Global Markets Summary

Global equity markets rose for a fifth consecutive quarter in the three months to 30 June, reaching record highs and continuing their rapid recovery from the pandemic shock of the first quarter of 2020.

While COVID-19 deaths approached 4 million amid concerns about the new more virulent Delta mutation, the rollout of vaccination programs globally and increasing signs of economic recovery provided reasons for hope.

In its global economic outlook in April, the International Monetary Fund upgraded its projection for growth this year to 6%, attributing this to additional fiscal support and a vaccine-powered recovery in the second half.

Even so, the IMF cautioned that the ongoing pandemic was having divergent impacts across different countries and sectors, with much depending on the degree to which economic policies can limit lasting damage from the crisis.

Dominating financial media over the quarter was a debate about the likely timing and pace of the withdrawal of policy stimulus and whether the spike in inflation seen in recent months will be as transitory as central banks assume.

Against that broad background, equity markets posted a strong quarter, with developed markets up around 9%. Developed markets outpaced emerging markets, though the latter still posted a solid return of more than 6%. The Australian equity market recorded a return of more than 8% in the quarter, reaching record highs in mid-June and posting a gain of more than 28% for the full financial year. Information technology and consumer discretionary stocks were among the best performing sectors in the quarter.

In developed markets, value lagged growth and small caps underperformed large. In emerging markets, value was also negative, although there was a positive size premium there. In Australia, small and large performed in line. It was also a buoyant quarter for real estate investment trusts, with the sector gaining almost 12% to post its best quarterly performance in more than two years. Within bonds, there was a strongly positive term premium over the quarter and a positive credit premium. The best performing bond markets were the US and Australia. On currency markets, the US dollar strengthened against the AUD. This boosted the unhedged returns from overseas equities for local investors.

What Dominated the News

The following news summary is not intended to explain the markets’ performance in the quarter, but to provide some perspective about what dominated headlines:

April

- US President Joe Biden proposes $2 trillion infrastructure package

- IMF forecasts 6.4% global economic growth rebound in 2021, led by US

- COVID-19 global death toll passes 3 million; confirmed cases top 150 million

- World leaders mark Earth Day with virtual summit on climate change

- US Federal Reserve leaves policy unchanged; waves of talk of shift

May

- Australian government projects record $161 billion deficit in big spending budget

- Bitcoin and other cryptocurrencies collapse as China enforces trading curbs

- US inflation fears rise as consumer prices post biggest surge in 12 years

- Eleven days of intense fighting in Gaza ends in Israel-Palestine ceasefire

- Dutch court orders Shell to deepen carbon cuts in landmark ruling

June

- OECD, in upward revision, forecasts world economy to grow by 5.8% this year

- G7 Summit in Cornwall pledges action on vaccines, climate change and taxes

- US Federal Reserve brings forward projections for first rate hike to 2023

- President Biden hails bipartisan deal on $1.2 trillion infrastructure plan

- Sydney enters two-week lockdown amid outbreak of Delta variant

Portfolio Movements

The June quarter delivered positive returns across all the major asset classes, particularly the Growth Assets of Australian Shares, International Shares, and Property & Infrastructure as all asset classes reflected a strengthening of the outlook for the recovery from the disruption caused by the pandemic and the measures taken by governments to manage its spread.

