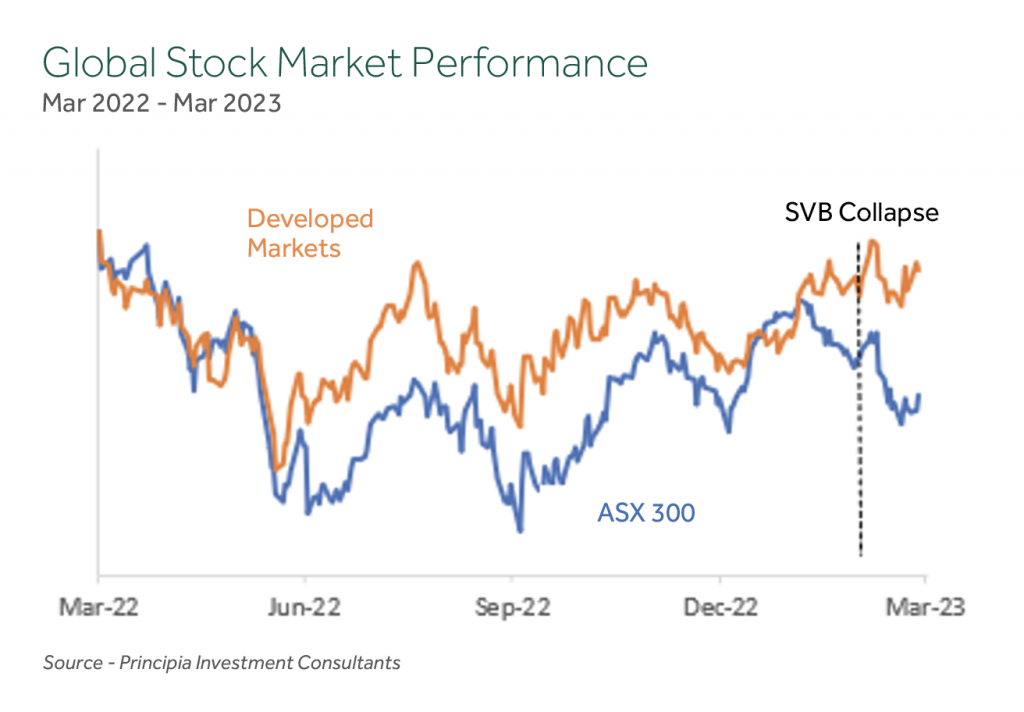

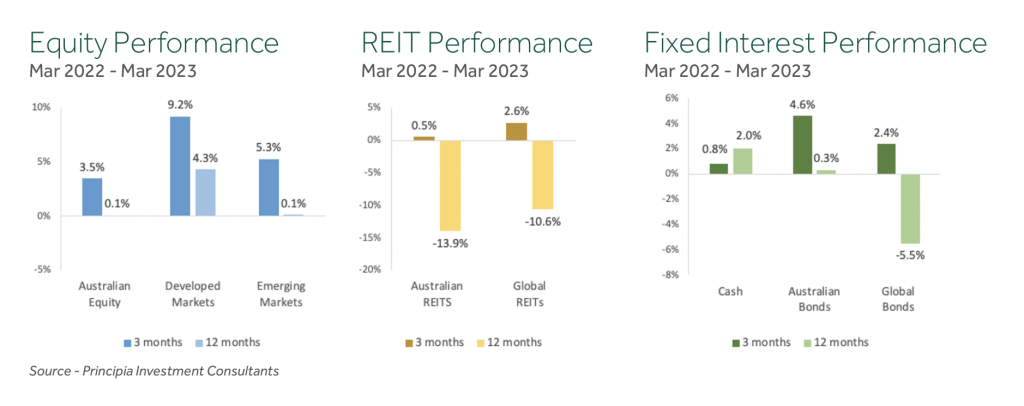

Global stocks and bonds staged a sharp recovery in the first quarter as signs that inflation is moderating encouraged hopes that central banks will soon begin to wind down their year-long cycle of tightening monetary policy.

Volatility picked up later in the quarter amid news of banking system problems in the US and Switzerland. Two regional US banks collapsed and troubled Swiss banking giant Credit Suisse submitted to a forced takeover by rival UBS.

The US Federal Reserve, which raised its rates benchmark twice in the quarter to 5%, adopted a more cautious approach following the banking turmoil, although markets were priced for at least one further increase in May.

With inflation showing signs of moderating, expectations were similar for other central banks. The Reserve Bank of Australia, which tightened for a 10th month in March, paused its cash rate at 3.6% in April.

