Global equity markets in the March quarter posted their worst quarterly performance since the onset of pandemic two years ago, while the global bond market notched up its worst performance in at least three decades.

Media and market attention focused on two themes – Russia’s invasion of Ukraine, together with rising inflation and what this would mean for the pace and magnitude of central banks’ winding back of monetary policy stimulus.

After months of speculation, Russia on 24 February invaded neighbouring Ukraine, a former Soviet republic which declared its independence from Moscow in 1991. Western allies responded with widespread financial and trade sanctions.

As Russia is a major exporter of oil, gas, wheat and other commodities, these events triggered significant volatility in energy and food markets. Benchmark Brent crude surged to multi-year highs near $US140 a barrel in early March.

Central banks, who had already started to withdraw policy stimulus in the face of rising inflation, noted that the surge in prices for energy and other commodities represented a substantial relative price shock to the world economy.

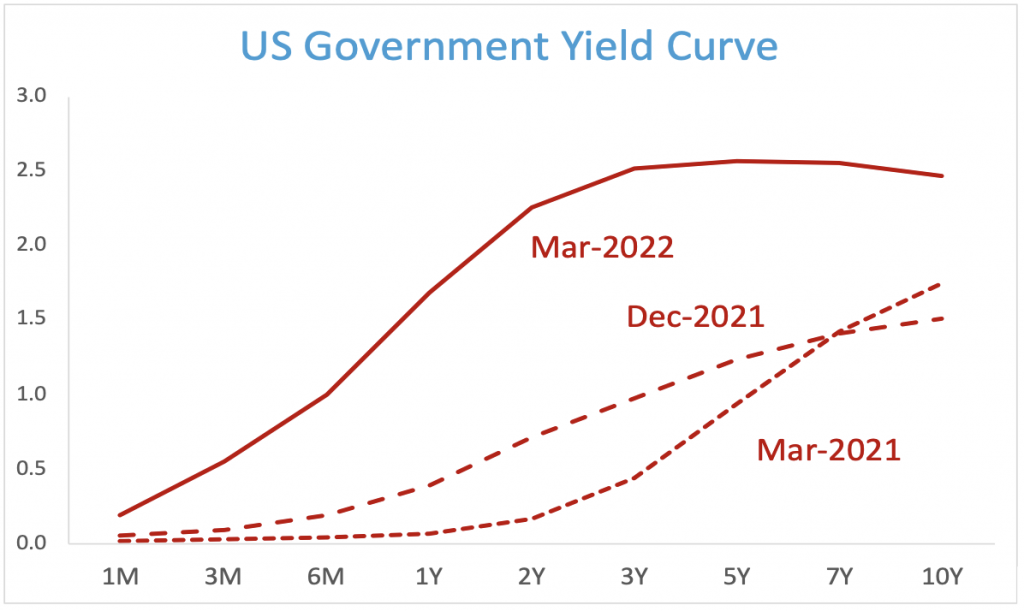

The US Federal Reserve in mid-March raised its benchmark interest rate for the first time since 2018 and flagged a program of another six quarter increases in each of its remaining meetings in 2022.

The Bank of England followed a day later with its third Cash rate increase since December, saying the war in Ukraine was likely to accentuate inflation. Likewise, the Reserve Bank of NZ made its third upward move in February.

The Reserve Bank of Australia, however, maintained its cash rate at the record low of 10 basis points, where it had been since November 2020, noting that while inflation locally had picked up it was still lower than in many other nations.

