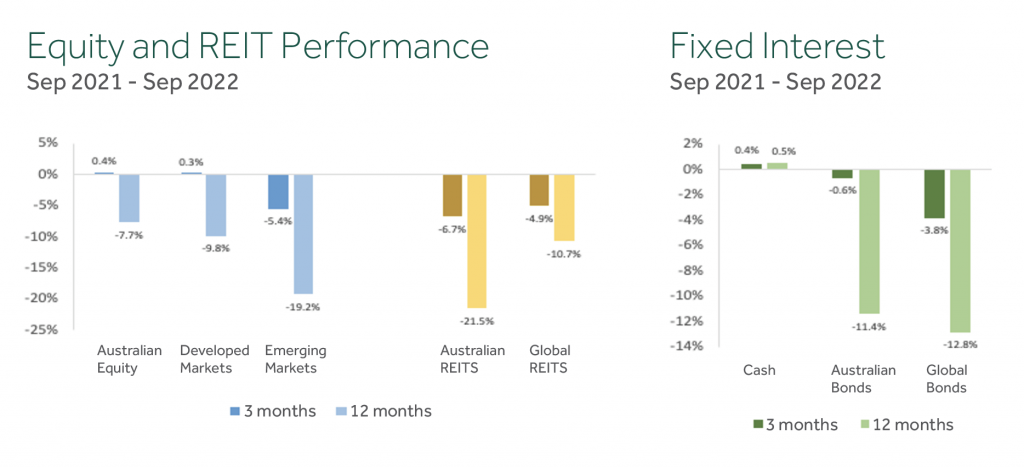

The Growth Asset Classes delivered mixed returns, with large cap Australian Shares (+0.4%), Australian Value (+2.6%), and unhedged International Shares (+0.4%) holding ground, while hedged International Shares (-5.1%), International Property (-6.8%), & Infrastructure (-3.9%) all posted negative returns as markets reacted to higher expected inflation and rising interest rates.