Against that news backdrop, technology stocks reversed their recent downward course to lead equity markets higher in the first quarter, alongside consumer stocks. Financials and energy were among the worst performers.

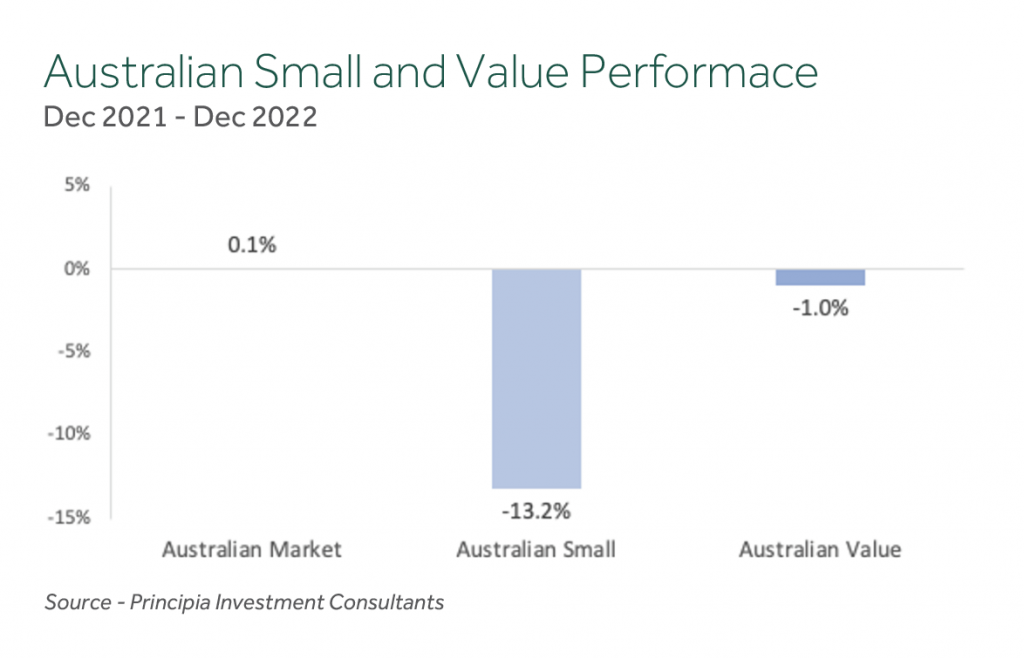

In a reversal of recent trends, value (cheaper) stocks lagged growth across the board in the quarter. The size premium (the higher expected return from smaller companies compared to larger companies) was flat in Australia, but negative elsewhere. The Profitability premium (the higher expected return for more profitable companies compared to less profitable companies) was positive in Australia, but flat in other markets.