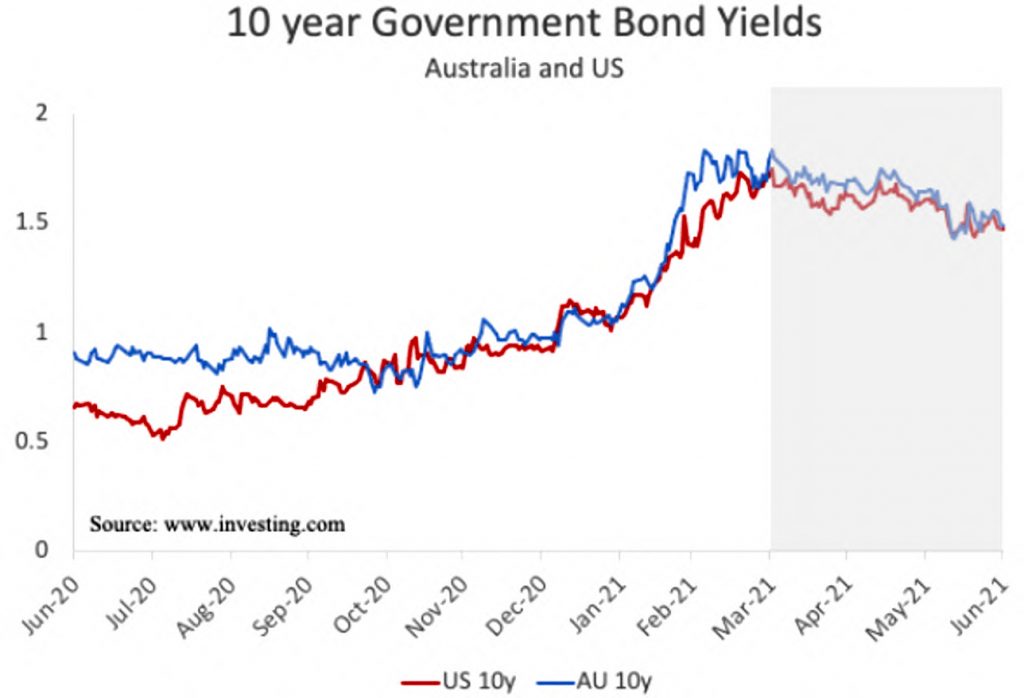

Defensive Assets also posted low but positive returns after the drama experienced in the March quarter which saw bond yields rise (prices fell) delivering the worst quarterly returns in 30 years for the benchmark. Yields rose on expectations of higher future inflation following the significant fiscal and monetary policy initiatives deployed since the onset of the pandemic.

Through the June quarter the market’s assessment of these risks abated somewhat, supported by Central Bank assessment that the recent spike in inflation reflects the effects from demand-supply imbalances resulting from the pandemic, and that higher inflation was “transitory”. This saw a pause in the upward rise to bond yields (as shown in the chart) and subsequently returns for the Defensive Assets (Credit and Bonds) were positive during the quarter, recovering a reasonable proportion of the losses incurred in the prior period.

Source: Principia Investment Consultants

This positive environment for investors flowed through to the returns experienced across broadly diversified portfolios, with the year to 30 June 2021 representing one of the strongest on record.

In this environment, one-year returns are much higher than long term expected returns and perspective should be taken when assessing performance as they only capture the ‘bounce-back’ period, and not the market collapse that went before. If we broaden our horizon to consider longer periods, we observe that returns achieved have been well in excess of inflation adjusted target rates.

Portfolio Rebalancing Opportunities over the Past Year

The year ended 30/6/2021 presented many opportunities for systematic portfolio rebalancing between asset classes (i.e. topping up hardest hit asset classes, and selling down those most resilient).

Over the last six months we have seen a rotation with many of the best performing asset classes being those that had underperformed in the first half of the year. Australian Value companies (notably Materials and Financials) delivered very strong returns, as did Property and Infrastructure funds. Over this period the Australian Dollar also retreated relative to other currencies providing a return boost for unhedged International Shares exposures.

We’ve seen this dynamic play out within asset classes as well. In Australian Shares we combine three broad components to construct a well-diversified aggregate portfolio:

- Large Companies (for broad market exposure),

- Value Companies (those with cheaper relative valuations), and

- Small Companies (expected to deliver higher returns over time).

Each of these three sub-categories behave differently through time, and each plays a role. Through the investment cycle we expect each to experience different sequencing of return, leading to opportunities to top up the underperforming components and take profits from the components that are performing well.

Over the last 12 months we’ve seen numerous divergences between the performance of the three components. As we started the year, large companies had performed the best, followed by small, and Value companies were experiencing one of the worst periods of relative performance in history. As we reflect on end of year returns, Value companies have had one of their strongest ever years, Small Companies were next best, and Large Companies lagged.

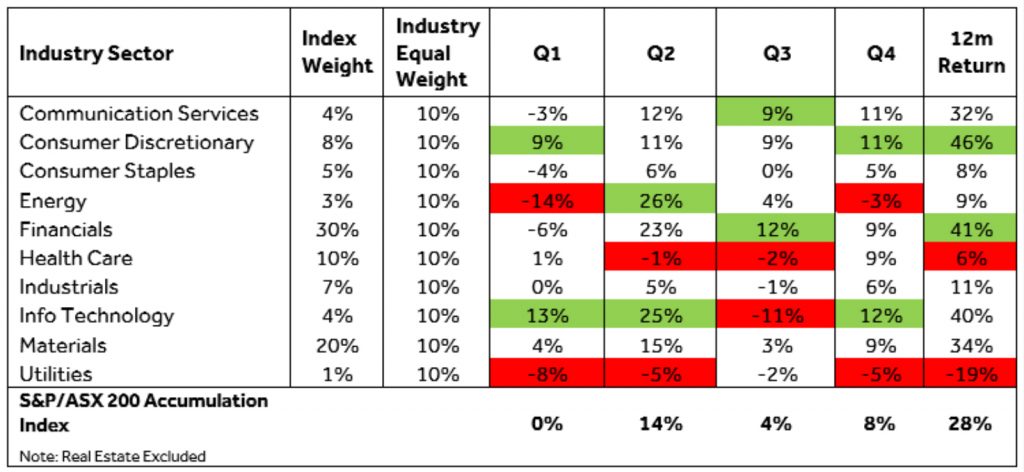

Our ‘Industry Equal Weight’ approach to the selection of direct Australian shares continued to provide diversified sources of returns and experienced a similar rotation of sectors driving returns. The performance of the Industry Sectors varied through the year as shown in the table below (the top and bottom two sectors each quarter have been highlighted).