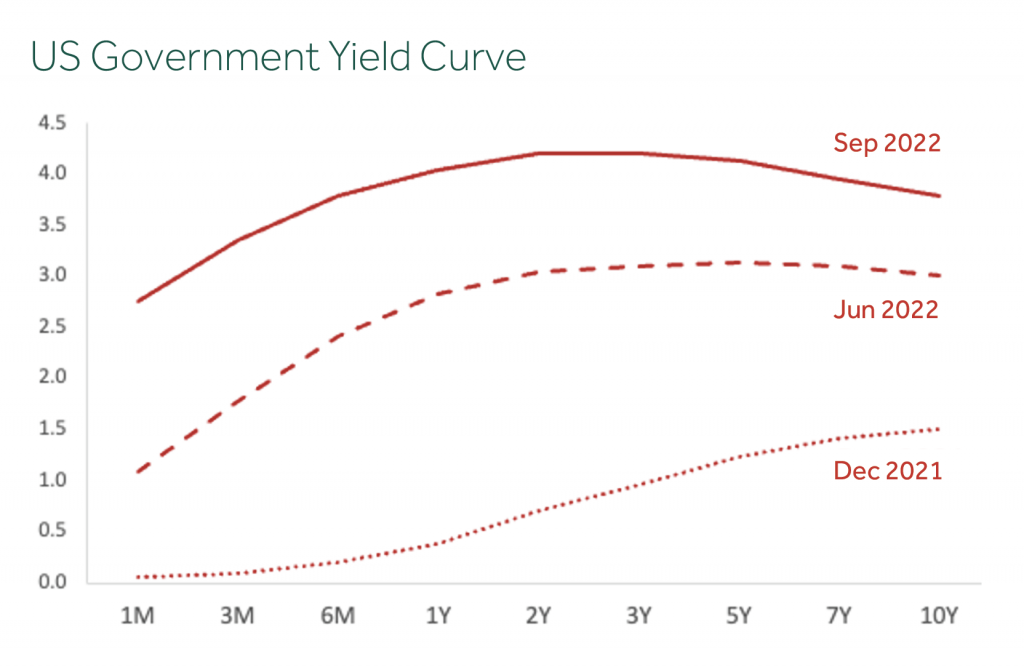

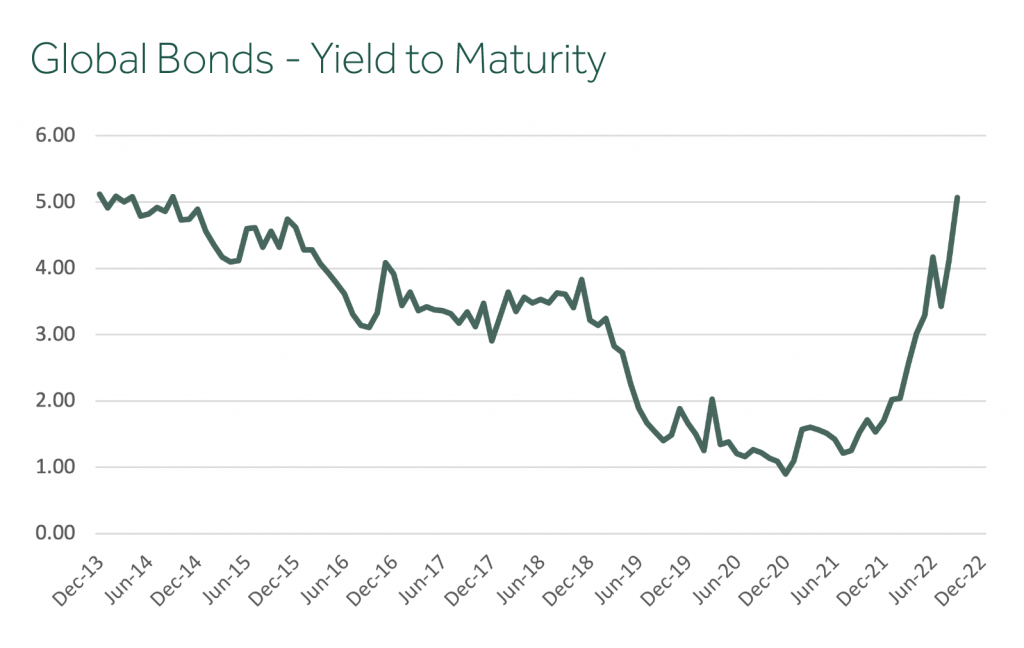

Hard hit bond investors finally saw some relief during the bear rally as yields declined between June and mid-July, before inflation expectations again lifted yields. By mid-September underlying inflation had accelerated, resulting in a third 75bps rate hike by the Federal Reserve. The yield on 10-year US Treasuries briefly hit 4% for the first time in 14 years.

Source: Principia Investment Consultants

Within Defensive Assets, International Debt (-3.8%) posted a negative return. Bond Yields rose (prices fell) on expectations of higher future inflation following the significant fiscal and monetary policy initiatives deployed since the onset of the pandemic. Australian Credit (hybrid securities) delivered a small positive return (+2.4%).

The 10y – 2y spread has increased over the last quarter. Yield curve inversion has been seen as an indicator of a coming recession in past cycles. Recent comments from the Fed have confirmed the central bank’s commitment to bring inflation back to its 2% – 3% target, and Fed members forecast that rates will reach 4.4% by the end of this year.

Source: Principia Investment Consultants

The year ended 30 September 2022 has been a difficult one for diversified portfolios, particularly since the start of 2022. During this period, investors have experienced a synchronised selloff across the major asset classes, with very few investments being spared.

International Debt (-13%) experienced the worst annual return since the inception of the Global Aggregate Bond Index in the 1990s as bond yields rose. Amidst this, US 10 year Treasury Bonds are experiencing the worst annual return in records going back to 1928. It is notable that higher bond yields are the driver of higher long term returns from the asset class and provide a greater buffer against future declines in Growth Assets should they occur.

Source: Principia Investment Consultants

As observed in our recent newsletter, US based 60/40 portfolios had fallen 20% since the start of January. That’s the worst performance for a US based balanced portfolio since 1931. Put another way, what we’ve witnessed in the financial markets in 2022 is almost a once-in-a-century event. For Australian investors, annual returns for diversified portfolios ranged from -7% for a 50/50 portfolio to -9% for a 75/25 portfolio, the weakest annual returns since the Global Financial Crisis (2008/09).

Green Shoots

Amongst the gloom there has been some positive news for diversified investors. A fall in the Australian Dollar, notably compared to the US Dollar where it fell 11%, has resulted in unhedged exposures within Property & Infrastructure and International Shares protecting against the decline in market values. Cheaper Value companies have outperformed more expensive Growth companies by 4% in Australia and 8% in International markets.