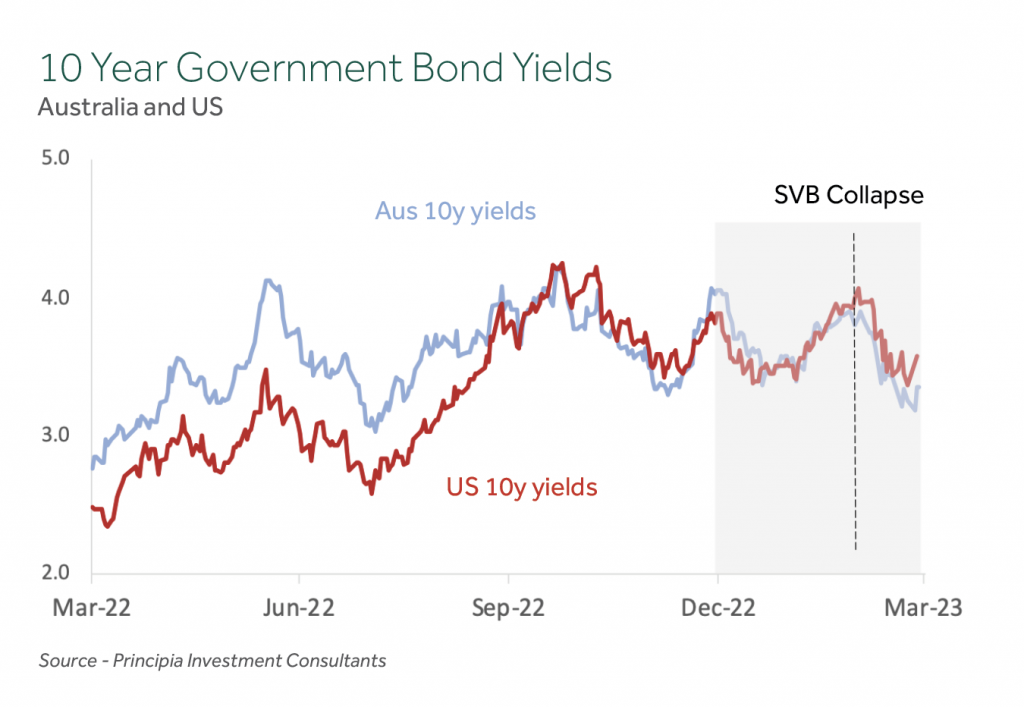

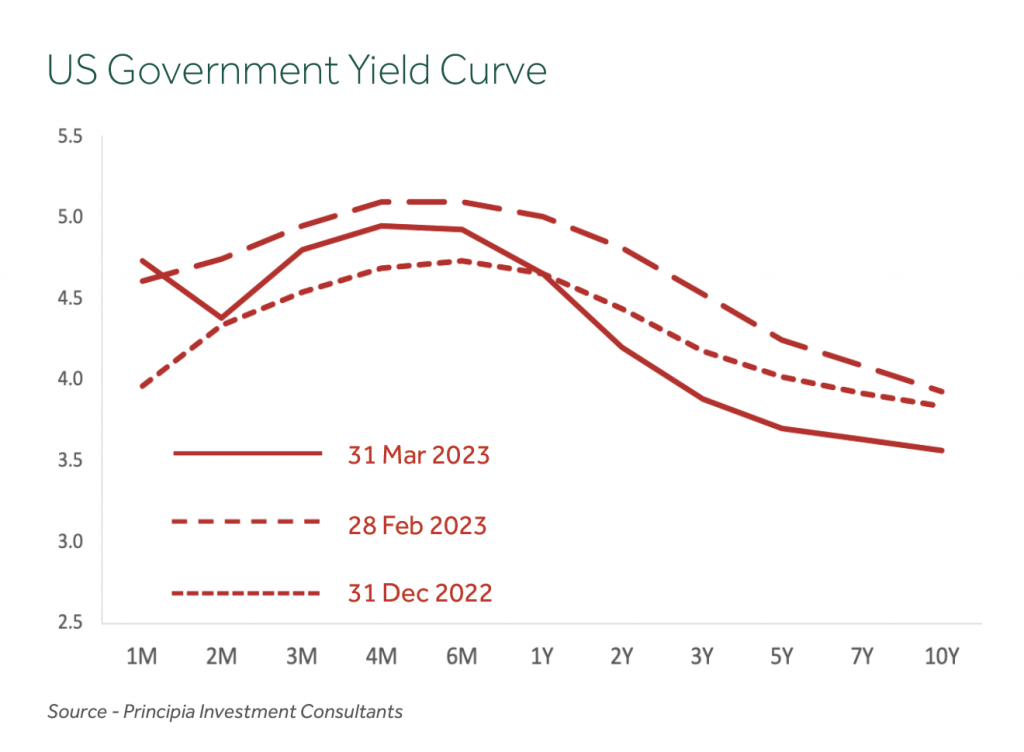

Bonds bounced back after a difficult 2022. Yield curves moved lower across the board and in some cases inverted. While term spreads narrowed in the quarter, credit spreads widened due in part to the issues in the banking sector.

While Real Estate Investment Trusts delivered a modestly positive performance over the quarter, they lagged broad equity indices.

The US dollar was broadly stronger over the quarter against the Australian Dollar which left unhedged portfolios outperforming their hedged counterparts by about 2%.

What Dominated the News

The following news summary is not intended to explain the markets’ performance in the quarter, but to provide some perspective about what dominated headlines:

January

- China relaxes covid restrictions; reopens borders to international visitors

- Softer US inflation data stirs hopes of ‘Goldilocks’ scenario for US markets

- Bank of Japan defies market and keeps yield curve control policy unchanged

- US Government hits debt ceiling amid standoff between Republicans and Democrats

- World Bank warns global economy risks second recession within three years

- Australian inflation hits 32-year high of 7.8%; Further rate rises expected

February

- US Federal Reserve, citing easing inflation, scales back rate increase to 25bps

- RBA unveils ninth consecutive Cash Rate increases, and warns not done yet

- IMF upgrades global economic outlook as inflation eases

- US-China tensions escalate over airspace intrusions by alleged ‘Spy Balloons’