Our approach seeks to manage risk and improve diversification by allocating equally across the Industry Sectors, rather than adopting the traditional market weighted approach. This method takes advantage of the less than perfect correlation between the Industry Sectors, which can be clearly seen in the table. Through the business cycle there are periods when each sector delivers superior returns and periods when they underperform. This variation in return provides opportunities to harvest returns from outperforming sectors and add to exposures in underperforming sectors at depressed prices.

How did the Experts go with their earlier Predictions for Returns in the Financial Year 2020/21?

Predicting where economies and markets are headed is a popular pastime around the beginning of a new financial year. Newspapers tend to call up economists and ask them for their ‘outlooks’, which inevitably have a short shelf life. Take 2020/21 for instance.

At the end of each financial year in Australia, the website ‘The Conversation’ polls economists from around the country for their view of a host of indicators, including GDP growth, unemployment, investment, and market variables like bond yields, currencies and shares.

The 2020/21 edition, published in late June 2020, featured the views of “22 leading economists from 16 universities in seven states”. While individual forecasts often varied widely, the consensus estimate for the economy and markets was not particularly hopeful.

For unemployment, for instance, the panel picked it would continue rising. The economy, after all, had suffered a major shock and gone into recession. The most pessimistic view was the jobless rate would hit 11% by December; the most optimistic at a little under 7%. As it turned out, however, unemployment, fell to 6.6% and kept falling to just above 5% by mid-2021.

House prices in Sydney and Melbourne were seen likely to go into reverse and end the year slightly lower. Some forecasters picked a fall of as large as 10%. By the end of 2020, however, house prices were 3-4% higher. And they kept rising. By the end of the March quarter, they had risen another 5-6%, according to the Australian Bureau of Statistics.

For the Australian economy overall, the panel expected historically weaker economic growth. The average prediction for through-the-year GDP growth was a contraction of 4.6%. By the end of 2020, GDP was down just 1.1%. A quarter later, it was up 1.1% through the year.

On currencies, there wasn’t much luck either. The consensus was that the Australian dollar, having plunged during the COVID-19 shock to 18-year lows near 55 US cents, would struggle back up to 69c. The currency ended the year around 77c.

The economists didn’t hold out much hope for Australian shares either. The average forecast for the S&P/ASX 200 index was a decline of 8% in the calendar year and a marginal rise of 2.3% in 2021. As it turned out, the market ended 2020 modestly higher and rose more than 28% for the full financial year, its best performance in 14 years!

Now keep in mind this was a heavyweight economic panel, including macroeconomists, economic modellers, former Treasury, IMF, OECD, Reserve Bank and financial market economists, and even a former member of the Reserve Bank board.

None of these observations is intended as a reflection on the skills of the panel, who are all undoubtedly highly credentialed experts. But it does show that when it comes to forecasting, no-one really has any idea about the future. There are just too many unknowns.

It also suggests that if even the professionals can’t accurately forecast the fortunes of the economy and the markets, what hope have the rest of us? In this case, the Australian economy turned out stronger and more resilient and the share market more buoyant than most expected.

The lessons for the rest of we ordinary investors are familiar. If you can’t forecast the future, you should really focus on all those things you can control – starting with a financial plan that takes account of your circumstances, goals and what you can stomach in terms of volatility.

What else? To control risk and increase the reliability of outcomes, you should diversify both across and within asset classes, and keep sufficient cash on hand to deal with emergencies. You should only take risks you understand, stay focused on the objectives your portfolio is targeting, and be mindful of costs and taxes. Lastly, you should systematically rebalance to ensure your mix of investment assets is appropriate for your risk tolerance and your goals.

The great US economist John Kenneth Galbraith once said: “There are two classes of forecasters – those who don’t know and those who don’t know that they don’t know.”

For the rest of us who don’t have to earn a dollar making financial and economic forecasts, living with not knowing is a whole lot easier with the right plan.

Source: With thanks to Jim Parker, Dimensional Fund Advisors