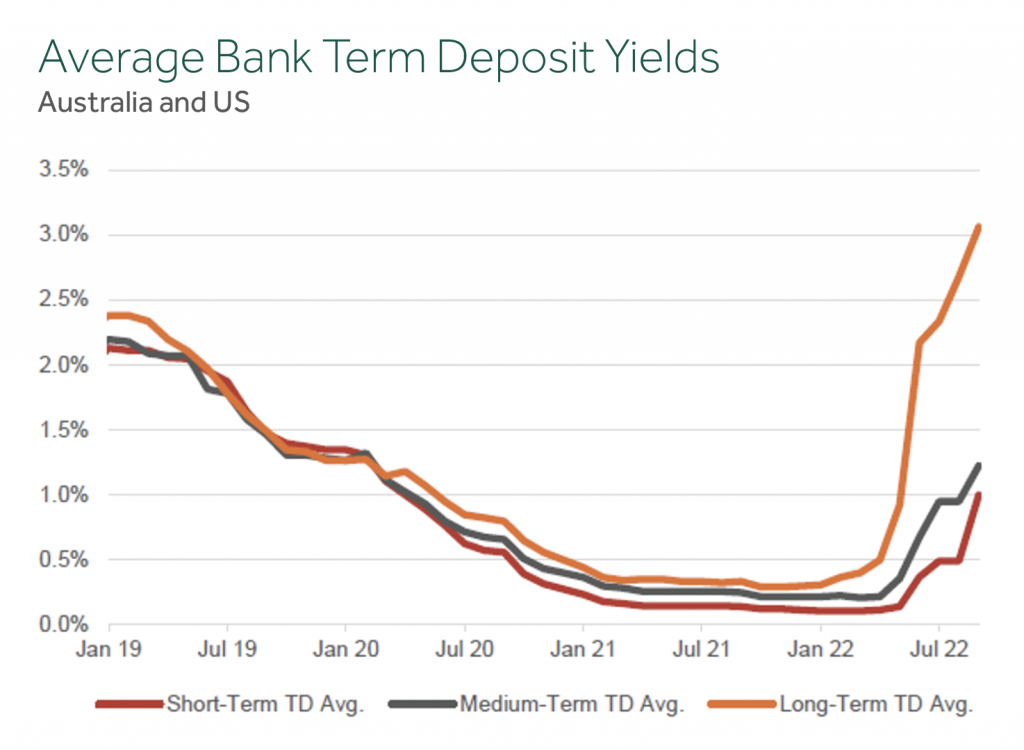

Higher interest rates are feeding through to improved returns from Cash and Term Deposit investments (as shown below) and push up the income returns on listed hybrid securities.

Source – BondAdviser, Company Websites, RBA

The other side to the coin of declining bond prices is a sharp increase in yields, which will flow through to investors as higher returns as the bonds head towards maturity over coming years.

Australian Shares Portfolio Strategy

Within Australian Shares we combine three broad components to construct a well-diversified aggregate portfolio:

Large Companies (for broad market exposure),

Value Companies (those with cheaper relative valuations), and

Small Companies (expected to deliver higher returns over time).

Each of these three sub-categories behave differently through time, and each plays a role. Through the investment cycle we expect each to experience different sequencing of return, leading to opportunities to top up the underperforming components and take profits from the components that are performing well.

Value companies continued their relative outperformance during the quarter and have now recovered their medium term (3 to 5 year) and long term (10 year) performance advantage over the broader market. After a period of excess returns to the end of 2021, Small Companies lagged over the period, significantly underperforming the S&P/ASX 200 Index.

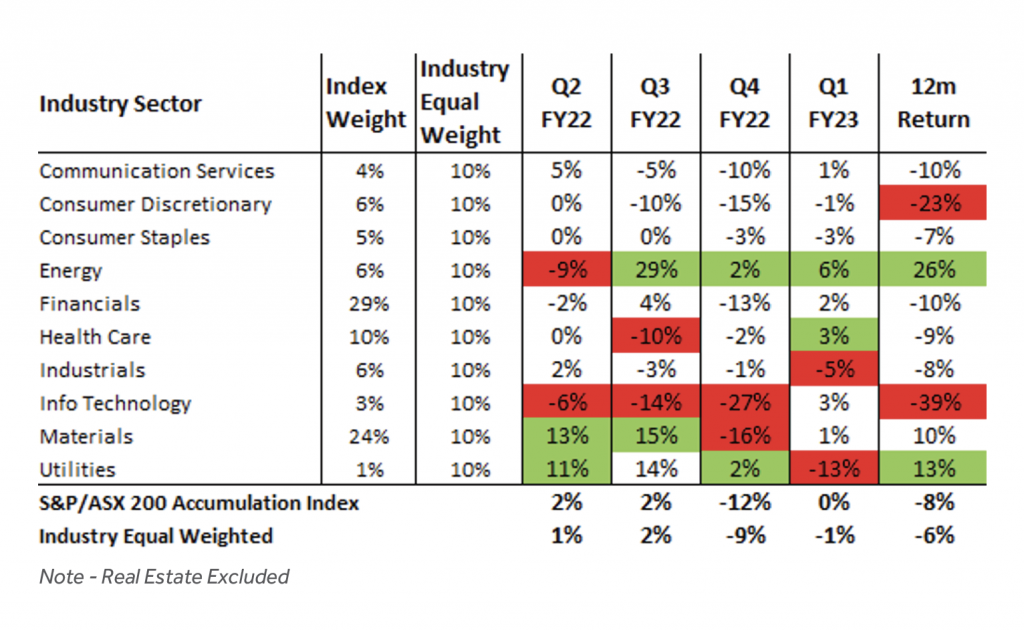

An ‘Industry Equal Weight’ approach to the selection of direct Australian shares continued to provide diversified sources of returns and experienced a similar rotation of sectors driving returns. The performance of the Industry Sectors varied through the year as shown in the table below (the top and bottom two sectors each quarter have been highlighted). In many respects the ‘winners’ and ‘losers’ have switched places, with Materials, Energy, and Utilities leading the way, and the Consumer Discretionary and Information Technology Industry Sectors lagging after posting much higher than market returns over the preceding 12 months.

Our approach seeks to manage risk and improve diversification by allocating equally across the Industry Sectors, rather than adopting the traditional market weighted approach. This method takes advantage of the less than perfect correlation between the Industry Sectors, which can be clearly seen in the table. Through the investment cycle there are periods when each sector delivers superior returns and periods when they underperform. This variation in return provides opportunities to harvest returns from outperforming sectors and add to exposures in underperforming sectors at depressed prices – without trying to forecast in advance when the rotation will occur.