- Japan names academic Kazuo Ueda as next Central Bank Governor

- US President Biden visits Kyiv on one-year anniversary of Ukraine war

- Putin blames Ukraine war on West, suspends nuclear disarmament pact

March

- Fed’s Powell opens door to higher, faster rate hikes after strong data

- RBA hikes rates for 10th straight month but signals pause ahead

- Silicon Valley Bank, 16th Largest US lender, fails; bank shares plunge

- Swiss banking giant UBS buys ailing rival Credit Suisse in forced bailout

- Intergovernmental Panel on Climate Change Issues ‘Final Warning’

- China’s Congress appoints Xi Jinping as President for unprecedented third term

- Trump criminally charged in New York; first for a US ex-President

Portfolio Movements

The March quarter was dominated by the collapse of Silicon Valley Bank and the ensuing banking crisis, set against a background of cooling inflation, continuing rate hikes, and the prospect of global recession in 2023.

The markets started the quarter with optimism. Economic data continually reinforced the narrative that inflation had indeed peaked – around December 2022 – and that central banks would reach the “terminal rate” much earlier than previously predicted. The S&P/ASX 200 gained 6.2% in January, the best January ever for the benchmark index. In the US the S&P 500 Index also rose 6.2%, its best start to a year since 2019.

The positive momentum reversed a few days after Federal Reserve Chairman Powell said the Feds are likely to take rates higher than previously anticipated and could move at a faster pace if needed. The bond market immediately repriced the peak interest rate to be significantly higher and yields jumped up – pushing down bond prices.

Silicon Valley Bank – which had half its assets in bonds – became insolvent. Its collapse, the collapse of several other smaller US regional banks, and the turmoil surrounding Credit Suisse Group spurred a frantic rush for safety, evoking memories of the GFC. Volatility gripped global markets and yields on bonds fell dramatically as the likelihood of global recession increased.

Throughout the quarter the prevailing market mood has switched from “hard landing ahead” in the economy to “soft landing’” to “no landing” and then back to hard landing again. High tech stocks have had their best month since June 2020 while the battered bond market has had its best gains since 2008. The fall in the banking sector is proof that when interest rates rise as rapidly and as high as they have then it’s not surprising that something must break.

Bond traders and equity investors are now scrambling to make sense of the most challenging macro setup in a generation as the global banking crisis potentially signals an impending recession while the ongoing battle against runaway inflation muddies the picture over the future of interest rates. The combined effects of higher rates and tighter credit conditions will certainly slow growth throughout the rest of 2023.

Despite the ructions, most of the Growth Asset Classes delivered positive returns for the quarter, a welcome reprieve after a tough 2022, with Australian Shares (+3.5%) unhedged International Shares (+9.0%), hedged International Shares (+7.1%), and International Property (+1.6%). Infrastructure (-0.4%) was the only detractor.

After the collapse of SVB, bond yields had their steepest fall since October 2008, as traders axed bets on any further interest rate increases this year and ramped up expectations for rate cuts. Uncertainty about the direction of interest rates is as high as it’s been, and the volatile bond market reflects the balance between the flight to safety as recession seems imminent and the view that rates will stay higher for longer.

Within Defensive Assets, the contraction in yields post the SVB collapse (and Credit Suisse takeover) saw International Debt (+2.6%) post a positive return for the quarter.

Australian Credit (hybrid securities) posted a small negative return (-0.9%). This was a telling outcome given the way the Credit Suisse takeover unfolded, with hybrid holders being ‘wiped out’, taking some market participants by surprise. This benign response highlighted that the Credit Suisse hybrids were radically different to the Australian bank issued hybrids in many respects, including: a much lower credit rating (sub investment grade compared to investment grade); the terms of the securities required them to be written down to zero whereas Australian bank hybrids are converted into equity; the Credit Suisse hybrids had a higher equity capital ratio trigger of 7% compared to the 5.125% threshold for Australian bank hybrids; and Australian bank hybrids expressly state they cannot be converted to shares unless equity bears the first and greatest share of any loss in the event of impairment.

Bond markets are predicting that a US recession is around the corner amid a growing dissonance between how markets and the Federal Reserve see the outlook for the economy. The historic drop in bond yields in March reflects the fact that cash rate futures now indicate no more rate increases. However, the Fed has signalled it’s not done yet.

Performance for the December quarter across diversified portfolios ranged from +2.8% for 50/50 Growth/Defensive portfolios to +4.5% for 85/15 portfolios.