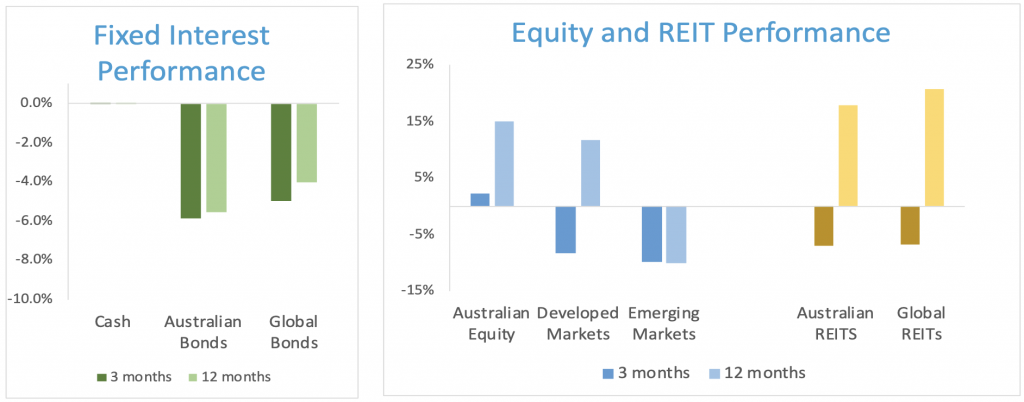

Regardless of the central bank actions, global bond markets had already responded to the inflation news by sending yields higher across the board. The Bloomberg Global Aggregate Bond Index (hedged to AUD) fell nearly 5% in the quarter, its worst quarter on record. Both term and credit premiums were negative.

Global developed market equities, as measured by the MSCI World ex-Australia Index, fell more than 8% in AUD terms over the quarter, faring better than the near 10% decline in emerging markets.

The Australian equity market bucked the negative trend elsewhere, finishing the quarter with a modest rise and underpinned by strong gains in leading energy and materials stocks.

There was a very strong value premium across developed and emerging markets in the quarter. However, small caps lagged large everywhere, while the profitability premium was mixed.

Real Estate Investment Trusts posted a negative quarter, falling nearly 7%, but this came after five consecutive quarterly gains.

The Australian dollar gained against the USD in the quarter, reducing the local currency returns for unhedged investors from global equity markets.

CPI Inflation rose 2.1% for the March quarter. Over the 12m to March 2022 CPI rose 5.1%. Underlying (trimmed mean) inflation increased 3.7% for the year, the highest since March 2009.

What Dominated the News

The following news summary is not intended to explain the markets’ performance in the quarter, but to provide some perspective about what dominated headlines:

January

- Bond Yields Surge as US Inflation Rate Jumps to a 40-Year High of 7%

- Eruption of Volcano in Tonga Triggers Widespread Tsunami Warnings

- Australia Revokes Visa of Tennis Star Novak Djokovic in Vaccine Row

- Russia Moves Troops Close to Border with Ukraine Amid Invasion Fears

- US S&P 500 Posts Worst January Performance Since 2009

February

- Russia Begins Full-Scale Invasion of Ukraine, Triggering Western Sanctions

- Brent Crude Prices Top $US100 for First Time in Eight Years

- UN Report Warns Global Warming Outpacing Efforts to Protect Humanity

- RBNZ Raises Rates for Third Time Since October; RBA Opens Door to Hike

- Millions of Refugees Flee Ukraine as Russia Bombards Major Cities

March

- International Criminal Court Starts Probe into Possible War Crimes in Ukraine

- NZ Police Break Up Three-Week Anti-Vaccine Mandate Protest in Wellington

- Conservative Yoon Suk-Yeol Narrowly Wins South Korean Presidential Election

- Federal Reserve Raises Rates for First Time Since 2018; Flags Six More in 2022

- US President Biden, in Poland, Warns Russia’s Putin Cannot Remain in Power

Portfolio Movements

The March quarter delivered very mixed returns across the Growth Asset Classes, with large cap Australian Shares (+2.2%) and Infrastructure (+2.0%) adding value, and International Shares (-6.7%), and Property & Infrastructure (-5.2%) detracting as the recovery faltered in the face of higher expected inflation and interest rates.

Within Defensive Assets, International Fixed Interest (-5.0%) posted a negative return. Bond Yields rose (prices fell) on expectations of higher future inflation following the significant fiscal and monetary policy initiatives deployed since the onset of the pandemic. Australian Credit (hybrid securities) also delivered a negative return (-0.4%) following a widening of credit spreads. Performance for the quarter across diversified portfolios ranged from -0.3% for 50/50 Growth/Defensive portfolios to +0.7% for 85/15 portfolios.

The US yield curve is now experiencing an inversion between the closely watched 10y – 2y spread. Yield curve inversion – which suggests rate rises in the short term before a slowdown or fall in economic growth leads rates to fall – has been seen as an indicator of a coming recession in past cycles and will therefore attract media attention.