Diversified Investment Grade International Debt (Bonds) have recovered some ground from the very poor returns experienced in 2022. The annual return has improved from -12% in December to -6% in March. It is notable that higher bond yields are the driver of higher long term returns from the asset class. They also provide a greater buffer against future declines in Growth Assets should they occur.

With a positive quarter across most asset classes, annual returns for diversified portfolios improved from the low point in December 2022 and ranged from -1.8% for 50/50 portfolios to -2.0%.

Australian Shares Portfolio Strategy

Within Australian Shares we combine three broad components to construct a well-diversified aggregate portfolio:

- Large Companies (for broad market exposure),

- Value Companies (those with cheaper relative valuations), and

- Small Companies (expected to deliver higher returns over time).

Each of these three sub-categories behave differently through time, and each plays a role in contributing to performance and risk management. Through the investment cycle we expect each to experience different sequencing of return, leading to opportunities to top up the underperforming components and take profits from the components that are performing well.

The recent period has seen quite a divergence in returns from the components, as shown below. The performance of smaller companies has lagged materially and performance from Value (cheaper) companies tapered over the quarter.

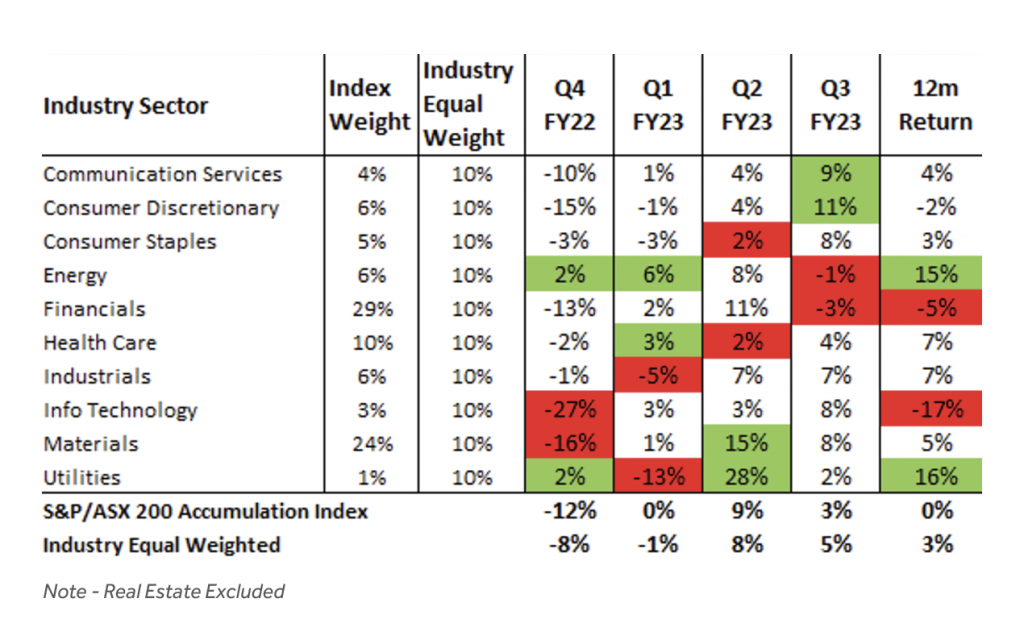

An ‘Industry Equal Weight’ approach to the selection of direct Australian shares continued to provide diversified sources of returns as shown in the table below (the top and bottom two sectors each quarter have been highlighted). The annual returns from the Industry Sectors ranged from -17% for Information Technology to +16% for Utilities. In many respects the ‘winners’ and ‘losers’ have switched places, with Consumer Discretionary, Communication Services, and Information Technology posting better returns after lagging over the preceding 12 months.

Our approach seeks to manage risk and improve diversification by allocating equally across the Industry Sectors, rather than adopting the traditional market weighted approach. This method takes advantage of the less than perfect correlation between the Industry Sectors, which can be clearly seen in the table. Through the investment cycle there are periods when each sector delivers superior returns and periods when they underperform. This variation in return provides opportunities to harvest returns from outperforming sectors and add to exposures in underperforming sectors at depressed prices – without trying to forecast in advance when the rotation will occur.

The quarter saw the divergence between traditional and sustainability focused portfolios narrow, as returns moderated from the Energy and Utilities Industry Sectors (which are typically not held in sustainability portfolios due to their exposure to fossil fuels) and improved in Industry Sectors more prominent in these portfolios, including Information Technology, Communication Services, and Consumer Discretionary. We continue to expect longer returns from each approach to be similar, particularly given a consistent underlying investment philosophy.