The year ended 31 March 2022 presented many opportunities for systematic portfolio rebalancing between asset classes (i.e. topping up hardest hit asset classes, and selling down those most resilient). During this period, returns from Growth Assets were well above long term return expectations, being above 15% for Australian Shares and Property & Infrastructure and 11% for International Shares. Returns from Defensive Assets much lower, with International Fixed Interest returns (-4.0%) the worst annual return since the inception of the Global Aggregate Bond Index in the 1990s. This meant that annual returns for diversified portfolios ranged from 6% for a 50/50 portfolio to 11% for an 85/15 portfolio. Portfolio Rebalancing has focused on profit taking in Growth Assets and reinvesting into Defensive Assets, noting that higher bond yields are the driver of higher long term returns from the asset class and provide a great buffer against future declines in Growth Assets should they occur.

Australian Shares, Portfolio Strategy

Within Australian Shares we combine three broad components to construct a well-diversified aggregate portfolio:

- Large Companies (for broad market exposure),

- Value Companies (those with cheaper relative valuations), and

- Small Companies (expected to deliver higher returns over time).

Each of these three sub-categories behave differently through time, and each plays a role. Through the investment cycle we expect each to experience different sequencing of return, leading to opportunities to top up the underperforming components and take profits from the components that are performing well.

Value companies continued their relative outperformance during the quarter and have now recovered their medium term (3 to 5 year) performance advantage over the broader market. After a period of excess returns to the end of 2021, Small Companies lagged over the period, underperforming the S&P/ASX 200 Index.

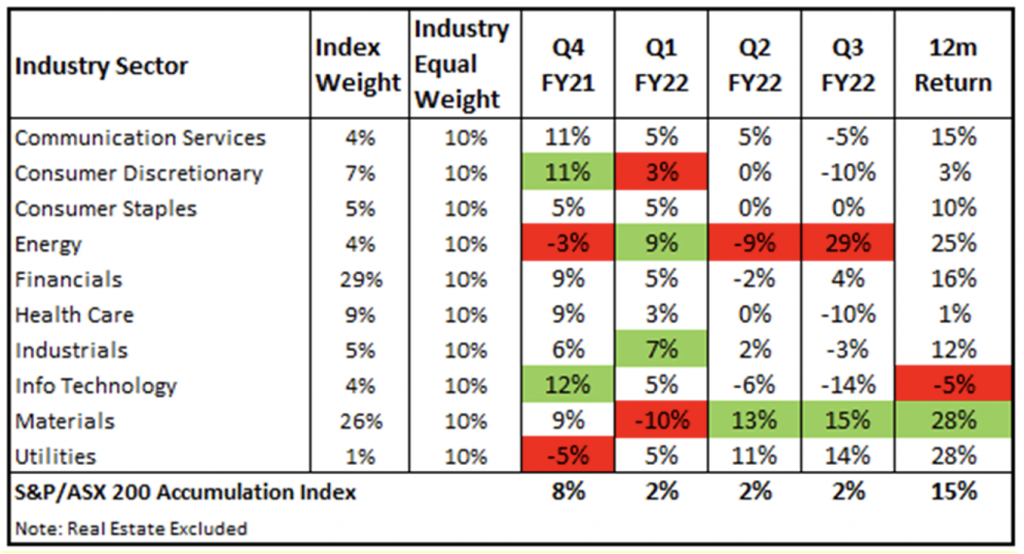

Our ‘Industry Equal Weight’ approach to the selection of direct Australian shares continued to provide diversified sources of returns and experienced a similar rotation of sectors driving returns. The performance of the Industry Sectors varied through the year as shown in the table below (the top and bottom two sectors each quarter have been highlighted). In many respects the ‘winners’ and ‘losers’ have switched places, with Materials, Energy, and Utilities leading the way, and the Consumer Discretionary and Information Technology Industry Sectors lagging after posting much higher than market returns over the preceding 12 months.

Our approach seeks to manage risk and improve diversification by allocating equally across the Industry Sectors, rather than adopting the traditional market weighted approach. This method takes advantage of the less than perfect correlation between the Industry Sectors, which can be clearly seen in the table. Through the business cycle there are periods when each sector delivers superior returns and periods when they underperform. This variation in return provides opportunities to harvest returns from outperforming sectors and add to exposures in underperforming sectors at depressed prices – without trying to forecast in advance when the rotation will occur.